Bitcoin’s short-term outlook depends on these key factors

Bitcoin’s price has seen its fair share of ups and downs over the past month. While the coin has been able to set record highs in 2021, there have also been strong pullbacks.

In the past 24 hours alone, Bitcoin breached the $50,000-mark after days, before succumbing to selling pressure again to trade under the said level. However, as always, the question remains – How far away is the next price rally to its latest ATH. Interestingly, there are signs that traders won’t have to wait too long before such an uptrend materializes.

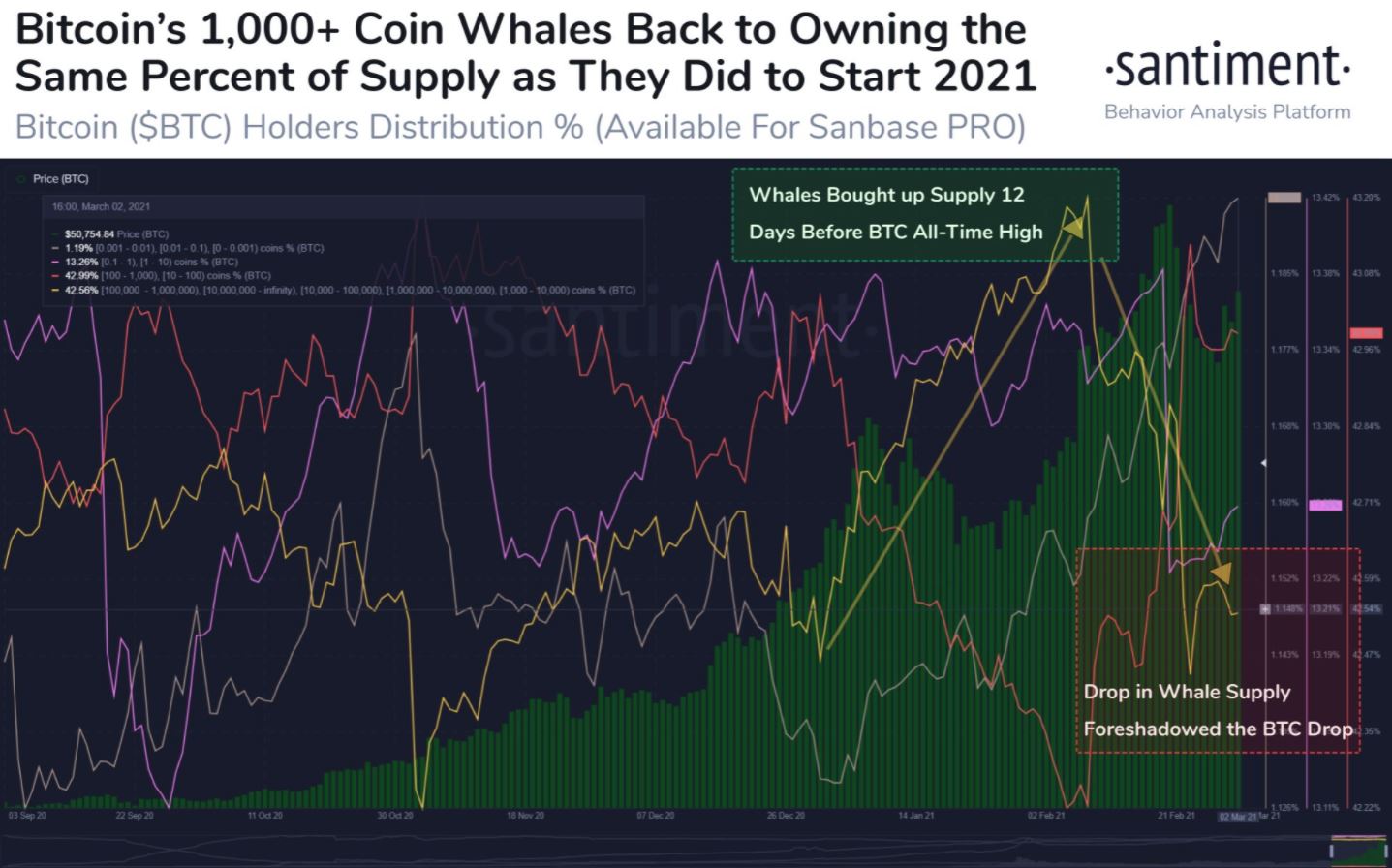

Source: Santiment

Large holders of the coin have played a key role in BTC’s growth over the years and 2021 has only highlighted their importance when it comes to price appreciation. According to data provided by Santiment, Bitcoin’s largest holders with over 1,000 Bitcoins currently hold around 42.56% of the total supply.

On 8 February, this was around 43.29% – a 54-week high, and one can argue that this fueled the Bitcoin run that established a new ATH that month. With its value inching towards 43%, traders can expect this to be an indication that whales are looking to fuel another rally in the coming weeks.

Bitcoin’s market data backed up this possibility. In Bitcoin’s market cycle, there has always been a balance between hodlers selling and re-entering the market at a lower price point. The smart money scenario may play a key role this time around as well.

Long-term supply decreases as Hodlers take profits during bull markets and increase in re-accumulation phases at cheaper prices. This lends context to the latest price dip as Bitcoin still retains strong fundamentals. In fact, its price corrections are symptomatic of hodlers selling high only to buy low and boost the price and complete a market cycle. Such has been the case over the past few months and this is likely to continue in 2021 as well.

Source: Glassnode

It is also important to note that Bitcoin’s rally, despite being a few months old, can be considered to be in its mid/early stages. Data provided by Glassnode highlighted this aspect of Bitcoin’s price action by taking into consideration the coin’s reserve risk and contrasting it with its previous bull runs.

Source: BitPremier

At the time of writing, Bitcoin’s volatility was continuing to rise. In fact, according to market data provided by BitPremier, the 30-day BTC/USD volatility was observed to be around 5.35 percent – a level not too far away from its 6-month high of 6 percent.

Increased volatility makes the coin open for further price action in either direction. Ergo, it also slightly increases the possibility of the cryptocurrency noting a greater pullback. If BTC is unable to sustain a breach of the $50k level, it could be trouble for its price aspirations in the short-term.

However, given its strong fundamentals and past precedents backing a renewed rally, traders can take consolation in BTC’s long-term prospects. Then again, this depends on the resistance being flipped to support – a scenario that will materialize if Bitcoin is able to gain substantial buyer momentum in the coming days. Such a trend reversal will enable it to take further advantage of its strong fundamentals while pushing it towards its latest ATH.