Bitcoin’s supply on exchanges shrinks: Time to stock up on BTC?

- Bitcoin drew closer to a supply crunch and a major rally as exchange reserves dipped lower.

- A CryptoQuant analyst highlighted why BTC’s reserves and increasing stablecoin supply pointed to an upcoming major rally.

Bitcoin [BTC] holders have been anticipating a major bullish outburst in 2024. But with the year approaching the tail end, many have been left wondering if the bull run has been cancelled.

Before the heights of expectations dip into the valley of despair, there are still signs signaling that Bitcoin bulls may still show up.

According to CryptoQuant analyst Tarek, the next major Bitcoin bullish move is rapidly drawing near.

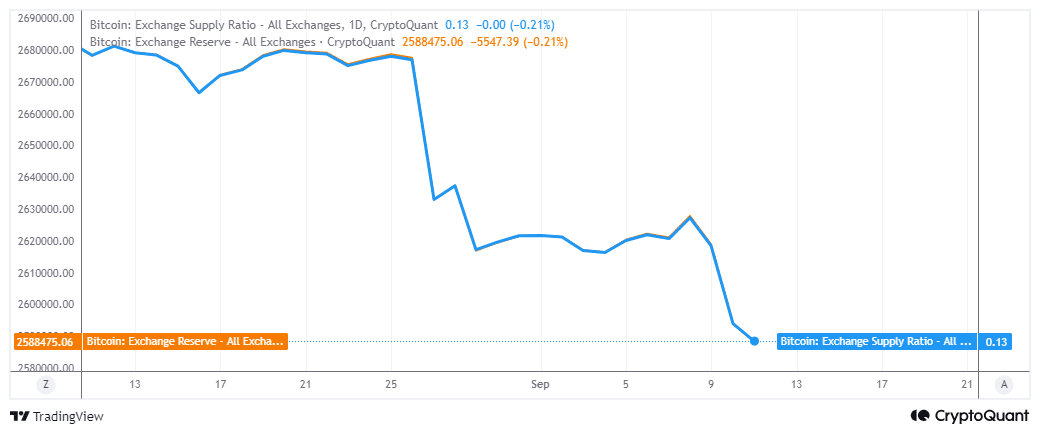

The analyst highlighted the declining Bitcoin exchange reserves as the first major sign. This decline accelerated in the last three days, after previously registering an uptick between the 4th and the 8th of September.

Exchange reserves dropped by 39,356 BTC (worth roughly $2.28 billion) during the three-day period. This may also explain why Bitcoin bulls recently demonstrated strength in bouncing back from recent local lows.

It also coincided with a resurgence of demand from ETFs.

Stablecoin reserves recently reached new highs

The declining reserves underscore the tightening Bitcoin supply. Lower prices observed recently provided a significant amount of time for buyers, especially whales, to accumulate at lower prices.

The analyst also pointed out rising stablecoin reserves as another sign pointing to the possibility of a rally.

The ERC20 total stablecoin marketcap on exchanges recently reached a new ATH above $25.5 billion, according to CryptoQuant.

The analyst noted that the rapidly growing stablecoin marketcap is a sign that the market demand for stablecoins is high. This tends to happen as investors prepare to move liquidity into crypto.

The combination of declining Bitcoin reserves and growing stablecoin reserves points to the likelihood that a major rally is on the way.

Bitcoin has also demonstrated strength above $50,000. An indication that any dip below that level would be seen as a heavy discount.

The above observations are also in line with the Bitcoin halving timeline. This event has historically been followed by a major rally, months after the halving.

The fact that institutional demand is now more present than ever could set Bitcoin up for another strong bullish move.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

What does it all mean for price action? Bitcoin could soon push into new price discovery regions. Some authorities in the investment landscape, such as Cathie Wood, expect prices to push above $200,000.

Therefore, a more modest expectation would be above $90,000 possibly before the end of the year and even higher in 2025.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)