Bitcoin

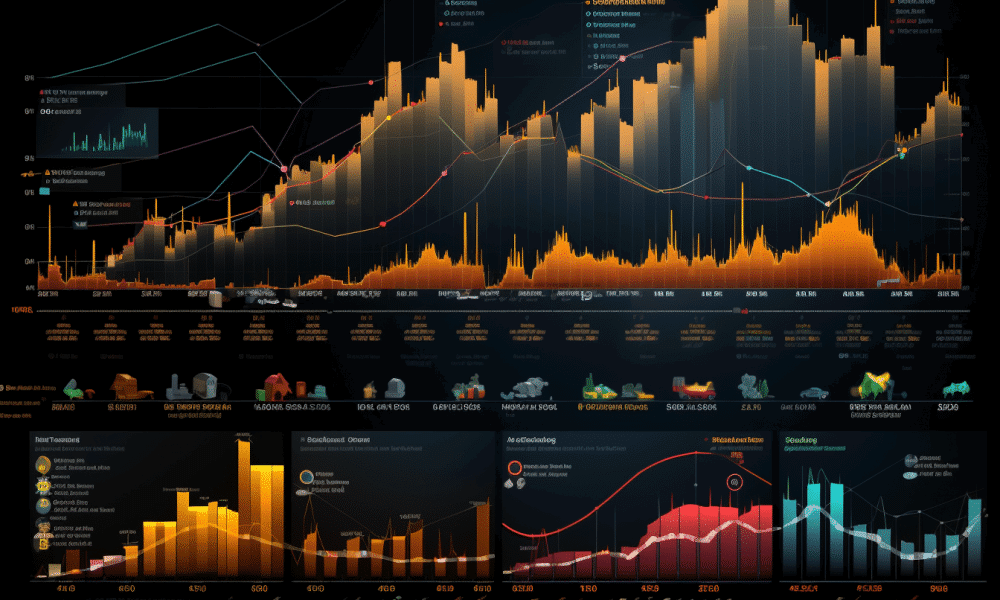

Bitcoin vs S&P 500 Index, Dow Jones Industrial Average, NASDAQ Composite Index, and FTSE 100 Index: How They Compare in 2023

Curious about Bitcoin’s performance in 2023 compared to major stock market indices? Explore the intriguing showdown between Bitcoin and S&P 500, Dow Jones, NASDAQ Composite, and FTSE 100 in our in-depth analysis.

Published

2 years agoon

By

Shaheen Banu

In 2023’s financial landscape, investors are constantly seeking avenues for growth and diversification. Bitcoin and other cryptocurrencies have introduced a new layer of complexity to traditional stock market indices such as the S&P 500 and Dow Jones Industrial Average (DJIA), which were once considered reliable options. So, if you’re wondering how Bitcoin compares to other major investment indexes, keep reading.

This blog delves into the fascinating world of Bitcoin vs. traditional investment indexes, comparing their financial performance in 2023. We’ll explore the unique characteristics of each asset class, analyze their historical trends, and offer insights to help you navigate the ever-shifting financial landscape. Get ready to discover which investment path might be right for you!

Comparing Bitcoin with major investment indexes

So, buckle up as we break down how the digital pioneer, Bitcoin, stands up to the titans of traditional finance.

Analysis of Bitcoin compared to investment indexes

1. Bitcoin vs. S&P 500

- 2023 performance: Bitcoin’s surge of +160.83% dwarfs the S&P 500’s solid +21.14%, illustrating the growing FOMO around Bitcoin due to the upcoming halving.

- Five-year performance: Bitcoin’s increase (+1,203.55%) is extraordinary, suggesting that over the medium term, it has been a highly lucrative investment than S&P 500’s +94.42%, albeit with likely higher volatility.

- All-time performance: When comparing the all-time performances, both assets show impressive growth, but the scale is vastly different. With Bitcoin at +16,718.28% and the S&P 500 at +2,778.54%, Bitcoin’s meteoric rise underscores its high-risk, high-reward profile, contrasting with the S&P 500’s steadier, long-term growth trajectory.

2. Bitcoin vs. Dow Jones Industrial Average

- 2023 performance: In 2023, Bitcoin significantly outperformed DJIA. Bitcoin had a bullish year with a staggering 160.83% gain. On the other hand, DJIA also had a positive performance, but its gain of 11.10% was comparatively low.

- Five-year performance: Here, Bitcoin’s impressive +1,203.55% gain significantly overshadows the Dow Jones’ gain of +65.21%, underscoring the potential of emerging digital assets against traditional stock indices.

- All-time performance: Bitcoin has significantly outpaced DJIA in terms of returns. Bitcoin’s colossal +16,718.28% growth towers over the Dow Jones’ +2,865.35%.

To understand how Bitcoin might perform in the future, check out our latest Bitcoin price prediction.

3. Bitcoin vs. NASDAQ Composite

- 2023 performance:Bitcoin, with a substantial gain of 160.83%, significantly surpassed the NASDAQ Composite, which saw a slower increase of 37.99%. This demonstrated its capacity for growth in a fluid market.

- Five-year performance: Over five years, Bitcoin’s +1,203.55% growth eclipses the NASDAQ Composite’s +133.35%, portraying the increased investor trust in the former asset class.

- All-time performance: Considering all-time performance, Bitcoin’s +16,718.28% vastly outpaces the NASDAQ Composite’s +5,243.87%, highlighting its status as a high-growth asset since its inception.

4. Bitcoin vs. FTSE 100 Index

- 2023 performance: Bitcoin’s explosive growth (+160.83%) contrasts sharply with the FTSE 100’s minor rise (+2.91%), highlighting the growing HODLing mentality of long-term investors.

- Five-year performance: Bitcoin’s astonishing +1,203.55% outstrips the FTSE 100’s steady +14.80%, underscoring the speculative nature of digital assets.

- All-time performance: Over the entire timeline, Bitcoin’s phenomenal +16,718.28% dwarfs the FTSE 100’s +603.79%, reflecting the escalating influence of cryptocurrencies.

Long-term investment potential of Bitcoin compared to major investment indexes

The long-term investment potential of Bitcoin compared to major investment indexes can be analyzed from various perspectives:

Volatility and risk

Bitcoin’s market is characterized by significant fluctuations due to its lack of an underlying asset. This offers both the potential for substantial returns and increased risk exposure.

Moreover, this contrasts with the relative stability and lower risk profile of major investment indexes, which typically provide more modest but steady returns over time.

Market dynamics

The performance of Bitcoin is influenced by factors different from those affecting traditional stock markets. These include technological developments, supply changes, mining difficulty, and shifts in investor sentiment towards digital currencies.

On the other hand, major indexes are influenced by broader economic indicators, corporate earnings, and geopolitical events.

Diversification

Bitcoin offers a diversification advantage in investment portfolios, attributed to its minimal correlation with conventional asset classes. Yet, investors need to thoughtfully evaluate their comfort with risk and the length of their investment period before allocating a substantial share of their portfolio to Bitcoin.

Regulatory environment

The regulatory landscape for Bitcoin is still evolving, which can introduce additional risks and uncertainties. In contrast, traditional investment indexes operate within a well-established regulatory framework.

Investment accessibility

Bitcoin is accessible through cryptocurrency exchanges and requires a digital wallet for storage, whereas investment in major indexes can be made through mutual funds, exchange-traded funds (ETFs), and individual stock trading accounts.

However, 2024 might finally bridge this gap, and it’s anticipated that there will be a final judgment on the BlackRock Bitcoin ETF.

Adoption and technological progress

The future of Bitcoin heavily relies on its adoption rate as a transactional currency and developments in blockchain technology. The widespread adoption of cryptocurrencies and blockchain technology can positively impact Bitcoin’s value.

Economic role

While traditional indexes reflect the performance of the industrial, technological, and financial sectors of the economy, Bitcoin represents a new asset class in the digital economy.

Cryptocurrency performance vs. traditional markets – Image via Pexels

Correlation between Bitcoin and major investments

The correlation between Bitcoin and major investment assets like stocks, bonds, and commodities is a topic of increasing interest, especially as cryptocurrencies gain more mainstream acceptance. Here’s an overview of how Bitcoin’s correlation with these assets has evolved:

Bitcoin and stock markets

Historically, Bitcoin was thought to be relatively uncorrelated with traditional stock markets. However, recent trends have shown that during times of market stress or global economic uncertainty, Bitcoin and stock markets can exhibit a positive correlation.

It contradicts earlier beliefs that Bitcoin could act as a hedge against stock market downturns. This correlation has become more pronounced during significant global events, such as the COVID-19 pandemic, where both Bitcoin and stock markets initially experienced sharp declines before recovering.

Bitcoin and gold

Bitcoin is often compared to gold, with some proponents labeling it as “digital gold.” Traditionally, gold is seen as a safe-haven asset and a hedge against inflation. While Bitcoin has shown some characteristics of being a digital store of value, its correlation with gold has been inconsistent.

At times, Bitcoin moves in tandem with gold, especially during periods of fiat currency devaluation and economic uncertainty. However, at other times, it behaves independently, driven by factors unique to the cryptocurrency market.

Bitcoin and bonds

The correlation between Bitcoin and bond markets is generally considered to be weak. Bonds are typically seen as low-risk, stable investments, whereas Bitcoin is known for its high volatility. Due to their different risk profiles and market dynamics, Bitcoin and bonds often do not exhibit strong correlation patterns.

Bitcoin and commodities

Bitcoin’s correlation with broader commodity markets, including oil and agricultural products, is typically low. Commodities are influenced by factors like environmental dynamics, geopolitical events, and economic cycles, which differ from the factors that influence Bitcoin prices.

Frequently asked questions (FAQs)

Q: What is the S&P 500?

A: The S&P 500, or Standard & Poor’s 500, is an influential stock market index tracking the performance of 500 companies listed on U.S. stock exchanges. Widely recognized as a key indicator, this index is often seen as a comprehensive reflection of the U.S. stock market and a gauge for the American economy.

Characterized by its market-capitalization-weighting method, the S&P 500 assigns more weight to larger companies based on their market value. This design allows the index to offer a diverse overview of the U.S. corporate sector, encompassing a variety of industries.

Q: What is the DJIA?

A: The Dow Jones Industrial Average, often simply referred to as the Dow Jones or DJIA, is another major stock market index in the United States. It was created by Charles Dow, one of the founders of Dow Jones & Company. The Dow Jones Industrial Average is one of the oldest and most widely recognized stock market indices in the world.

The Dow Jones Industrial Average, unlike the S&P 500 with its 500 companies, consists of 30 large, blue-chip companies seen as industry leaders. The Wall Street Journal’s editors, part of the Dow Jones & Company, select these companies to represent a diverse range of the U.S. economy.

Q: What is the NASDAQ Composite?

A: The NASDAQ Composite is a stock market index that includes almost all stocks listed on the NASDAQ stock exchange. With its inclusion of over 3,000 companies, it offers a comprehensive perspective on the technology sector and the broader market, though it leans significantly towards tech stocks.

Q: What is FTSE 100?

A: The FTSE 100, or Financial Times Stock Exchange 100 Index, is a prominent stock market index encompassing the 100 most highly capitalized companies listed on the London Stock Exchange (LSE). As a barometer of the UK economy, the FTSE 100 reflects the performance of major sectors such as finance, oil and gas, pharmaceuticals, and consumer goods.

Managed by the FTSE Group, a subsidiary of the LSE Group, its composition changes periodically, reflecting the rising and falling fortunes of UK-listed companies. Investors globally monitor the FTSE 100 for insights into the health of the UK stock market and broader economic trends.

Historical performance of Bitcoin vs. traditional markets – Image via Pixabay

Future of finance

The evolution of finance is characterized by technological advancements and a commitment to inclusivity. Digital-only banks, leveraging artificial intelligence (AI)-for financial advising, are gradually supplanting traditional banking institutions. Concurrently, blockchain technology is transforming stock exchanges, enabling a seamless blend of traditional and digital assets.

This transformation extends to enhancing accessibility to financial services for underserved communities. Innovations include providing small-scale loans through mobile technology, investing in sustainable energy, and using smart contracts for insurance. Additionally, the rise of decentralized finance (DeFi) is shifting power from large corporations to peer-to-peer networks.

However, this rapid evolution brings challenges, particularly in data privacy and cybersecurity. There is an urgent need for regulatory frameworks that evolve alongside these innovations. As the sector continues to transform, it’s vital to be prepared for the dynamic changes ahead.

Conclusion

In summary, the comparison between Bitcoin and traditional stock market indices in 2023 highlights the ongoing growth of the financial landscape. This comparison draws attention to the importance of aligning investment decisions with personal objectives, risk appetite, and time frame considerations.

The necessity for staying well-informed and consulting with financial experts remains paramount in 2023. This holds true irrespective of one’s inclination towards the burgeoning realm of cryptocurrencies or the established stability offered by traditional stock indices.