Bitcoin’s revisit to this area would be a good shorting opportunity

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

Bitcoin [BTC] dropped to a low of $20.8k in the hours preceding press time. This was a level that Bitcoin last traded at eighteen months ago. The global crypto market capitalization stood at $928 billion, and over the past two days of trading, crypto lost its status as a trillion-dollar market. However, the pain for investors might not have ended, and new lows could yet be set.

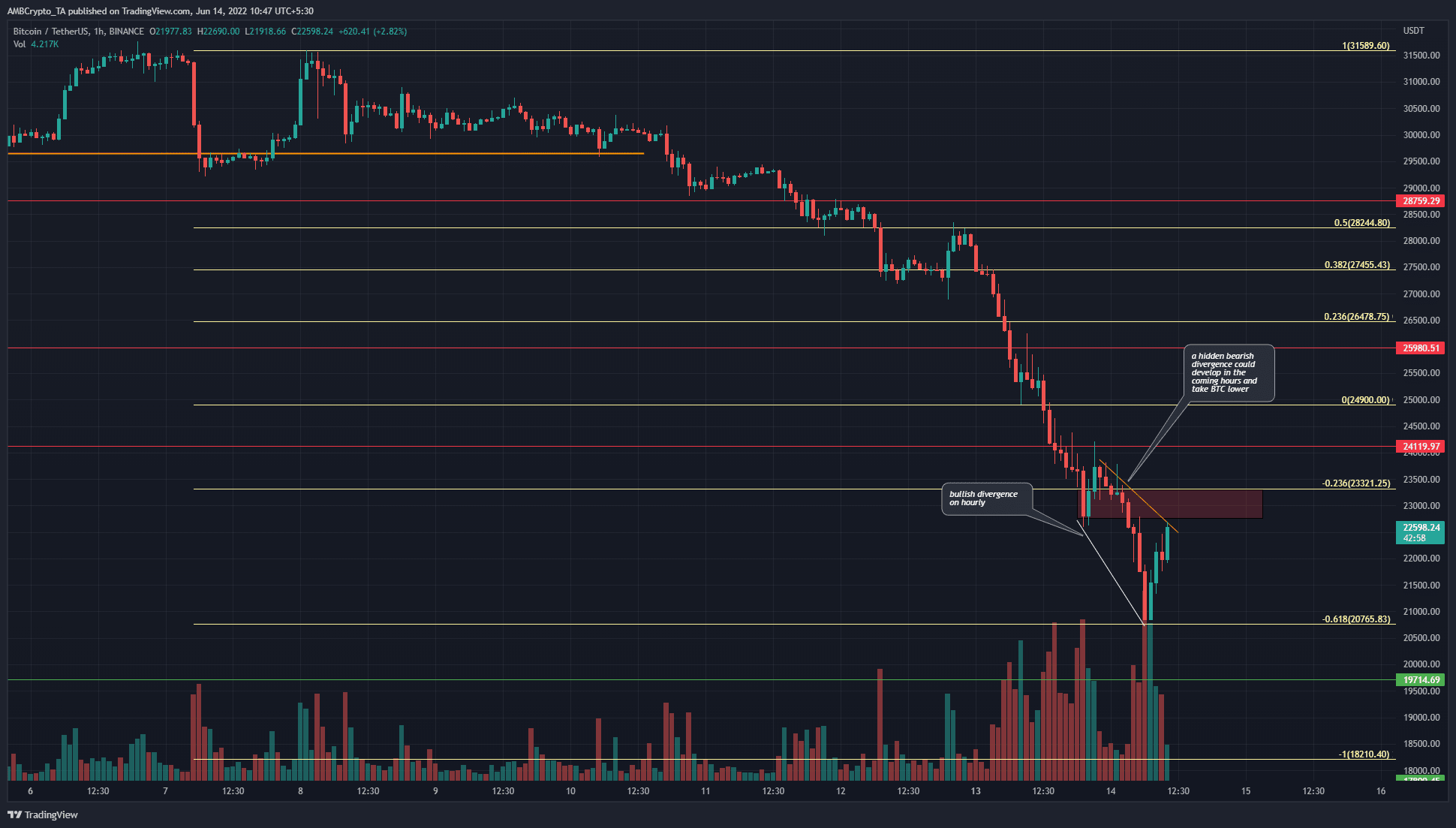

BTC- 1 Hour Chart

Bitcoin could be a great buying opportunity at $20k, but the short-term market structure was strongly bearish. A drop of 25% for Bitcoin within 36 hours is quite uncommon, and sometimes it does see BTC form a local bottom and grind its way higher.

The Fibonacci levels plotted (pale yellow) were based on the move from $31.5k to $24.9k, and the 61.8% extension level was almost perfectly tested as a support level. The $23k area acted as support for a brief period of time but was overwhelmed by the selling pressure. It could be revisited in the hours to come and could form a hidden bearish divergence shortly. Its confluence with the 23.6% extension level presents this area as stiff resistance and could offer a shorting opportunity.

Rationale

In white is highlighted a bullish divergence, which saw BTC pullback from the $20.8k mark. However, a hidden bearish divergence (orange) could also present itself soon. Hidden divergences signal the continuation of the former trend, and therefore the downtrend could continue and push BTC lower.

The Awesome Oscillator (AO) was also well below the zero line to show strong bearish momentum, while the OBV also saw a sharp dip southward. Hence, sellers have the upper hand by a large margin.

Conclusion

Sellers have been dominant, and a revisit to the $23k area would likely be a shorting opportunity for Bitcoin. The break southwards comes after a month of consolidation within a range, and the $20k mark could be visited once again.