Bitwise CIO responds to Bitcoin 2024: ‘Making me rethink what’s possible’

- Politicians’ Bitcoin endorsements reflected major shifts in U.S. financial strategies.

- BTC’s recent decline is tempered by an optimistic RSI and potential bullish reversal.

The Bitcoin [BTC] 2024 conference took center stage in July, drawing attention from enthusiasts and industry leaders alike.

Hougan’s unique take on Bitcoin

Amidst the excitement, Bitwise’s chief investment officer, Matt Hougan, offered a fresh and insightful perspective, especially following the endorsement of BTC by several prominent U.S. politicians.

In a recent blog post dated the 31st of July, titled- “We’re Not Bullish Enough: The Big Takeaway From the 2024 Bitcoin Conference,” Hougan said,

“What’s happening in the bitcoin market right now is making me rethink what’s possible.”

The political shift

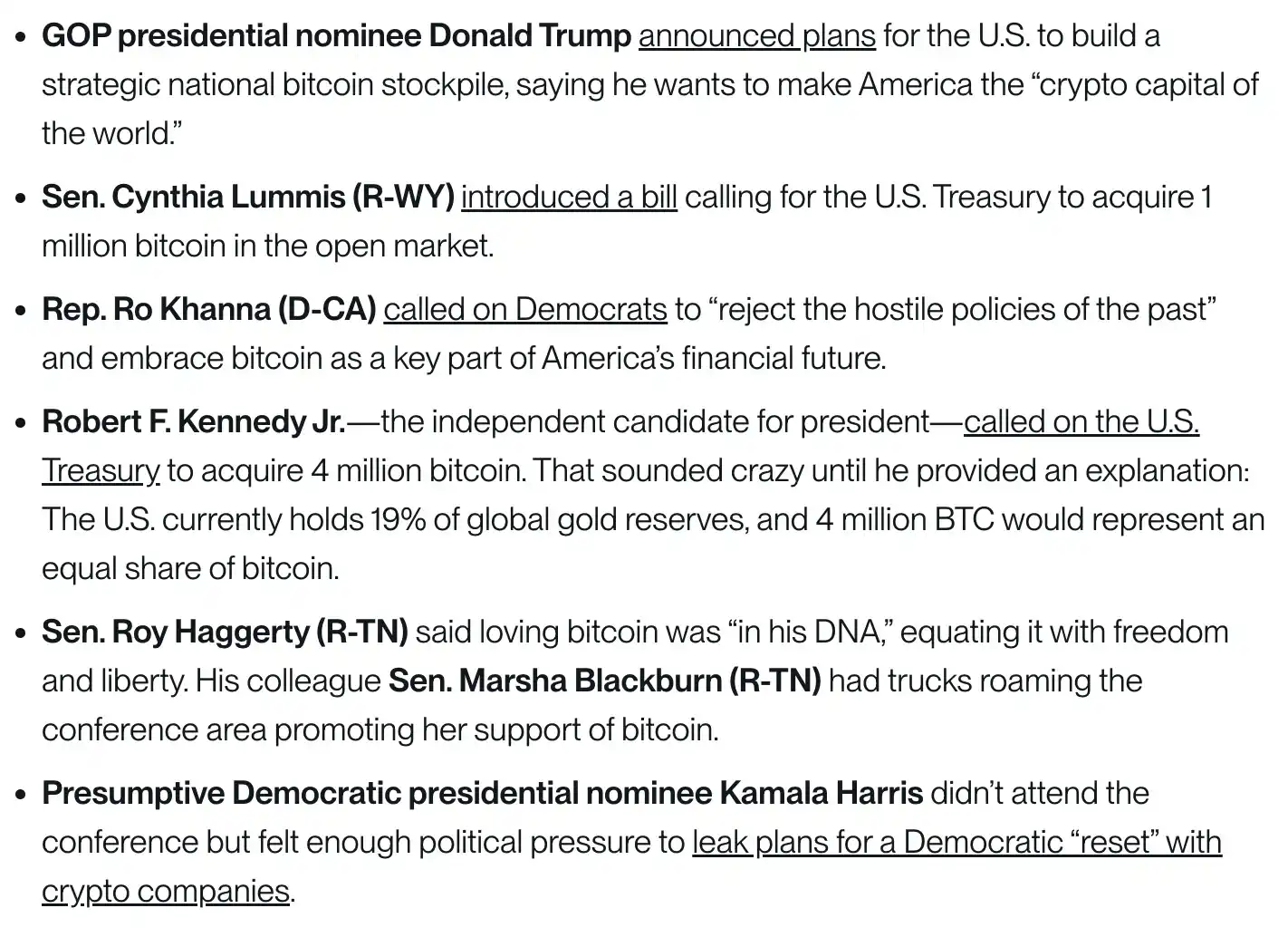

This aligns with the ambitious plans of several U.S. political figures to integrate BTC into national financial strategies.

For context, Donald Trump proposed creating a strategic Bitcoin reserve for the country, while Senator Cynthia Lummis suggested a bill that would use BTC reserves to address the U.S.’s $35 trillion debt crisis.

Additionally, Robert F. Kennedy Jr. pledged that if elected, the U.S. Treasury would purchase 500 Bitcoin daily until accumulating at least 4 million BTC.

Key takeaways from the conference

That being said, Hougan also highlighted several key takeaways from the conference, which included,

Here it’s important to note that the sudden shift of politicians toward cryptocurrency has surprised many, not just Hougan.

He captured the sentiment aptly when he said,

“Less than two years ago, FTX was collapsing in a historic fraud, bitcoin was trading at $17,000, and skeptics were dancing on crypto’s grave. Now politicians are openly talking about building a ‘Bitcoin Fort Knox’.”

Fueling optimism about BTC’s future and broader crypto adoption, Hougan remarked,

“These ideas would have been the stuff of daydreams a year ago. But after what I witnessed last week, they look more likely than not.”

Trump’s Bitcoin influence

In fact, Bitcoin hit a two-week peak on the 12th of July as per Reuters, driven by the increased likelihood of President Trump winning the upcoming election following an attempted assassination.

As of the latest update, BTC had fallen by 2.40%, trading around the $64,000 mark as per CoinMarketCap.

Despite this decline, the Relative Strength Index (RSI) nearing a neutral level at 49 and trending upwards indicated a potential shift where bulls might soon overtake bears.