Bitcoin

Bitcoin’s post-halving price drop reveals THIS about whale behaviour

Hours after Bitcoin finished its halving, its price action lost all its bullish momentum.

- Whale activity around Bitcoin has remained high over the last seven days

- Technical indicators hinted at a few low volatility days ahead

After a considerable hike in value on 19 April, Bitcoin [BTC] once again flashed red within hours of its much-awaited 4th halving. In the meantime, however, whales made their move as they increased their accumulation and built on their existing holdings.

Bitcoin whales are active

Hours before the halving, the crypto’s price action turned bullish as its value surged past $65k. However, the scenario changed soon after the episode had transpired.

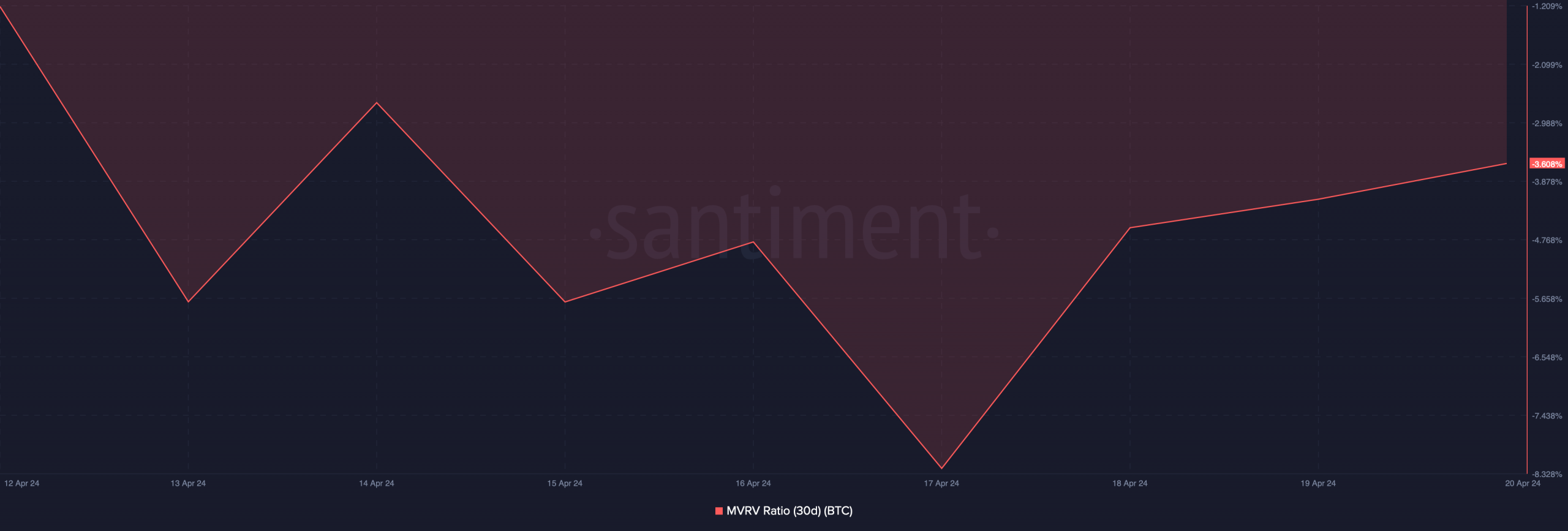

At press time, Bitcoin was trading at $63,777 with a market capitalization of over $1.2 trillion. Here, it is interesting to note that BTC’s MVRV ratio climbed over the last few days, meaning that more investors are now in profit.

While the price remained volatile, the top players in the crypto-space tapped up the opportunity to buy. In fact, as per a recent tweet from IntoTheBlock, the biggest Bitcoin holders, holding over 0.1% of the total supply, collectively added 19,760 Bitcoins to their holdings at an average price of $62.5k.

AMBCrypto’s analysis of Santiment’s data also revealed that whale activity around BTC surged, as is evidenced by the rise in its whale transaction count.

Will buying pressure help BTC turn bullish?

AMBCrypto then took a look at CryptoQuant’s data to find out whether buying pressure on BTC has been high or not. We found that Bitcoin’s exchange reserves dropped sharply over the last seven days.

At press time, Bitcoin’s exchange reserves stood at 1.92 million BTC.

Additionally, both BTC’s Coinbase Premium and Funds Premium were green, meaning that buying sentiment was dominant among U.S and institutional investors. However, the rising demand might take some time to translate into a bull rally, as a few other metrics looked bearish.

For example – BTC’s Net Unrealized Profit and Loss (NUPL) suggested that investors are in a “belief” phase where they are in a state of high unrealized profits. Moreover, its aSORP was red at press time. This implied that more investors have been selling at a profit.

In the middle of a bull market, it can indicate a market top.

Is your portfolio green? Check out the

BTC Profit CalculatorAMBCrypto then analyzed BTC’s daily chart to see whether the cryptocurrency will flash green signals anytime soon. We found that both the Relative Strength Index (RSI) and the Money Flow Index (MFI) were trending sideways below their levels of equilibrium.

Additionally, the Chaikin Money Flow (CMF) registered a slight downtick as well.

All these indicators hinted that investors might see a few slow-moving days before Bitcoin’s price turns volatile again.