Bitcoin’s realized cap reflects fresh capital inflows

Bitcoin’s realized cap — which reflects the aggregate value of coins at their last transaction price — has seen good growth, underscoring fresh capital inflows into the market.

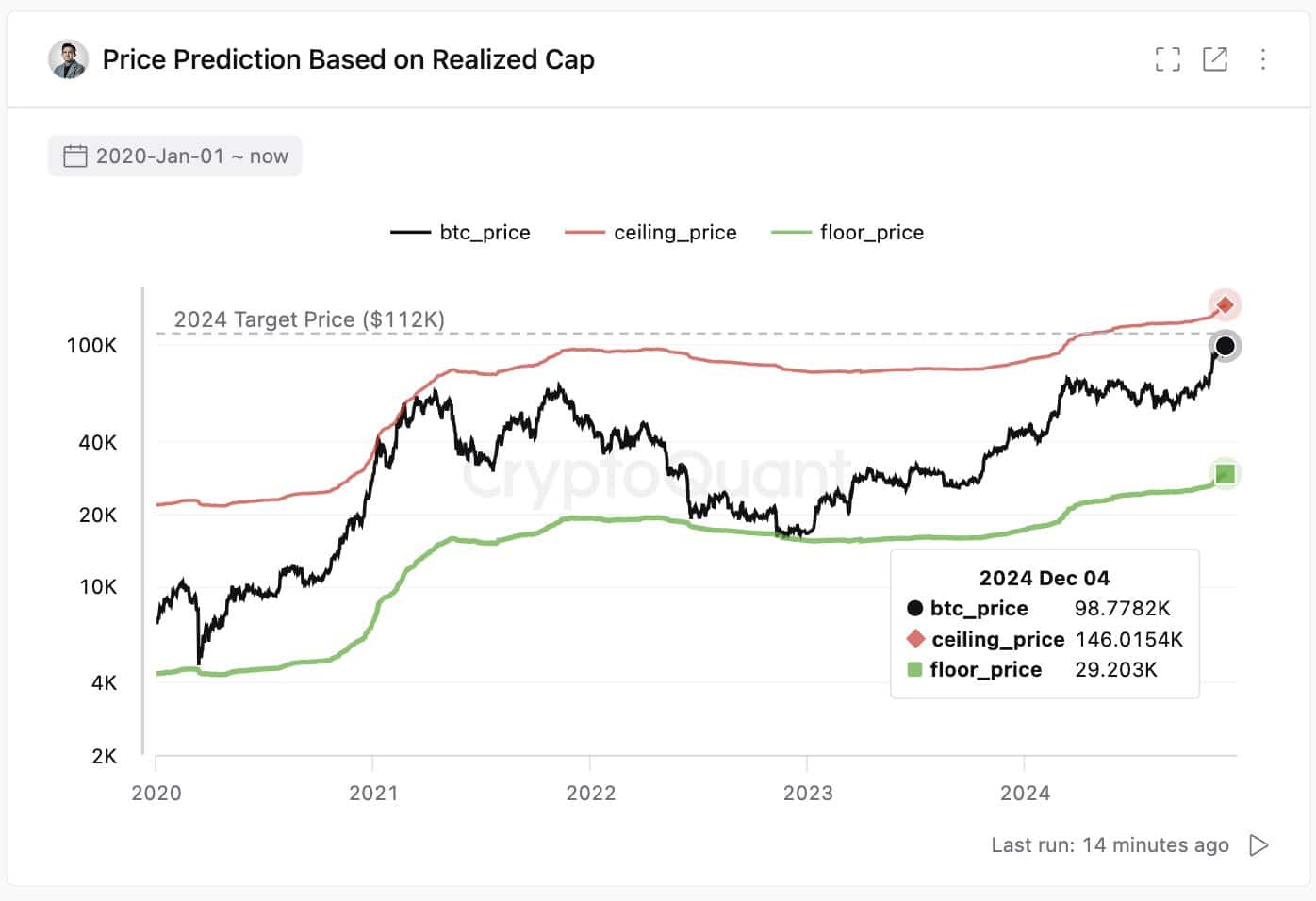

Over the past 30 days, Bitcoin’s ceiling price surged from $129K to $146K, as noted by CryptoQuant CEO Ki Young Ju, highlighting increased investor confidence and new liquidity entering the ecosystem.

This dynamic is a critical indicator of market health, showing that recent price action isn’t solely driven by speculative trading but supported by tangible buying activity.

Notably, at $102K, Bitcoin remained well below the bubble threshold, which would require a 43% rise to breach.

Such data points to a balanced market rally, grounded in sustainable demand rather than irrational exuberance.

The combination of realized cap with price suggests that Bitcoin’s upward momentum could have further room to grow, driven by solid fundamentals.

Bitcoin’s $102K price and the 43% surge

Bitcoin’s current price of $102K places it firmly in a growth phase, yet still far from the $146K ceiling price — a level often associated with “bubble” conditions.

The 43% gap underscores the relative sustainability of the current rally compared to past euphoric peaks.

This threshold, as derived from Bitcoin’s realized cap data, represents a hypothetical upper limit where speculative exuberance could dominate rational valuation.

The need for a 43% surge reflects both the scale of liquidity required and the tempered pace of current inflows, suggesting market participants are focused on accumulation rather than chasing parabolic moves.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This measured advance supports the narrative of a healthy bull cycle, driven by institutional participation, macroeconomic trends, and long-term holders increasing their stakes, rather than speculative retail frenzy.

Bitcoin’s resilience at these levels remains key to sustaining upward momentum.