Bittensor [TAO] pumps 80% in April as ecosystem expands – But will the rally end?

- TAO has recovered +80% in April, outshining SOL and BTC.

- Analysts linked the upswing to growing demand from AI-focused Bittensor subnets.

Bittensor [TAO] recovered over 80% in April and jumped 30% last week, outperforming top assets like Bitcoin [BTC] and Solana [SOL]. But what’s the catalyst behind the explosive upswing?

TAO rally drivers

According to Mark Jeffrey, the growing demand for Bittensor subnets (communities building new AI projects on the chain) could be one of the driving factors. In his X (formerly Twitter) post, he stated,

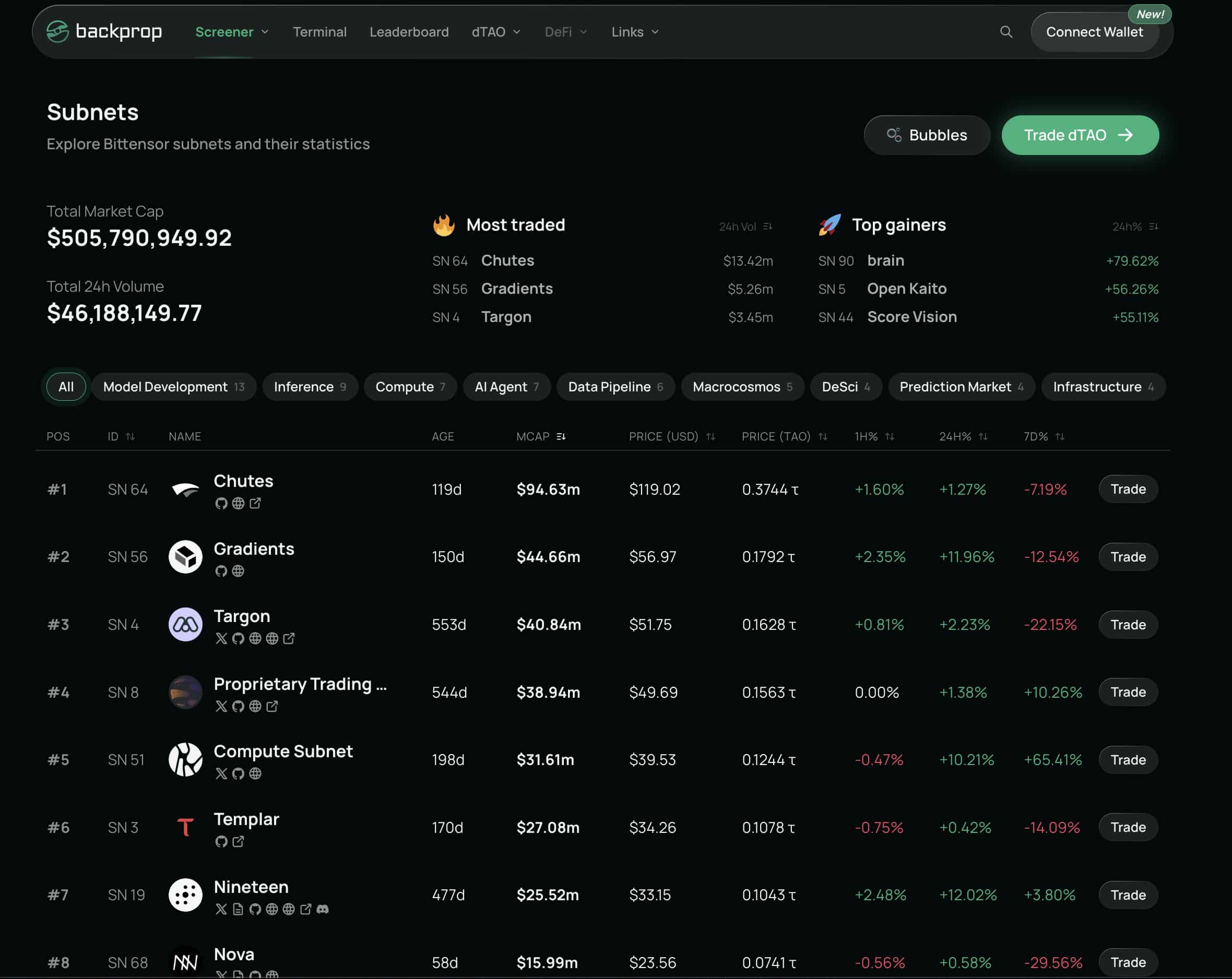

“$TAO Subnet total market cap just crossed $500M. That’s a full 10x from 9 weeks ago.”

Source: Backprop

For groups (subnets) creating AI systems using Bittensor, they must lock TAO. This directly fuels demand for the native token.

Since, per Jeffrey, Subnets grew 10x in the past 10 weeks, the growth could have positively boosted TAO.

Source: TaoStats

Per TaoStats, the subnets stagnated briefly in January, then traction picked up afterward. Between January and April, subnets increased from 65 to 95 — A 46% growth.

This wasn’t surprising at all. In fact, Coingecko recently reported AI as one of the top crypto narratives. However, according to another analyst, DeFi Jeff, subnets were still early and had enough growth potential.

“Yet we’re still early—only 6% of $TAO is in subnets, while hedge funds like Unsupervised Capital & crypto investors YumaGroup, DCG are doubling down on the Bittensor ecosystem.”

That said, TAO’s market readings were mixed at the time of writing. According to Coinglass, volumes tanked massively, with Binance recording a $214M drop in the past seven days.

Additionally, $390K TAO were sent to Kraken for sell-off per exchange netflow. However, Binance users were bullish and grabbed $192K worth of TAO.

This meant more selling pressure last week as traders rushed to lock in profits after a 30% surge.

However, the spot CVD (Cumulative Volume Delta) remained flat, suggesting that spot market demand stagnated. On the contrary, Open Interest (OI) rates spiked 100%.

This meant that last week’s extra 30% rally was leverage-driven and might not be sustainable if spot demand does improve in the short term.