Bityard launches ‘Grayscale zone’ to let users trade coins related to Grayscale trusts

The crypto market remained bullish for the past few months, which attracted much attention from global investors. Furthermore, Bitcoin price reached its all-time high and surpassed $41,000 earlier this year. One reason that led to increasing Bitcoin price is that many financial institutions and retail investors entered the market and invested significant amount of Bitcoin and other digital assets, and have been holding them.

Among those institutions and investors, Grayscale is one that made a huge impact to the crypto market. In the market, the entry of Grayscale made other investors who were skeptical about the intrinsic values of digital currencies became more confident in Bitcoin, and once again, attracted more people to enter the market.

About Grayscale

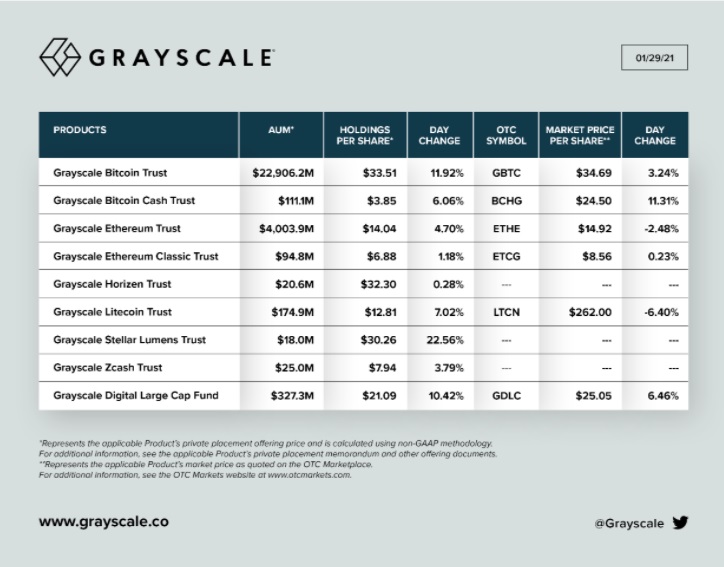

Grayscale, a subsidiary of the Digital Currency Group, is the world’s largest crypto asset manager and has created investment trusts for Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Horizen, Litecoin, Stellar, XRP, and Zcash. According to Grayscale’s official Twitter on January 29, 2020, the company’s total crypto assets under management (AUM) was above $27 billion.

How Grayscale affects the market and individual investors

In January 2021, Bitcoin price dropped from $41,000 to below $32,000 and climbed again after Grayscale reopened its Bitcoin Trust back up to new investors, which implied that the company plays an important role in the crypto market.

When Grayscale increases the investment funds for a certain crypto asset, the asset price has a chance to go up, which also brings the potential for individual investors to gain profits from the price change. Hence, most investors consider the assets that Grayscale has created investment trusts for types of indicators or hints in order to construct proper investing strategies.

Bityard has launched ‘Grayscale Zone’

As an exchange that offers professional crypto trading services, Bityard has been focusing on the fast-changing market as well as the increasing needs of global investors. In 2020, Bityard, with Binance as the liquidity supplier, started offering crypto spot trading services with more than 30 types of trading pairs.

Moreover, Bityard also launched “Grayscale Zone” recently to let its users to trade coins related to Grayscale investment trusts, which is a friendly design for both experienced investors and crypto beginners. Compared to some risky altcoins, the assets in the “Grayscale Zone” would be better options for crypto beginners since Grayscale has created investment trusts for those assets.

In addition, on Bityard, the fee of spot trading is only 10%, which is much lower than most crypto exchanges in the market. Bityard is committed to bringing a reliable and easy-to-understand trading platform to crypto beginners around the world, and plans to offer more advanced trading services to its users.

About Bityard

Bityard is the world’s leading crypto exchange, providing global investors with safe, simple and fast digital currency trading services. With the service concept of “Complex Contract Simple Trade”, Bityard has developed a well-simplified, and also highly professional trading platform for its users. Bityard will keep improving its services to bring the users a better trading experience. Bityard official website: www.bityard.com

Disclaimer: This article is a paid post and must not be considered as news/advice.