Bitcoin’s price ‘will recover’: Here’s the how and when?

Since the onset of Bitcoin’s correction phase, traders have been facing a very indecisive market and sentiment is largely bearish. The instability was particularly evident over the past week that was characterized by massive fluctuations, panic sell-offs and long liquidations. With emotions ruling the market lately, people from the community are still trying to get a sense of what is happening.

Nonetheless, on-chain analyst Willy Woo seemed quite optimistic about where the market was heading. Sharing his perspective on the same in a recent podcast, he said,

“We’ll recover, we’ve got to go sideways first. The coins that we dumped need to be re-accumulated by longer term hodlers.”

Unsurprisingly, Bitcoin supplies held by entities have been declining since 19 May.

Woo went on to state that the recovery would take time and wouldn’t reflect in the prices in the upcoming week. He asserted that the same would take a month or two at least. Supplementing the same, he added,

“Now we’ve got a lot more traditional guys in the markets. Summer holidays in the northern hemisphere tend to be a bit soft amongst traditional traders. So maybe that’ll take a bit of times until that’s finished.”

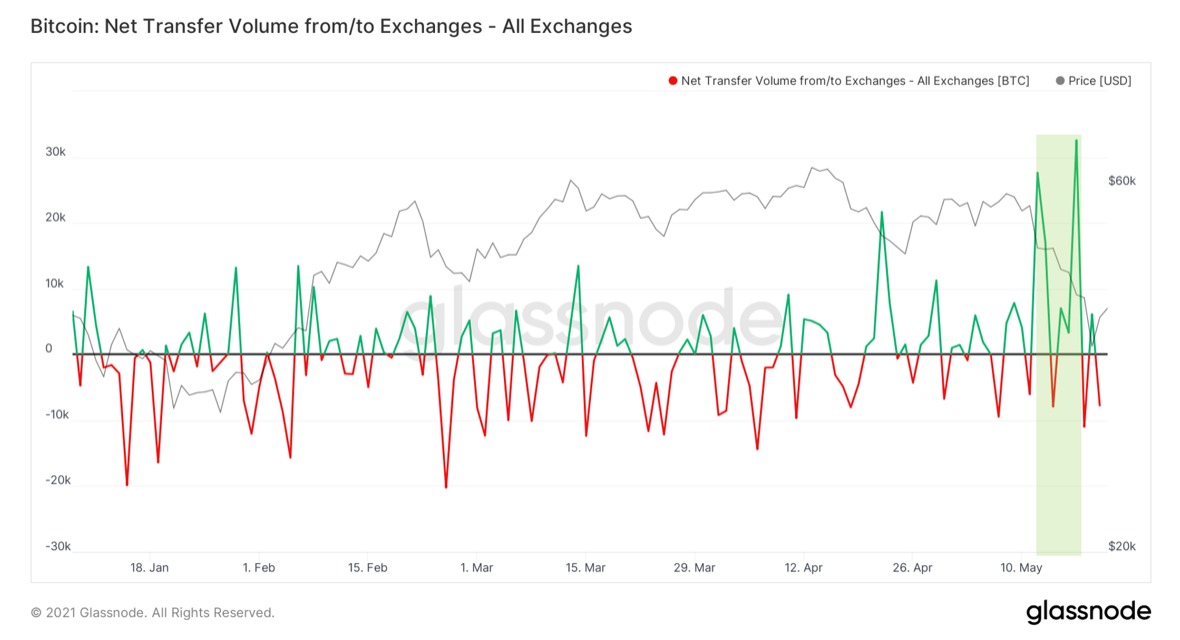

Highlighting the peaks and the amount of flows out of the exchange as Bitcoin slipped below the $40,000 range, he said

“A lot of coins are coming off. So very bullish on the exchange flows.”

Morgan Creek Digital’s Anthony Pompliano, on the other hand, emphasised the “bearish” state of the exchange flows. In the time following the recent FUD surrounding Bitcoin, newer market participants decided to sell off their hodlings when compared to the traditional players. Highlighting the same, he said,

“In the 4 days leading up to the dump, exchange flows turned clearly bearish, with exchanges having +59,313 BTC in just 4 days.”

Coins had been moving from “strong hands” to “weak hands,” but the momentum has started to swing back lately and strong hands currently bear the torch. Drawing parallels to last year’s situation, the analyst said,

“This is similar to the last year’s Covid crash where an exaggerated movement caused strong hands freak out and sell massively, but that’s subsiding now.”

Despite spot coins being massively sold during Wednesday’s bloodbath, Bitcoin rallied back to the same price it was two days ago. Asserting the same, another analyst said,

“… Because they all got bought up by spot buyers with real cash instead of leverage, which are stronger hands, these coins have now transferred from short term leverage speculators to real cash buyers.”

Interestingly, a similar crash of the same scale happened during 2018’s dead cat bounce and a massive sell-off made the coin’s price drop from $20,000 to $7,000. In his concluding remarks, Woo said,

“No indicator right now is saying we are in a bear market and I’m pretty sure that coins are moving back into the strong huddle.”