Bittensor leads AI coins with gains, volume surge: What’s next for TAO?

- TAO surged by 7.1% over the past 24 hours.

- Bittensor outpaced other AI coins as its trading volume soared by 104%.

The crypto market has seen a strong upswing with Bitcoin [BTC] reaching $71,500, at press time.

This upswing has positively impacted most altcoins. Among these, Bittensor [TAO] stands out. At the time of writing, TAO was trading at $544 after a 7.12% increase.

TAO’s trading volume surged by 104.58% to $211 million in a day, outperforming most AI-themed altcoins.

TAO outpaces other AI coins

As such, over the past day, while Tao climbed over 7%, other AI coins like Injective [INJ] increased by 6.53%, and Near Protocol [NEAR] hiked by 5.84%.

Other coins like Artificial Superintelligence Alliance [FET] rose by 5.49% and Internet Computer [ICP] gained by 3.52%.

This upswing shows increased investor favorability for AI-themed coins, with TAO seeing a heightened interest.

What it means for TAO’s price charts

AMBCrypto’s analysis showed that TAO was starting to gain upward momentum.

As such, the prevailing market conditions could set the altcoin for more gains on price charts.

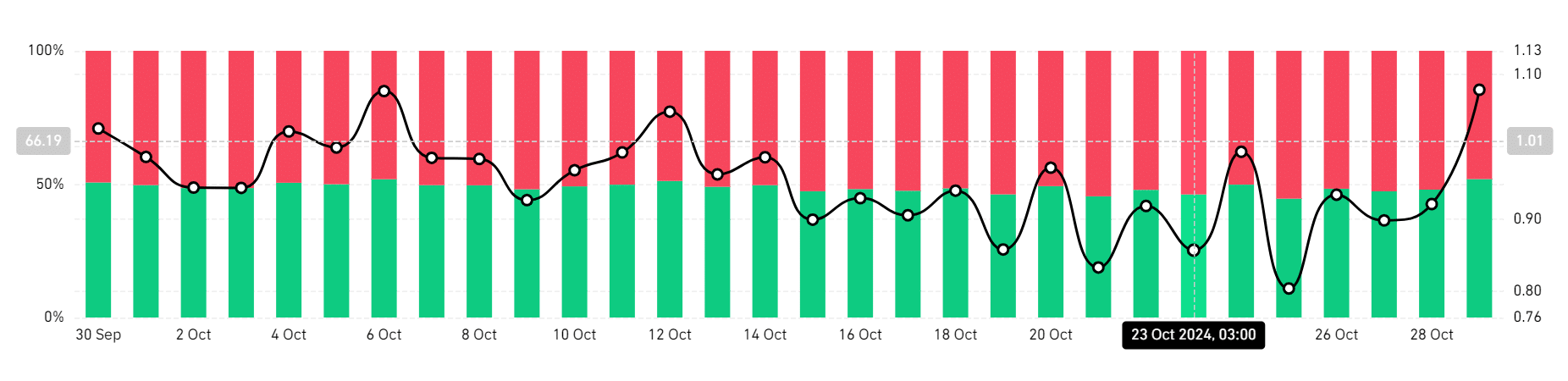

For example, Bittensor’s Long/Short Ratio shows that long position holders are dominating the market.

At press time, longs accounted for 50.96% while shorts are 49%. With a 1.039 ratio, this suggested that most investors were bullish and anticipated the prices to rise.

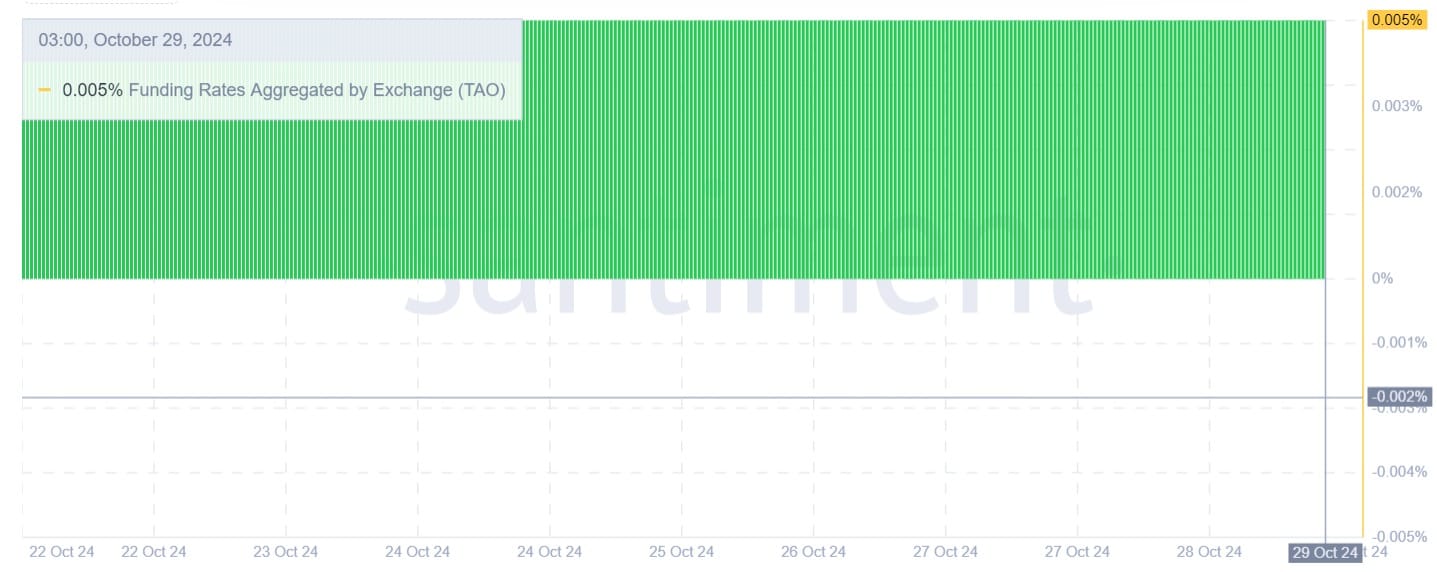

This demand for long positions was further supported by a positive funding rate aggregated by the exchange.

This metric has remained positive over the past week, implying that longs are willing to pay premium fees during downturns to hold their positions. Such behavior signals bullish sentiment.

In conclusion, TAO was seeing an upward momentum, as depicted by RSI that surged from 45 to 50, at press time, indicating increasing buying pressure.

Read Bittensor’s [TAO] Price Prediction 2024–2025

Therefore, with a positive sentiment and investor favorability, the altcoin is well-positioned for more gains. If these conditions hold, it will reclaim the $584 resistance level.

Consequently, if this price increase arises from mere speculation, TAO might face rejection and decline to $463.