Bittensor whales dominate with 77% of long positions: Impact on TAO?

- TAO declined by 6.8% in 24 hours.

- Bittensor whales were dominating, taking 77% of long positions.

While Bitcoin [BTC] has surged over the past two days to hit a high of $68k, AI-themed coins have been dipping.

Barely two weeks ago, AI coins, especially Bittensor [TAO], were leading the crypto market with massive gains. However, the past week has shown a strong difference with the current trend.

As such, TAO has experienced a sharp decline. In fact, at the time of writing, Bittensor was trading at $578. This marked a 6.80% dip over the past day and a 1.11% decline on weekly charts.

Previously, TAO had been on an upward trajectory, hiking by 98.68% on monthly charts. Despite the recent decline, increased whale dominance shows a sign of life for the altcoin.

TAO whales dominate the market

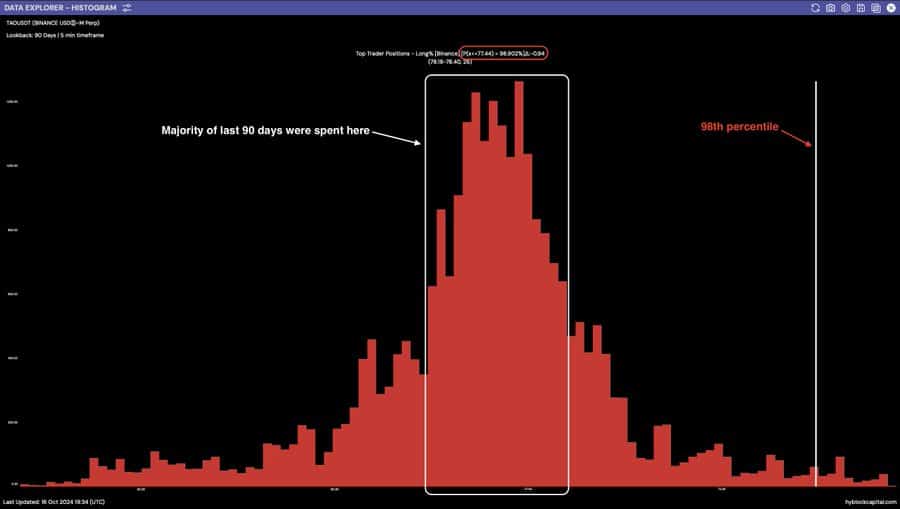

According to the report by Hyblock Capital TAO whales stands out on the Crypto Rankmap.

Based on this report, whales have dominated the market compared to retail traders. As such, a higher value suggests whales are positioned in longs relatively more than retail. This means that most whales are taking more long positions compared to retail traders.

According to Hyblock, over the past 90 days, the top traders control 77% of long positions in the market. This meant that retail traders only took 23% of the longs.

In context, for TAO, the delta points out that whales are significantly more bullish compared to retail traders. In this case, whales are taking numerous longs, signaling confidence that prices of TAO will increase.

What does it mean for TAO?

As observed by Hyblock, the market is highly bullish with most top traders anticipating prices to rise in the near term.

AMBCrypto’s analysis showed that the altcoin is experiencing strong upward momentum, with bulls still dominating.

For instance, the Advance Decline Ratio (ADR) was 2.84, at press time. This suggested that the market is experiencing broad-based strength as buyers are dominating the market.

Thus for every decline, there are 2.8 advancing assets, indicating TAO is experiencing more gains than losses.

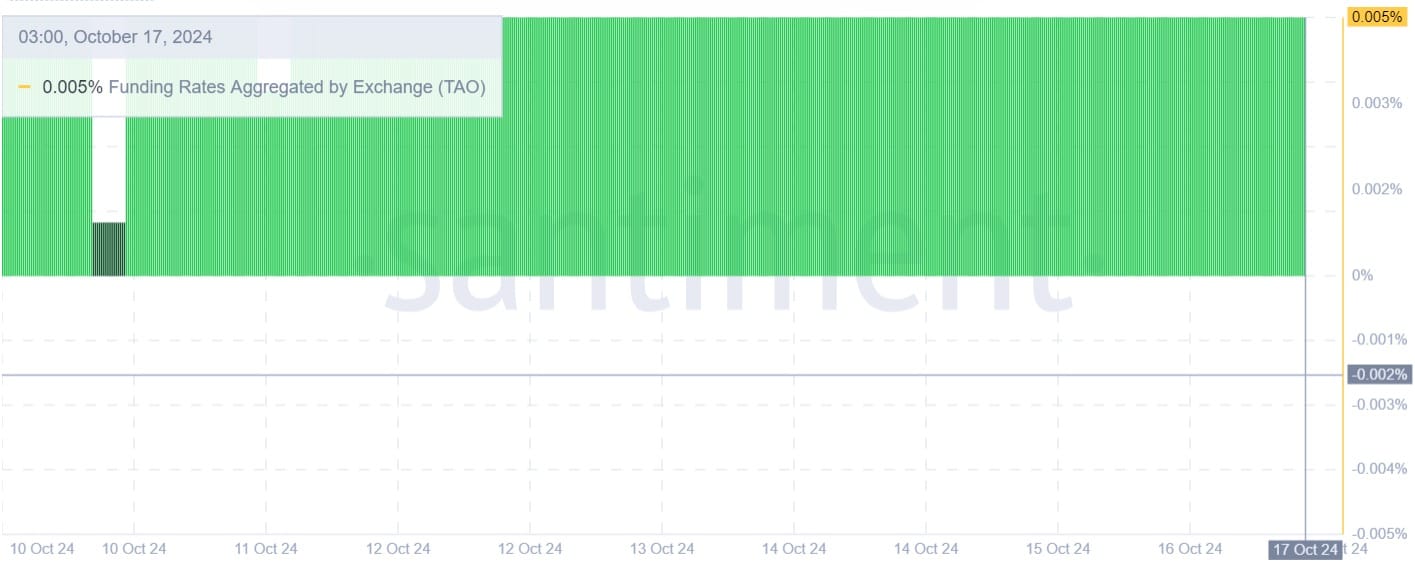

Additionally, TAO’s funding rate aggregated by exchange has remained positive throughout the past week. This shows that more traders are taking long positions than shorts and longs are paying short during downturns to hold their positions.

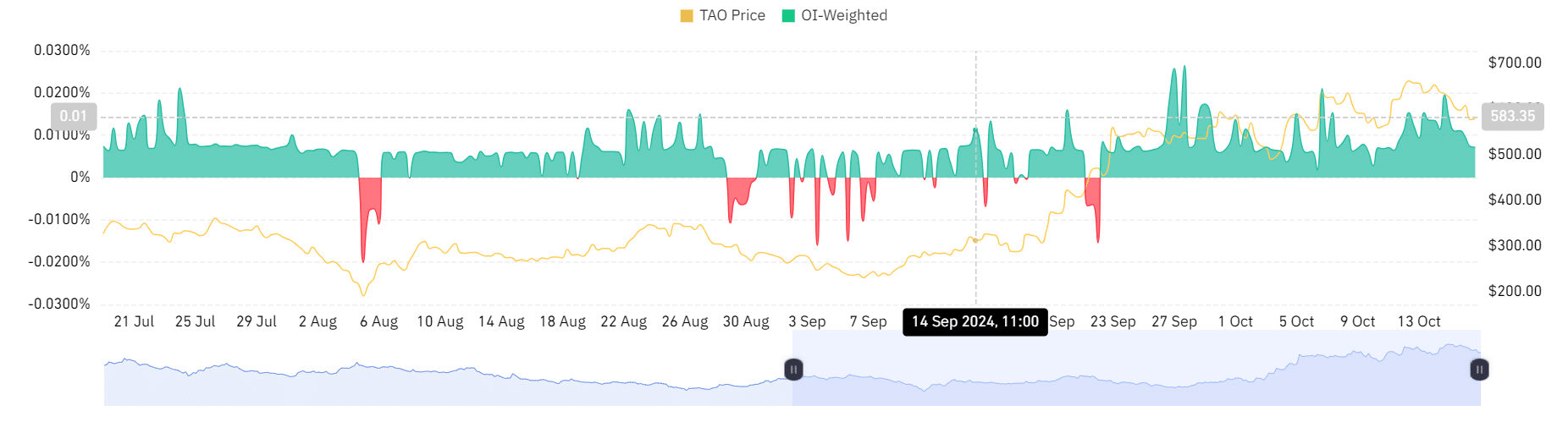

This demand for long positions is further supported by a positive Open Interest (OI) weighted funding rate. OI weighted funding rate has remained positive for the last three weeks, suggesting more traders anticipate prices to rise.

Read Bittensor’s [TAO] Price Prediction 2024–2025

Simply put, Bittensor is experiencing market favorability, with most traders taking long positions.

Thus, both whales and retail are going long. This shows high confidence in the market. If the current market sentiment holds, TAO will be well-positioned to challenge the next significant resistance level at $620 in the short term.

![dogwifhat [WIF] whales scoop $0.76 lows - But can they beat THIS fading force?](https://ambcrypto.com/wp-content/uploads/2025/08/Kelvin-_97_-400x240.webp)