Ripple

Bitwise files for XRP ETF – How did the community, XRP price react?

Bitwise XRP ETF filing as raised hopes of potential approval after US elections amongst market pundits.

- Bitwise filed an XRP ETF in Delaware.

- The update hasn’t stirred much for XRP price amid rising geopolitical tensions.

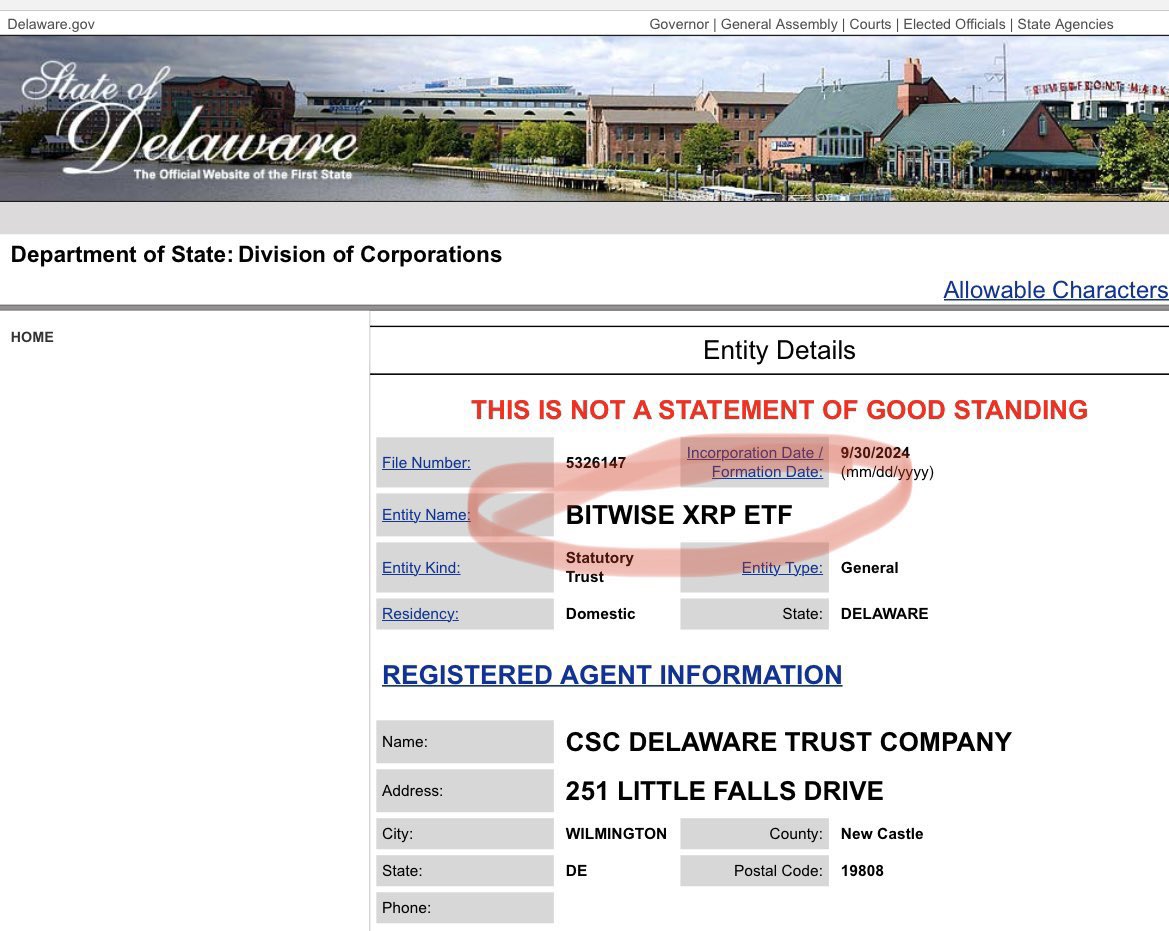

Digital asset manager Bitwise has reportedly filed a Ripple [XRP] exchange-traded fund (ETF) with Delaware.

Per the filing, as seen in the State of Delaware’s division of corporations section, the entity, Bitwise XRP ETF, was incorporated on the 30th of September.

ETF experts have confirmed the application’s authenticity but noted that it doesn’t effectively mean filing with the U.S. Securities and Exchange Commission (SEC).

However, market pundits have deemed an XRP ETF as ‘inevitable.’

Community reacts to XRP ETF application

Nate Geraci, an ETF expert and president of ETF Store, hailed the Bitwise XRP ETF filing as ‘strategic’ and, by extension, an outlook on the November U.S. election outcome. He said,

“Bitwise positioning to file for XRP ETF is highly noteworthy IMO…In short-term, this is likely call option on the November election…This is strategic.”

For context, most market observers and insiders believe that more regulatory clarity on the sector will emerge after the U.S. elections.

If so, the status of a host of tokens, which the SEC has viewed as securities, could be officially clarified.

This reinforced Geraci’s claim that Bitwise was early, as the ETF was inevitable once the election was done.

“Point being that XRP ETF probably coming at some point…Bitwise just early. Politics clearly matter here in short-term, but I think this is all inevitable over time.”

SEC vs. Ripple Labs lawsuit

Ripple Labs, the firm behind the XRP token, has been in a legal battle with the SEC since 2020, which has become the most tracked crypto lawsuit.

The regulator claimed the firm violated securities laws by selling XRP tokens to investors without prior registration. The agency sought $2 billion as a fine.

However, federal judge Analisa Torres found that XRP was only a security when sold to institutional investors, not the public. In doing so, she ordered the firm to pay only $125 million for failing to register the institutional sale with the agency.

The firm and the general market deemed this a partial win. But it’s not a decisive win yet, as the regulator has until the 7th of October to repeal the judge’s decision.

At press time, XRP was valued at $0.60, down nearly 10% since the 1st of October amid an overall market sell-off following escalations in the Middle East.

The recent Bitwise update seemed to have less impact amid the risk-off approach from investors.