Bitcoin’s price bottom – Is it in already or do traders need to wait more?

- Bitcoin holder loss trends showed that the bulls can be hopeful of a recovery

- If historical trends repeat themselves, an even deeper price correction might be due

Bitcoin [BTC] has twice faced rejection from the short-term range highs at $58.8k in two days. After losing the psychological $60k support last week, sentiment across the market was fearful.

There is some hope for a rebound though. At press time, the rising accumulation trend score suggested buyers were willing, but other metrics implied more pain may be due.

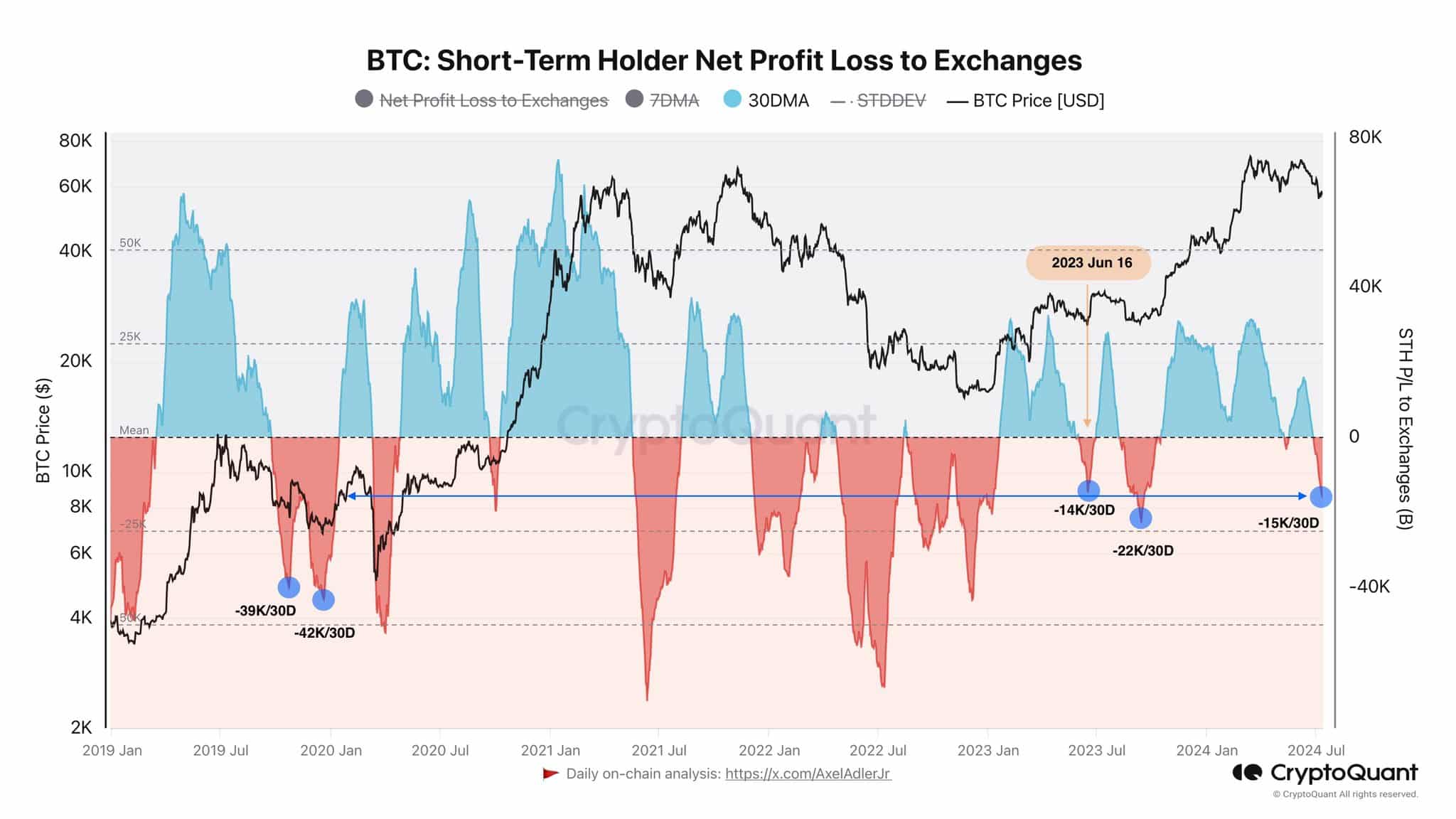

Source: Axel Adler on X

In a post on X, crypto analyst Axel Adler drew attention to the current average losses of short-term holders (STHs). While the losses match that of June 2023, the magnitude was far lower than the pain seen in 2021 or 2022.

While it did signal a potential local bottom, it also showed that traders and investors must be prepared for the worst-case scenario of a sharper price drop on the charts.

Clues that Bitcoin’s local lows are behind us

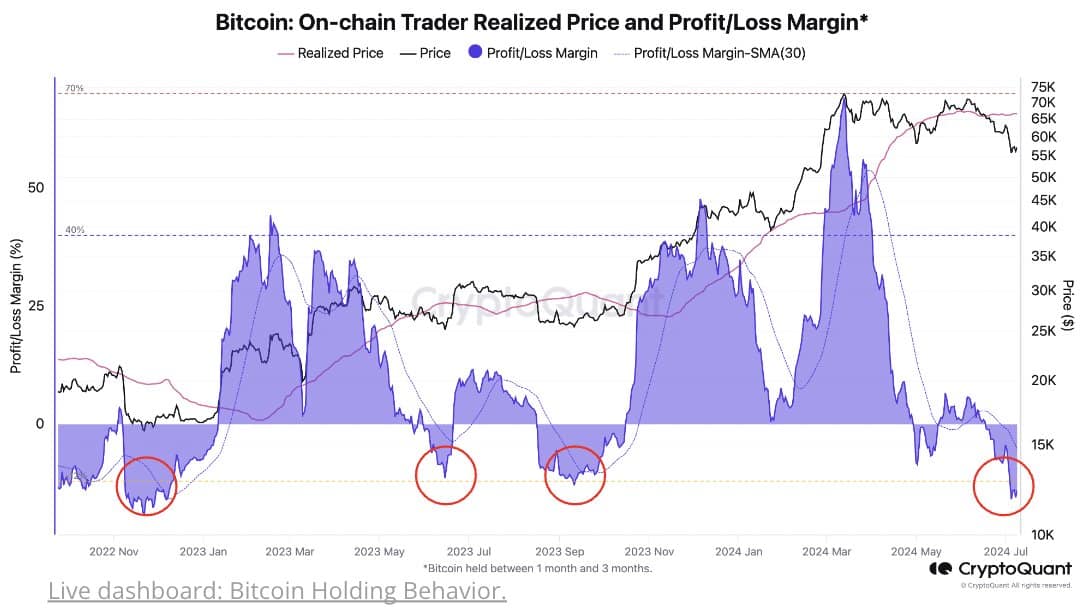

Source: CryptoQuant on X

CryptoQuant observed that the trader realized profit/loss margin was at -17%. This was in the same ballpark as the market bottoms over the past two years, reinforcing the idea that Bitcoin is more likely to rebound higher than to drop lower.

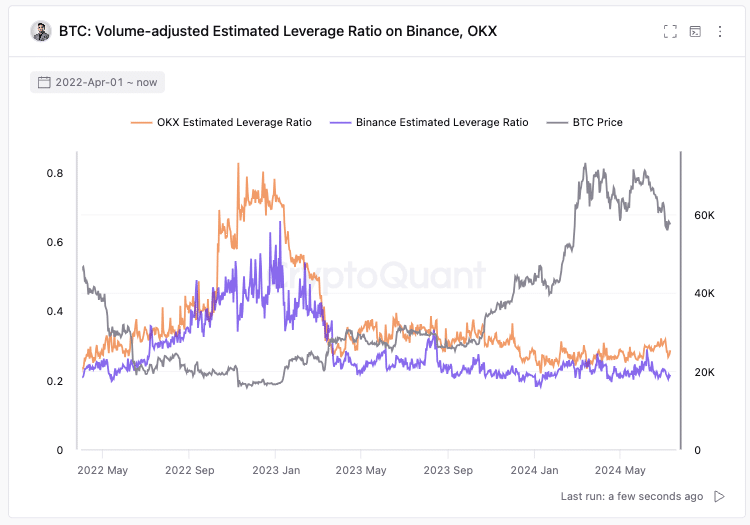

Source: Ki Young Ju on X

According to Founder and CEO of CryptoQuant Ki Young Ju, whales tend to use leverage at their cyclical bottoms, making the markets over-leveraged and forcing another downward price flush.

At press time, whales were not over-leveraged, which could have set the stage for a deeper correction below the $50k-mark.

Traders were humbled after trying to catch the breakout and ATH

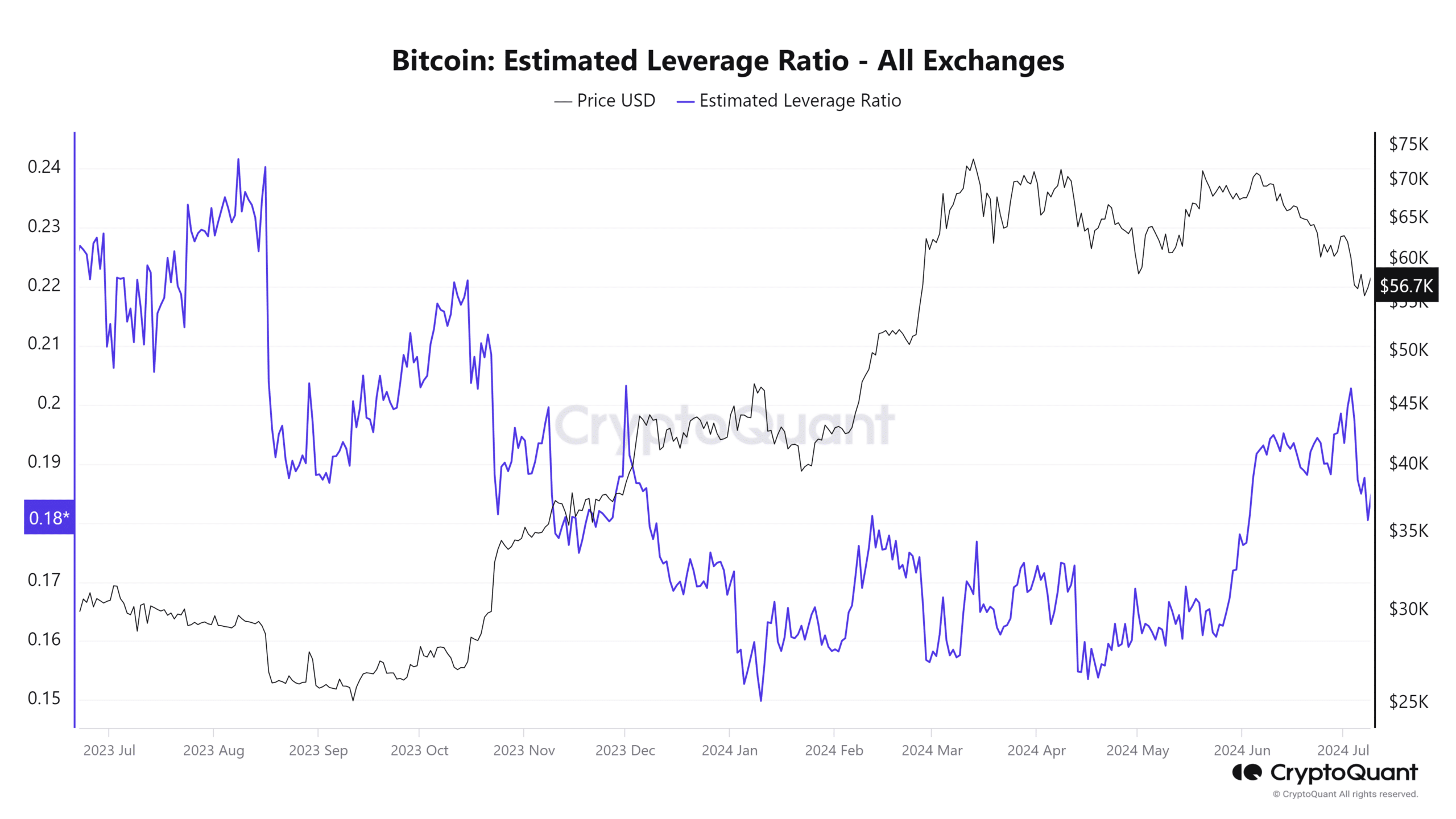

Source: CryptoQuant

From the final week of May to the 3 July, the estimated leverage ratio on exchanges rose quickly. During that time, the price of Bitcoin was hovering around $67k-$69k. As the price fell below $66k, the leverage ratio climbed once more, indicating that traders were trying to time the bottom out of greed.

Over the past week, their hopes were quelled by BTC’s sustained descent. The leverage ratio also fell lower, which could be healthy for the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, it is hard to say with certainty that Bitcoin has formed a bottom.

Several bottom signals have been flashing and seller pressure might begin to drop. Even so, investors should still have a plan of action in case the price fall below $50k.