Analysis

Bittensor bulls move towards $380 with 21% gains in 2 days

TAO’s Open Interest has gained more than $12 million in two days alongside soaring prices.

- Bittensor has recorded large gains in recent days, pushing past a key Fib level.

- The $360-$380 zone that was significant in June could be pivotal once more.

Bittensor [TAO] has risen 21% since the low registered on the 21st of August at $280.5. This steep price increase occurred when Bitcoin [BTC]

floundered around the $60k resistance zone without a definite trend.The price action strongly hinted that a move toward $380 is on the cards. Are the bulls strong enough to maintain the upward trajectory?

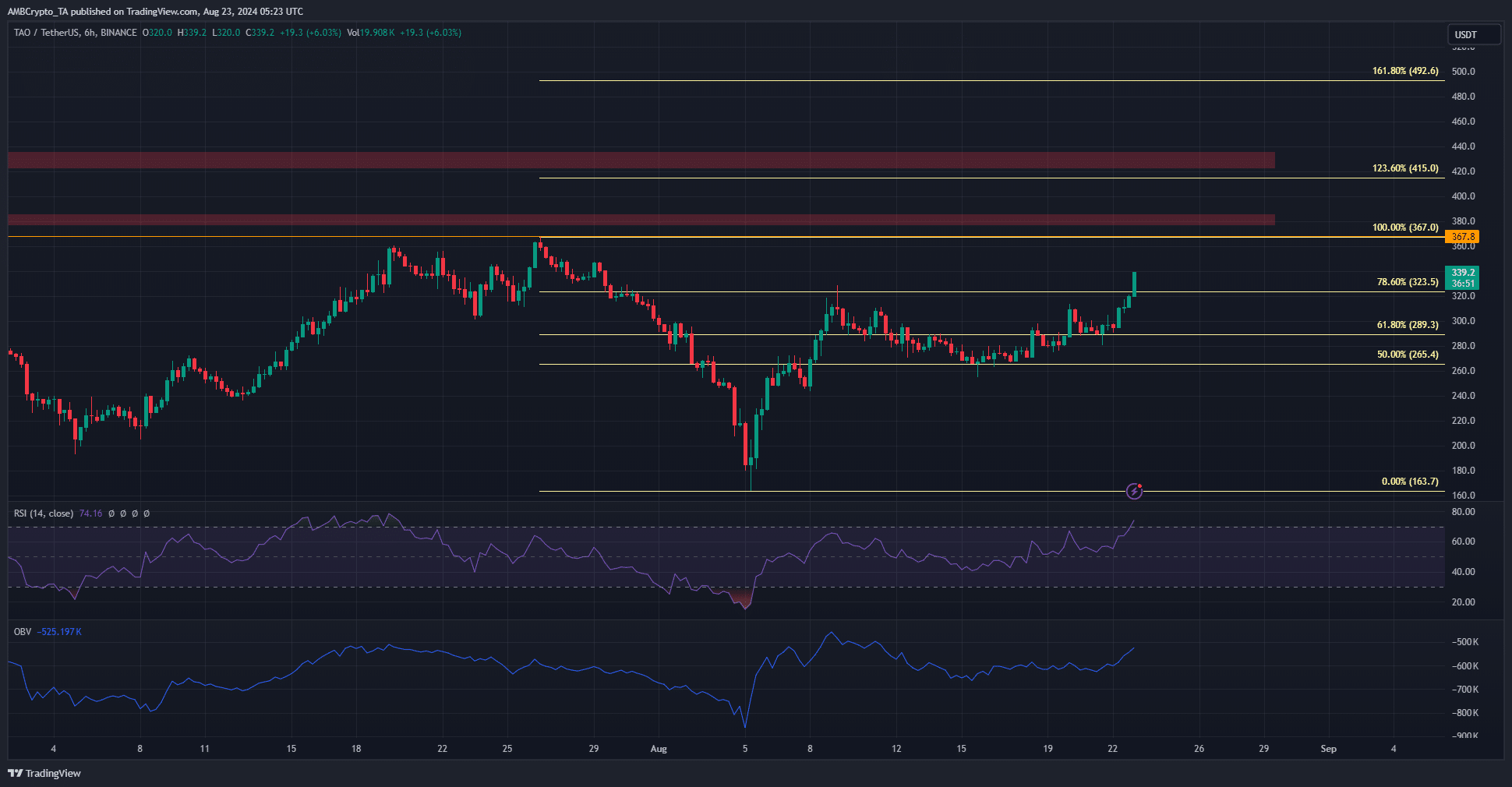

TAO bursts past key resistance

Throughout August, the$323 served as a strong resistance. The bears flipped it in late July, and it was retested during the price bounce after the 5th of August. This retest was a failure and TAO was forced back to $265.

Since then, the bulls were resurgent and drove prices upward once again. This time they succeeded in breaking past the 78.6% Fibonacci retracement level, which was plotted using the July-early August slump.

The OBV was climbing higher to show demand in the market. The daily RSI signaled strong momentum, with a reading above 70. It appeared likely that Bittensor prices would reach $367 soon and potentially go higher.

The lower timeframe data was hugely encouraging

Source: Coinalyze

The Open Interest has gained more than $12 million in two days alongside soaring prices to indicate strong bullish speculative activity. The spot CVD also jumped higher to outline increased spot demand.

Read Bittensor’s [TAO] Price Prediction 2024-25

The long/short accounts ratio fell toward 1. This showed some bearish sentiment, but it was encouraging because it showed the skewed long/short ratio was resetting even as prices trended higher.

This reset could help TAO move even higher as long positions closed, likely taking profits but not impacting the bullish sentiment much.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion