What next after Bitcoin’s latest plateau

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

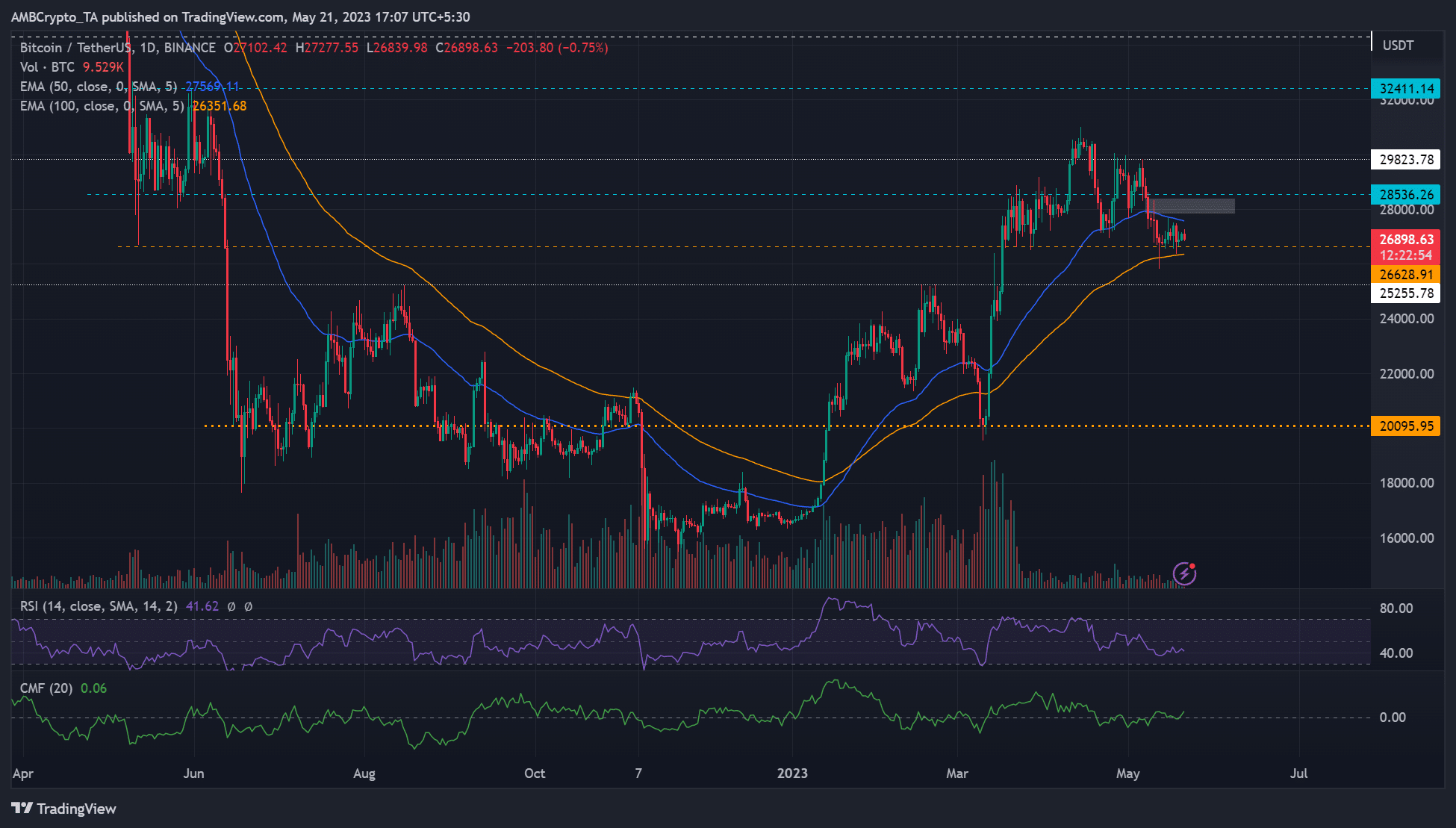

- BTC oscillated between 50-EMA and 100-EMA since 9 May.

- Open interest rates remained unchanged; longs discouraged.

Bitcoin [BTC] continued consolidating near $26.6k support, with volumes remaining low since late March. While the current level could be an accumulation zone, BTC is yet to register a strong rebound, highlighting the tussle between bulls and bears at $26.6k.

Read Bitcoin [BTC] Price Prediction 2023-24

A recent report highlighted that self-custody for both BTC and ETH has been on the rise, suggesting investors’ huge bets on a likely uptrend move.

But key price resistance levels await, and here is a strong bearish stronghold for BTC bulls to watch out for on the daily chart.

Will $26.6k and 100-EMA check further drop?

The drop from 6 May, left behind an FVG (fair value gap) zone between $27,826 – $28,396 (white). Just below the FVG zone lay the 50-EMA of $27.57k (blue line). Above it lays the $28.5k resistance, a key obstacle back in the second half of March.

This makes the area a strong bearish stronghold, and bulls must clear it to gain leverage and dent any prevailing bearish sentiment.

A negative price reaction from the above bearish zone and subsequent breach of the $26.6k support could further weaken BTC’s market structure. The next support levels to the south are the dynamic 100-EMA (yellow) and $25.26k.

However, a daily session close above the bearish stronghold ($28.5k) could set BTC to rally and retest recent highs of $29k or $31k. Above these resistance levels, the next resistance level lay at $32.4k.

Meanwhile, the RSI was below the mid-range, highlighting limited buying pressure. However, the CMF (Chaikin Money Flow) was above the zero mark, indicating substantial capital inflows.

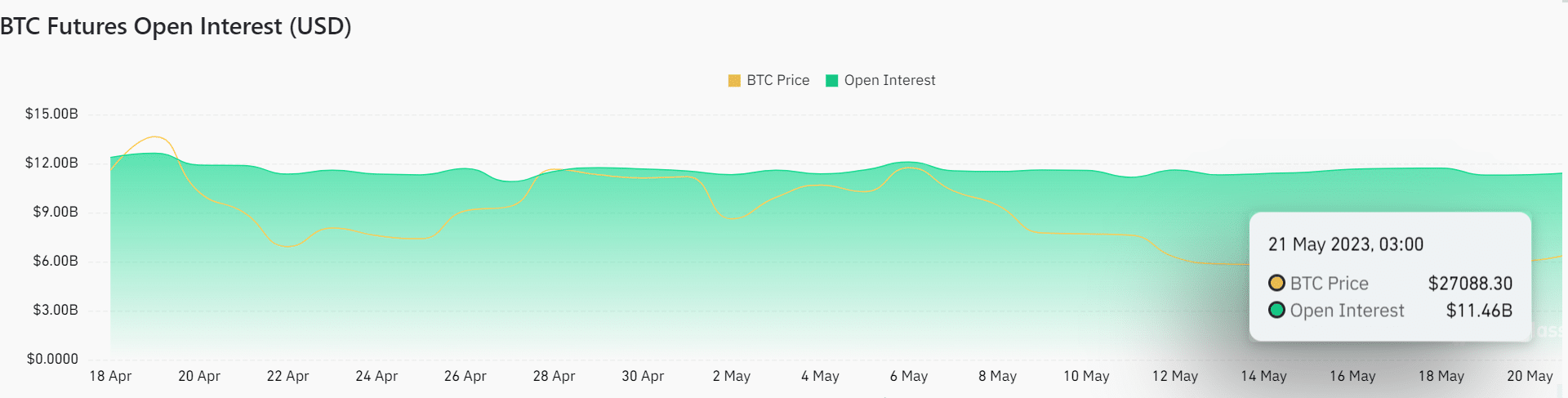

BTC’s open interest rates stagnate

Is your portfolio green? Check BTC Profit Calculator

According to Coinglass data, BTC’s futures open interest rates hovered around $11 billion since the second half of April. This shows a neutral position in the futures market in the same period, meaning prices can go in either direction.

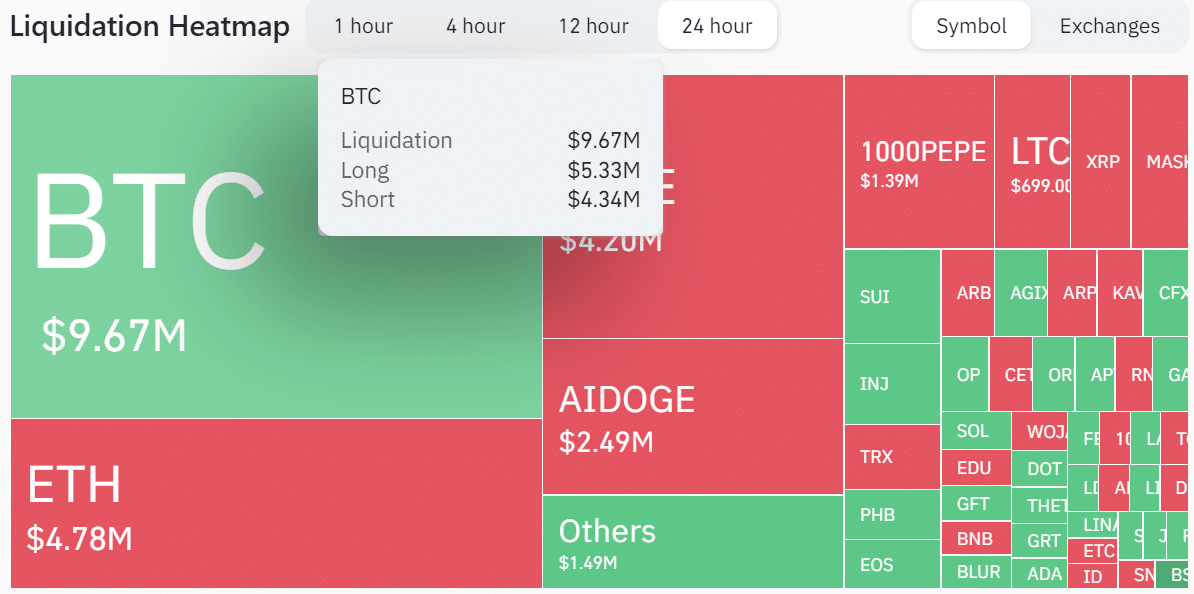

However, Coinglass’s total liquidation data showed longs were discouraged, with over $5 million worth of positions, out of $9.7 million, wrecked in the past 24 hours as of press time. This reinforces a mild bearish sentiment in the futures market.

A more nuanced direction could be clear from Monday (22 May). The U.S. debt ceiling negotiation is a major development worth tracking over the coming days as it may affect BTC’s movements.