Bitcoin’s price to $70,000 again? THIS historical example could be key…

- Popular analyst believes BTC’s potential to reach a new peak is based on historical data

- Anticipated rally hinges on how well the crypto holds the $54,000 support level

Over the past week, Bitcoin’s market performance has been sluggish, with a 4.53% decline on the charts. At the time of writing, it was priced at $58,371.56, with its market cap dropping marginally too. That being said, its valuation was still above a trillion dollars.

Even so, cautious sentiment still reigns supreme in BTC’s market, with many still hesitant about wanting to buy in.

Is Bitcoin going to reach a new all-time high?

Crypto analyst Moustache asserts that Bitcoin is at a key turning point right now, potentially leading to a breakthrough above the $70,000 threshold.

His analysis is based on a comparison of BTC’s current price action post Japan’s stock market crash, which triggered a crypto downturn in August, to the COVID-19-induced crash.

According to his chart, the COVID-19-induced crash led BTC to rally significantly, reaching highs of around $11,892.92. This could posisbly be duplicated in this case.

The analysts claimed that based on BTC’s historical trends, the current price consolidation may be temporary and could set the stage for potential upward movement.

“If $BTC continues to copy 2020, the current range is the second best chance because it’s only a retest for the time being.“

That being said, he cautioned that the stability of the $54,000 level is required for this upward trajectory to materialize. He added,

“$54,000 must hold for this [rally to a new high] to happen.“

What this means is that a dip below $54,000 could tilt the market towards bearishness, dominated by selling pressure.

Now, with the spotlight on the $54,000 level now, AMBCrypto dug further to ascertain if this level is likely to hold and what the sentiment around BTC actually is.

Market sentiment – Will the $54,000 level hold?

Data from IntoTheBlock revealed that 80% of BTC holders are currently profitable. This suggested that the overall market sentiment remains optimistic.

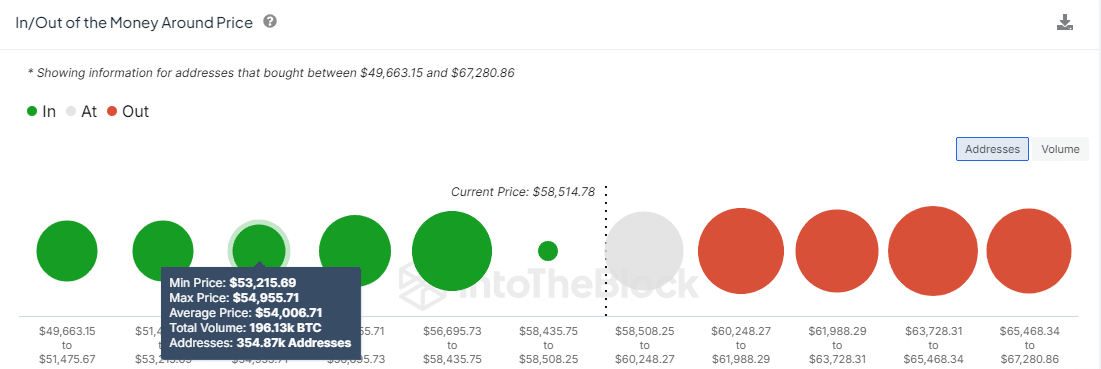

Upon analysis of the In/Out of the Money Around Price (IOMAP) metric, AMBCrypto discovered that $54,018.30 is a strong support level, with over 355,000 addresses with a collective trading volume exceeding $1 billion.

The IOMAP tool illustrates support levels where a majority of holders are profitable (“in the money”), and which could prevent prices from falling further. Conversely, it also identifies resistance levels where many are unprofitable (“out of the money”), potentially triggering sell-offs as prices climb, thus capping further hikes.

With Bitcoin priced where it is right now — A figure close to the analyst-highlighted $54,000 mark — It appears well-positioned to act as a buffer against further declines. This finding could catalyze another surge on the price charts.

Finally, Coinglass reported significant negative netflows of $738.06 million from three major exchanges, Binance, OKX, and Bybit, over the last week – A sign that more BTC is being withdrawn than deposited.

This trend typically implies market participants have a preference for holding or securing their assets offline. This will potentially reduce the supply on exchanges and drive up BTC’s price if demand remains the same or grows.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)