Blockchain

How Many Solana Do You Need to Become a Millionaire by 2034?

Crunching the numbers! Explore the calculations to determine how many Solana you’ll need to become a millionaire by 2034. Uncover the investment strategy for financial success.

Published

1 year agoon

Curiosity about cryptocurrencies’ potential to transform fortunes often leads investors down a rabbit hole of speculation and projections. Among the myriad of digital assets, Solana (SOL), with its rapid rise and innovative ecosystem, garners significant attention. As the crypto landscape evolves, the question looms: How many Solana tokens must one possess to attain millionaire status by 2034?

Delving into this inquiry requires navigating through market dynamics and financial forecasts. Join us as we explore the possibilities and considerations for achieving millionaire status through Solana investments in the coming decade.

Unlocking the answer: How many Solana required to become a millionaire?

Before delving into the numbers, let’s first look at Solana’s current market performance.

Solana price analysis

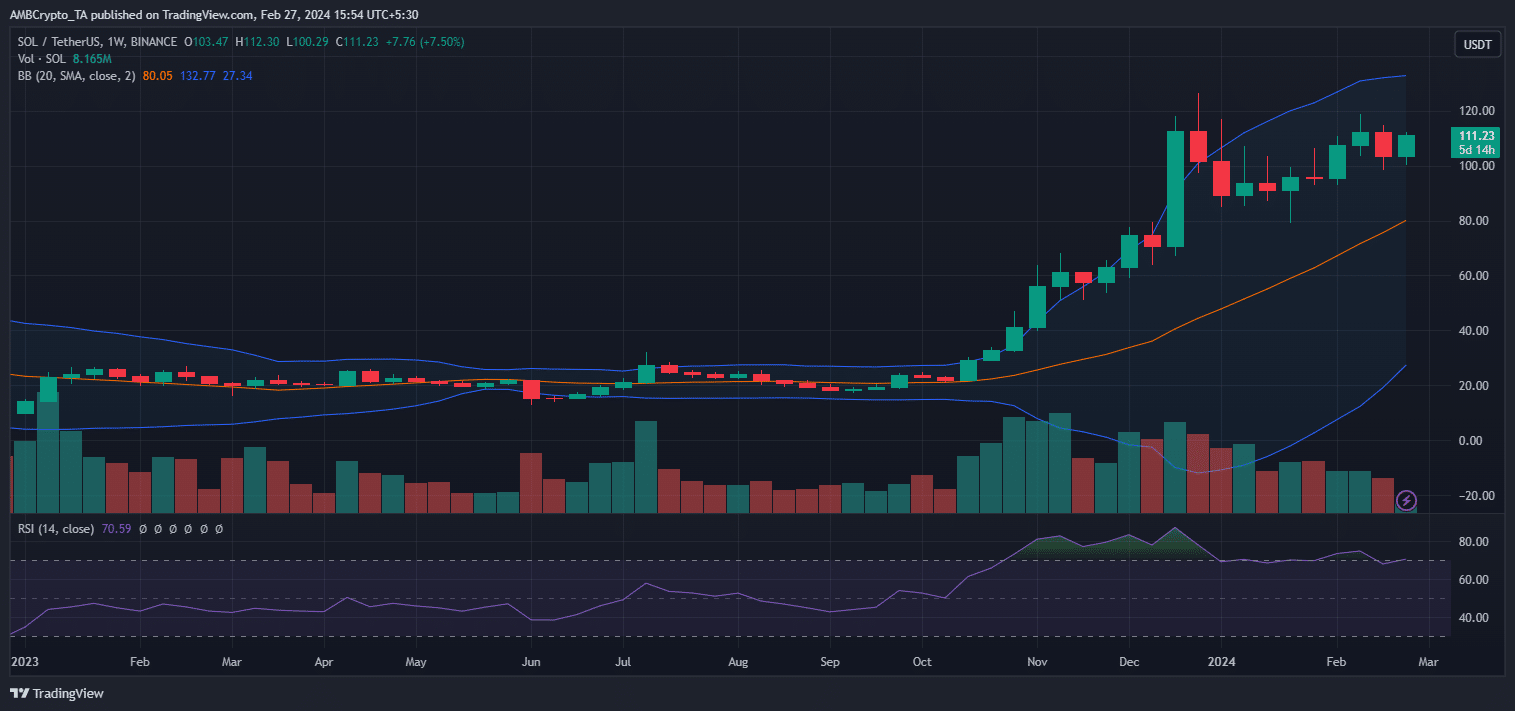

Solana millionaire potential – Image via TradingView

SOL showcased a remarkable performance throughout 2023, emerging as one of the top-performing cryptocurrencies of the year. Furthermore, the market sentiment has been predominantly bullish, a trend that is vividly illustrated in its weekly chart.

Despite encountering some bearish setbacks at the onset of 2024, SOL’s price dynamics have illustrated resilience and a strong recovery trajectory. The bullish sentiment was further corroborated by technical indicators, such as the price candles’ dominance over the 20-week moving average (MA) and a Relative Strength Index (RSI) of 70.75, signaling strong buying momentum.

However, the expanded Bollinger Bands pointed towards notable market volatility, suggesting that while the outlook is positive, investors should brace for potential price swings.

At the time of writing, Solana’s market capitalization stood at $49.29 billion. The recent price movements, characterized by a 10% increase in a single day, a 3% rise over the past week, and a 21% growth over the last month, also reflected the strong investor interest.

The ecosystem’s continuous development has played a crucial role in bolstering investor confidence in Solana. Some of the latest innovations include the Solana Saga phones, various airdrops, and the introduction of new token extensions.

Deciding the right entry point is crucial for potential investors. Learn whether waiting for Solana’s price to drop below $100 is a strategic move.

Solana’s long-term outlook – Image via Solana

Solana millionaire math

While predicting the future of any cryptocurrency is inherently tricky, we can explore various scenarios to make an educated guess. So, let’s break down the components of this plan:

SOL current price

As of the latest data, SOL was exchanging hands at $111. This is our starting point for calculations.

Target price and time frame

Market speculations indicate that Solana might achieve a price between $500 and $1,000 over the next 5 to 10 years, which would position its market capitalization between $200 billion and $400 billion, aligning it with the current market valuation of Ethereum (ETH).

Solana investment analysis

Let’s consider the following cases to understand the dynamics of reaching a $1 million goal:

1. Scenario A: Solana at $100

- Target price: $100

- Number of SOL needed: This scenario is below our specified future price range, but for educational purposes, the calculation would be $1,000,000 / $100 = 10,000 SOL.

2. Scenario B: Solana at $200

- Target price: $200

- Number of SOL needed: $1,000,000 / $200 = 5,000 SOL.

3. Scenario C: Solana at $500

- Target price: $500

- Number of SOL needed: $1,000,000 / $500 = 2,000 SOL.

4. Scenario D: Solana at $1,000

- Target price:$1,000

- Number of SOL needed: $1,000,000 / $1,000 = 1,000 SOL.

Capital required and potential profits

For each scenario, let’s calculate the following:

- Investment required:

Number of SOL Needed×$111 (Current Price) - Potential profit:

Number of SOL Needed×Target Price–Initial Investment

Let’s perform these calculations for scenarios C and D, where Solana reaches $500 and $1,000, respectively, which are the most speculated future price ranges.

Solana at $500

- Number of SOL needed: 2,000 SOL

- Initial investment required: $222,000

- Potential profit: $778,000

Solana at $1,000

- Number of SOL needed: 1,000 SOL

- Initial investment required: $111,000

- Potential profit: $889,000

So, there you have it. Whether aiming for modest gains or dreaming big, these insights pave the way for tailored investment strategies in Solana’s promising future.

Examining in-depth projections like whether SOL could reach $1000 by 2040 to get valuable insights.

SOL millionaire timeline – Image via Solana

Is it wise to be bullish on SOL?

Whether it’s wise to be bullish on Solana or any cryptocurrency depends on various factors. Here are some considerations:

- Technology and adoption: Solana is known for its high throughput and low transaction costs, making it attractive for developers and users alike. If the platform continues to attract quality projects and can maintain its technological edge, it could see increased adoption.

- SOL’s appreciation:SOL is currently trading approximately 57% below its all-time high (ATH). Despite this, it has experienced a significant appreciation of 389% over the past year and an astounding 13,200% since its inception. This signifies its ability to deliver substantial returns.

- Recovery: Following the FTX collapse, the price of SOL dropped around 75% between November and December 2022. However, it managed to make a strong recovery from its lows and established itself as the 5th largest cryptocurrency. This resilience suggests a strong underlying value.

- Regulatory environment: Changes in regulations affecting cryptocurrencies can have positive or negative impacts. Favorable regulations could lead to increased adoption, while restrictive regulations could hinder growth.

- Competition: The blockchain space is very competitive, with many platforms vying for developers and projects. Solana’s ability to compete with other high-performance blockchains like Ethereum, Cardano (ADA), etc., is crucial for its long-term success.

While exploring the potential of Solana to make you a millionaire by 2034, it’s worth considering the perspectives of industry experts on whether Solana is truly the ‘ETH killer’ many believe it to be.

Read this before investing in Solana

While the possibility of becoming a crypto millionaire might seem exciting, here are some important considerations to keep in mind:

- Volatility: Be aware that the crypto space is highly volatile, subjecting investments to significant price fluctuations.

- Time horizon: The longer your investment timeframe, the more time SOL has to potentially reach its target price. However, a longer timeframe also means you are tying up your capital for a longer period.

- Inflation consideration: Note that this analysis does not take into account the effects of inflation on investment returns.

- Alternative investments: Diversification is essential for any investment strategy. Consider including safer traditional assets like stocks and bonds alongside exploring cryptocurrency.

- Historical performance: It’s important to note that past performance is not indicative of future results in the cryptocurrency market, so consider both bearish and bullish possibilities.

For a broader perspective on accumulating wealth in the crypto space by 2030, explore various strategies that could accelerate your journey.

Reasons to be bullish on Solana – Image via Solana

The takeaway

Remember, this is purely a hypothetical exercise, and the actual price of SOL in 2034 could be significantly higher or lower than our estimations. It’s crucial to conduct your own research, consider your risk tolerance, and don’t invest more than you can afford to lose.

We hope this blog post has provided key insights into Solana’s potential future. As the cryptocurrency landscape continues to evolve, staying informed and making informed decisions is paramount.

Disclaimer: This blog represents the author’s personal opinions and should not be taken as financial advice. Please consult a qualified financial advisor and evaluate your individual circumstances before making investment decisions.