Bitcoin’s roller coaster ride had these turns to reach below $20k

Assessing the broader market condition, in the current times, cryptocurrency hype looks to be fading away into the mist as per Santiment.

In fact, crypto-related commentary hasn’t been this scarce since the end of 2020.

That being said, the price of the king coin witnessed yet another correction below the $20k mark. But, interestingly, the number of Bitcoin holders continues to hike despite the looming bearish season.

Smiling through pain

BTC price rebounded by +7% over the past week and held up better than the SP500 for a change. Thus, marking a much-needed relief for the crypto market. However, the happiness didn’t last too long.

In fact, after just two hours, as clocked by the analytical firm, Santiment, the king coin took another nosedive given the close correlation with the equity market.

Herein BTC’s rise got ‘stifled’ by the S&P 500’s mid-day plummet as per Santiment. Here’s a graphical representation of this occurrence.

Following the dive, BTC, at press time, slid down to the $18.7k mark after witnessing a fresh 8% correction in 24 hours. Ergo, erasing all the hard work it did recently.

You ask if BTC holders followed this pattern to dump their coins. Well, the reality was quite the opposite. According to the latest data from IntotheBlock, the number of BTC holders grew in the bear market.

Source: IntotheBlock

As per ITB’s analysis, ‘Over 42M addresses are currently holding $BTC, 4.5M more than a year ago.’ As could be seen in the aforementioned graph.

No hope to reach atop?

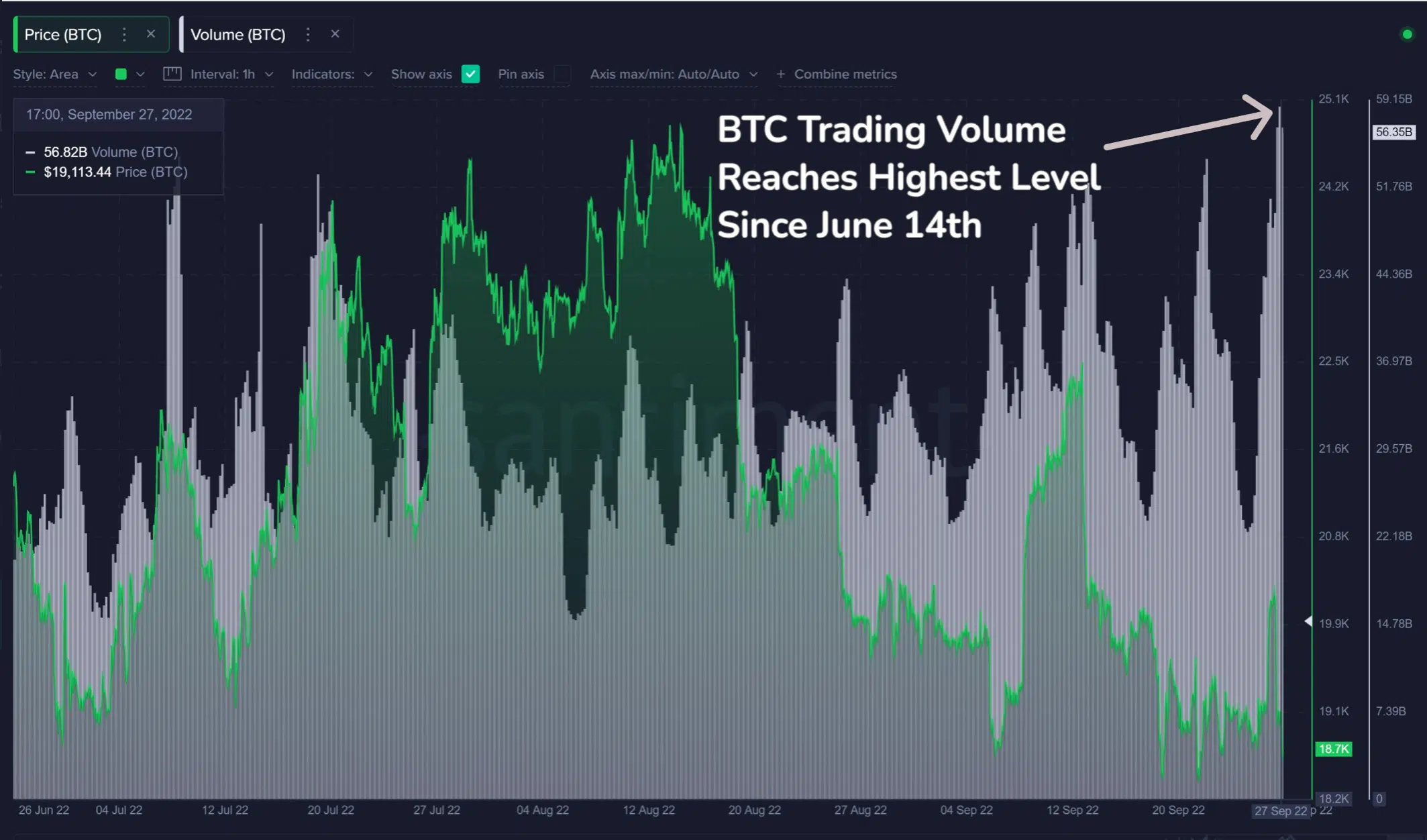

Well, that’s never the case with BTC, given the decorated past. Yes, BTC fell around the $18.7k mark but investors/traders continued to show increasing interest. For instance, consider the trading volume for the flagship token.

Trading volume heated up for crypto markets, especially BTC. During the big leg down, BTC peaked at its highest level of trading since 14 June. According to Santiment’s 28 September insight, the volume has “gradually risen all year since bottoming out in late January.”

Herein, BTC hit a 3-month high in trading volume as the price declined. This could act as a much-needed catalyst to trigger BTC’s price above the $20k mark.

But again, one needs to keep an eye out on the movement of short-term holders as the cohort suffered significant unrealized losses.