Bitcoin

Bitcoin’s risk dynamics: Safe haven or speculative bet?

Analysts present divergent views on BTC as a hedge and ‘risk-on’ asset.

- Analysts expressed views on BTC’s sensitivity to global liquidity conditions.

- BlackRock’s Mitchnick saw BTC as a ‘risk off’ asset; Alden viewed it as a ‘risk on gold.’

Bitcoin [BTC] was reportedly more sensitive to global liquidity conditions than gold and other asset classes.

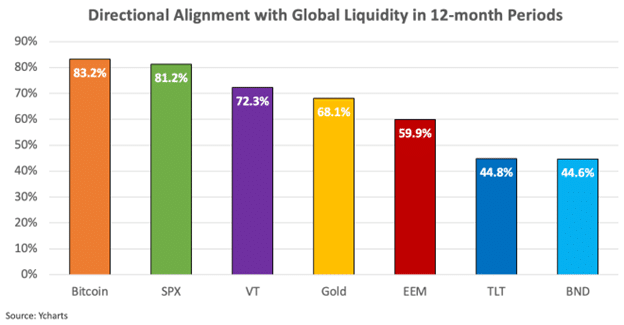

According to Lyn Alden, a reputable macro analyst, BTC reacts 83% of the time to global liquidity conditions than any other asset.

“Bitcoin moves in the directional of global M2 83% of the time; more than other assets.”

BTC: A ‘risk on’ or ‘risk-off’ asset?

U.S. equities, as denoted by SPX, are the second most reactive asset to global liquidity conditions, while gold came in fourth.

This indicated that BTC was more of a ‘risk-on’ asset that performed better when interest rates were low or during quantitative easing cycles.

That also suggests that BTC is less of a relative hedging asset than gold. Per Alden, BTC is ‘risk-on gold’ because it’s new sound money, but some capital allocators have limited understanding of it and treat it as a ‘risk-on’ asset.

She added that the correlation could continue for another 5–10 years before BTC begins acting like gold.

“If it gets really big, then it could switch more to gold-like correlation, which is not that far off.”

However, BlackRock’s Head of Digital Assets, Robbie Mitchnick, sees BTC as a ‘risk-off’ and hedging asset. For context, ‘risk-off’ assets tend to perform well during periods of uncertainty and turmoil.

Mitchnick noted

that BTC and gold have almost zero long-term correlations to U.S. stocks, with occasional and temporary positive valuations. He added,“When we think about Bitcoin, we think about primarily as an emerging global monetary alternative…Scarce, global, decentralized, non-sovereign asset. And it’s an asset that has no country-specific risk, that has no counterparty risk.”

Per Mitchnick, rising inflation and investors’ concerns about U.S. political/fiscal sustainability will be key growth drivers for BTC, making it a ‘risk-off’ asset.

That said, there have been ongoing debates about whether BTC is more sound money with extra upside potential compared to gold.

However, in the short term, Alden’s projections look more likely. BTC behaves like a ‘risk-on’ asset.

In fact, per the BTC Pearson Correlation, the cryptocurrency has increasingly become positively correlated with U.S. stocks in Q3.

Put differently, BTC’s price action could be forward-looking to U.S. Fed monetary policy updates rather than crypto-specific events in the near term.

In short, the U.S. PCE (personal consumption expenditure) data, which will be released on the 27th of September will drive BTC volatility.

Additionally, the recent Chinese economic stimulus and expected easing cycle will also boost BTC in the medium run.

Ergo, tracking this front can be helpful as part of a macro-approach to risk management strategy for BTC investors and traders.