Bitcoin’s prices depend on this week’s Fed events: What’s going on?

- Key events that could impact BTC’s price are coming up this week.

- BTC has lost some gains from its previous trading session.

Bitcoin [BTC] has encountered volatile price movements in recent days, exemplified by a notable over 3% decline on the 10th of May, which drove its value down to $60,000.

However, indications suggest that these choppy fluctuations may persist, largely influenced by the impending Federal Reserve meetings.

Bitcoin investors await BLS events outcomes

The upcoming events scheduled by the US Bureau of Labor Statistics (BLS) this week are noteworthy for investors due to their potential impact on investment decisions.

Historical data suggests that announcements from the Federal Reserve (Fed) have influenced Bitcoin prices in the past.

Therefore, the upcoming speech by Fed Chair Jerome Powell, scheduled for the 14th of May, is particularly significant.

The BLS schedule indicates two key events: the Producer Price Index (PPI) today and the Consumer Price Index (CPI) on the 15th of May.

The PPI measures changes in prices received by producers for goods and services, while the CPI tracks changes in prices paid by consumers for those same goods and services.

Both indices serve as vital economic indicators that investors rely on to gauge the state of the economy.

Additionally, the BLS website indicates an upcoming event focused on employment claims later in the week.

These macroeconomic events are poised to influence Bitcoin price movements as investors closely monitor them to inform their investment strategies.

What to expect from Bitcoin price moves

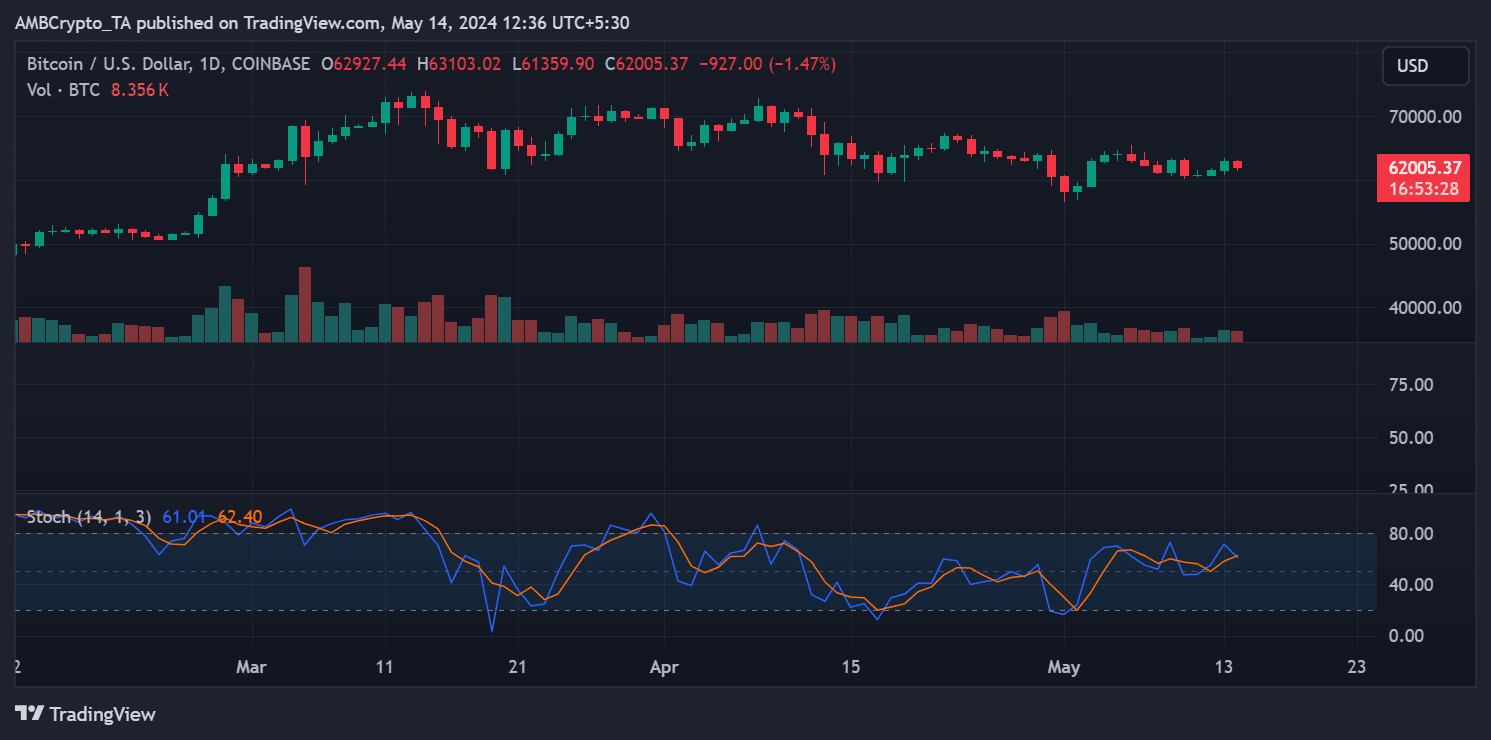

AMBCrypto’s analysis of Bitcoin’s price trend on a daily timeframe chart indicated a sluggish performance over recent weeks.

On the 10th of May, the price experienced a significant drop from over $63,000 to around $60,000, reflecting a loss of over 3%.

While attempting to recover since the 11th of May, Bitcoin could only reach approximately $62,900. At the time of this writing, it was trading at around $62,000, with a decline of over 1%.

Examination of the stochastic indicator suggested the possibility of further decline, as a crossover was still ongoing.

However, based on recent price action, the $60,000 level appears to serve as a strong support region. Should the price drop further, around $57,000 might act as another level of support to prevent further decline.

Possible rise in BTC volume expected

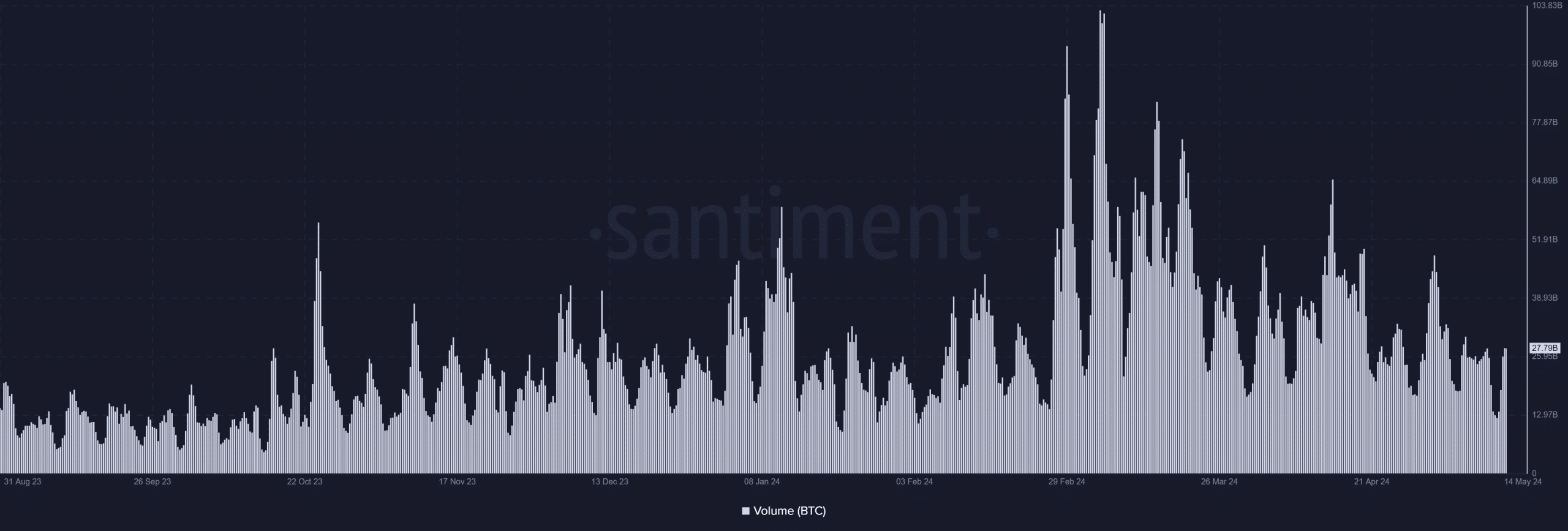

The volume metric for Bitcoin could experience increased activity if the price begins to decline.

The chart revealed that during the previous trading session, when the Bitcoin price was rising, the volume was approximately $25 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, at the time of writing, as the BTC price has dropped, the volume has already surged to nearly $28 billion.

This uptick in volume suggests heightened trading activity, potentially indicating increased selling pressure if the price continues to fall.