Bitcoin’s price hike follows surge in inflows; Here’s why it’s ‘a bit odd’

- Bitcoin ETFs recorded the highest inflows in nearly five months.

- ETFs could likely overtake Satoshi’s holdings by December.

Bitcoin [BTC] continued to exceed expectations with its staggering price rise and record-breaking exchange-traded fund (ETF) inflows.

On the 29th of October, BTC peaked at over $73,000. Simultaneously, spot BTC ETFs reported a net inflow of $870 million, according to data from SoSo Value.

This marked the highest single-day net inflow since early June.

It is worth noting that typically, such volumes spike during downturns are anticipated as investors “buy the dip.”

Ergo, the question: why are inflows surging alongside a rising BTC price?

Why are Bitcoin ETF inflows rising?

Interestingly, Eric Balchunas, senior ETF analyst at Bloomberg, also found this rise “a bit odd” in a recent post on X. However, he explained:

“Occasionally tho volume can spike if there a FOMO-ing frenzy.”

The analyst further remarked,

“Look for (more) big inflows this week.”

He added that iShares Bitcoin Trust ($IBIT) saw trading volumes soar to $3.3 billion, the largest figure in six months. Nonetheless, this product wasn’t the only one seeing elevated trading volumes.

Although it led by a significant margin, all major Bitcoin ETFs experienced increased activity, suggesting that FOMO was definitely at play.

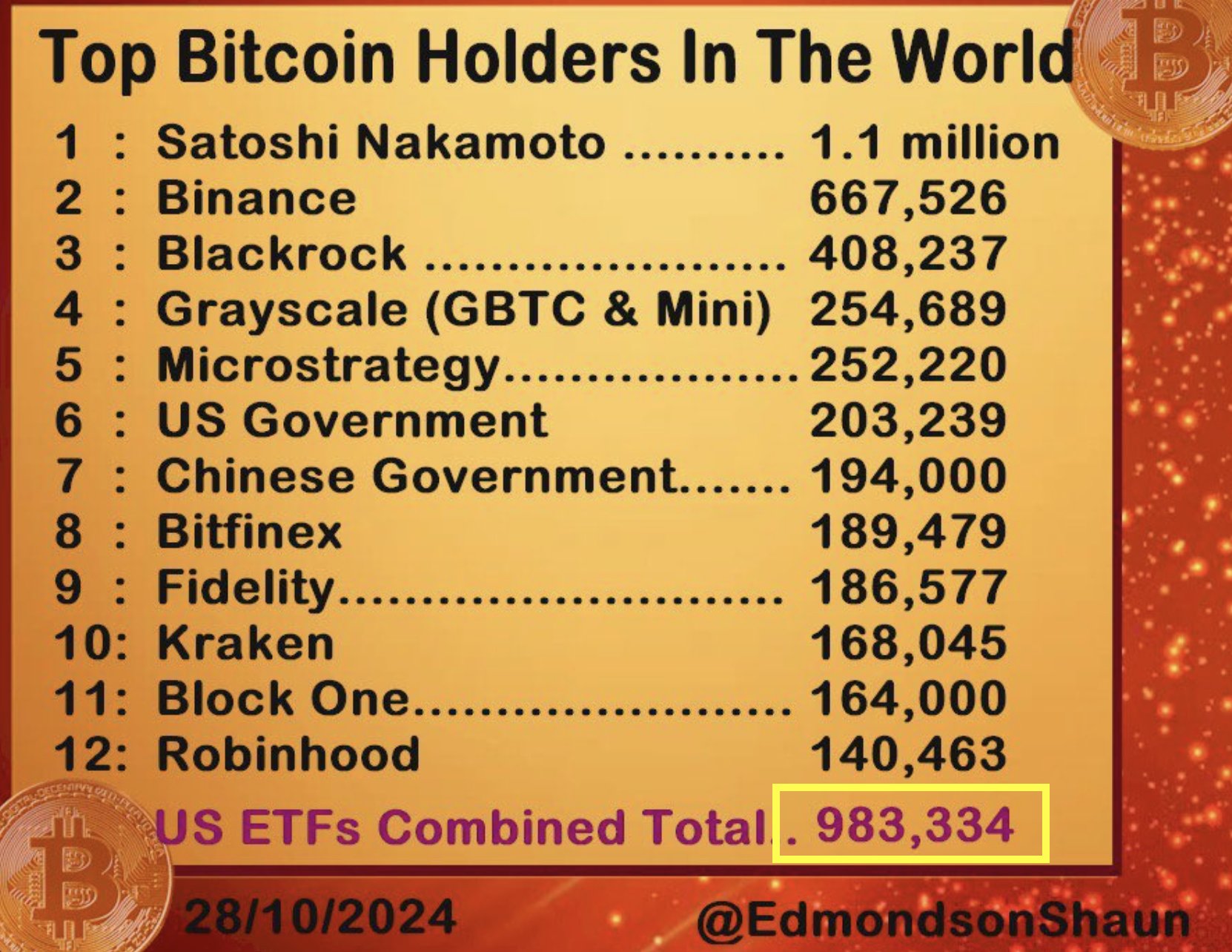

ETFs closing in on Satoshi

Notably, inflows weren’t the only area where ETFs seemed to be thriving. In another post, Balchunas highlighted that a major milestone looms for Bitcoin ETFs as the total BTC held by U.S. spot ETFs is set to surpass 1 million BTC by next Wednesday.

Furthermore, it could exceed the holdings attributed to Bitcoin’s creator, Satoshi Nakamoto, by mid-December.

Source: Eric Balchunas/X

He noted that the ETFs have been acquiring approximately 17,000 BTC weekly, pushing them closer to holding more Bitcoin than the iconic Satoshi wallet—a historic achievement for this asset class.

Yet, Balchunas cautioned that this rapid accumulation isn’t without potential disruption, stating,

“Anything can happen, eg a violent selloff and all this is delayed albeit still inevitable.”

He added that, under certain conditions, including a price surge or Donald Trump taking the Oval Office, FOMO could accelerate the timeline even further.

Institutional demand continues to climb

Meanwhile, the acceptance of Bitcoin ETFs has expanded across every type of institutional investor. Balchunas noted that recently, Emory University became the first endowment fund to report a Bitcoin ETF position.

The university disclosed ownership of over $15 million worth of shares in the Grayscale Bitcoin Mini Trust in a filing with the U.S. Securities and Exchange Commission [SEC].

This development signaled that Bitcoin ETFs are now represented in a broad spectrum of institutional categories, including banks, hedge funds, insurance companies, advisors, pensions, venture capital, and family offices.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

For an ETF market segment under a year old, this level of institutional adoption underscored Bitcoin’s maturing role in traditional finance and its appeal among professional investors.