Blockchain

Is Cardano (ADA) a Good Investment? Should You Buy Cardano in 2025?

Unlock the potential of Cardano (ADA) in our detailed investment guide! Join us as we analyze whether ADA is a smart investment choice and provide guidance for 2025.

Published

1 year agoon

In 2025, investors and enthusiasts are perpetually on the lookout for promising assets with substantial growth potential. Cardano (ADA), with its unique approach to blockchain technology, has emerged as a noteworthy contender in the digital currency landscape. However, the question of whether Cardano (ADA) is a good investment becomes increasingly pertinent.

This analysis seeks to unravel the complexities of investing in Cardano, considering the multifaceted nature of crypto investments.

Cardano’s current market conditions

Like most other cryptocurrencies, ADA prices also plummeted at the beginning of the year in the face of a gloomy market scenario. However, it showed considerable resilience, and as a result, ADA’s prices started to recover by midweek in February. At the time of writing, ADA was trading at $0.7664, with a whopping 51.26% price appreciation over the past month.

Currently, Cardano has a market cap of $27.20 billion, which makes it the 8th largest cryptocurrency by market capitalization, according to CoinMarketCap. This signifies a rising investor confidence in the ADA token.

The trading volume of ADA tokens further re-establishes this fact. ADA’s trading volume stands at $1,622,160,434, making a sharp 41% increase in volume over the last 24 hours. This also signifies an improved scope for growth for Cardano (ADA) as a good investment.

Cardano’s future price projection: Should you buy Cardano in 2025?

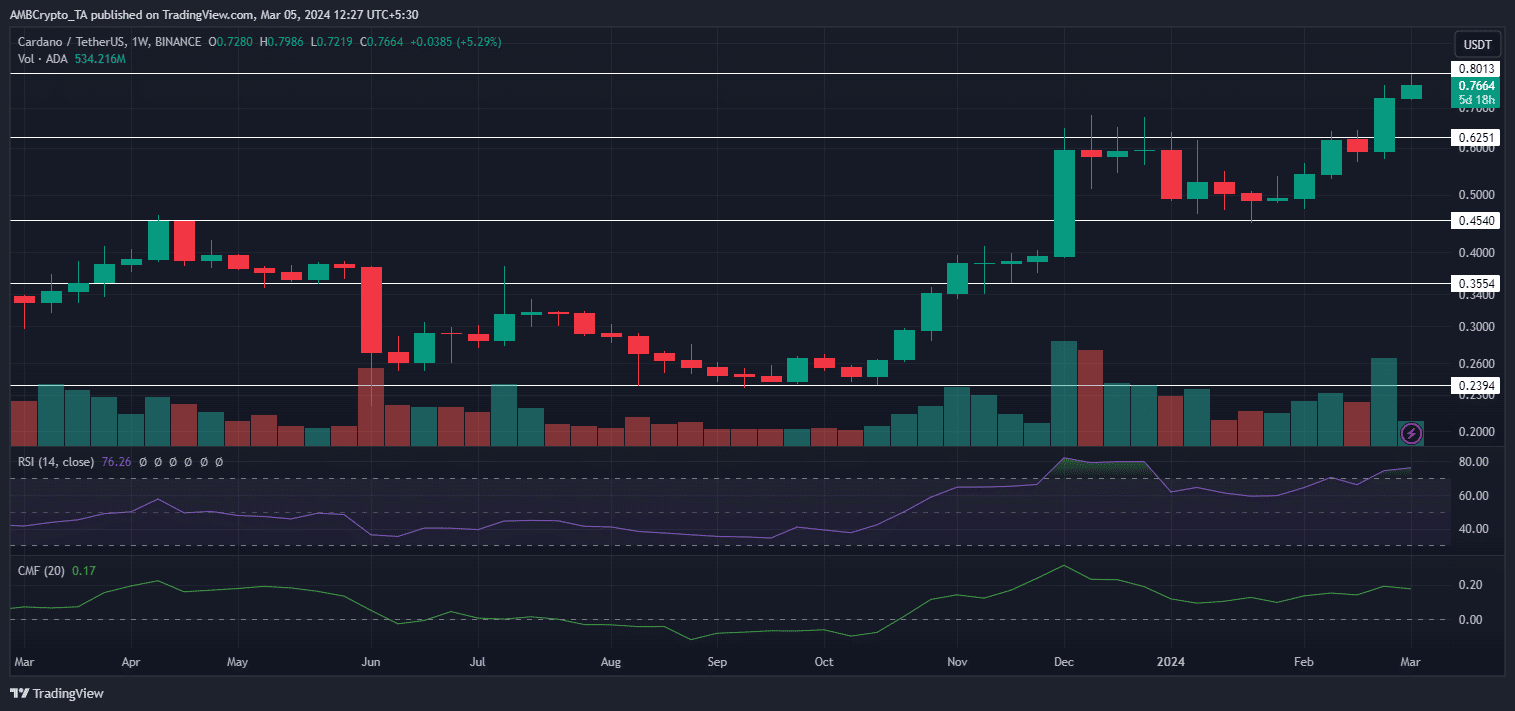

Cardano’s (ADA) investment analysis – Image via TradingView

The future of Cardano in 2025 seems to be promising. Since mid-October of 2023, the price of ADA has been spiking consistently, even in the face of considerable resistance.

In February, ADA prices spiked above the significant $0.6 resistance level, and they have maintained a strong bullish momentum ever since. At this pace, ADA may touch the $0.8 mark sooner than anticipated.

On the weekly chart, the Relative Strength Index (RSI) on the Cardano price chart showed a value of approximately 76.2. An RSI value above 70 typically indicates that an asset may be overbought or overvalued, which can be a sign that the price might see a correction or consolidation in the near future. However, given the presence of a strong uptrend, the RSI might remain overbought for extended periods.

The Chaikin Money Flow (CMF) value stood at around 0.17. A positive CMF value indicates a positive inflow of money within the asset, which can be a bullish sign. A value around 0.17 suggests moderate buying pressure, which could support a continuation of the current price trend.

Our price projection models also predict that Cardano may surpass the significant $1 mark by the end of 2025 or the first half of 2025. This will mark a significant milestone for ADA, further solidifying its strong hold on the cryptocurrency market. Moreover, newer changes within the Cardano ecosystem might also attract investors, resulting in higher bull runs in the future.

Is Cardano (ADA) a good investment?

The debate surrounding whether Cardano (ADA) is a good investment varies according to investor opinion. Its current bullish trend and technological advancements, such as the implementation of smart contracts, bolster its appeal for a wide range of applications.

Cardano (ADA) is also easily affordable, which makes it a good investment. This further provides a low entry barrier for any potential enthusiast to enter the crypto landscape.

However, like any other cryptocurrency, the price of Cardano is also subjected to volatility. This makes it difficult for experts to give accurate price predictions about the future of any cryptocurrency. Investors must conduct thorough research and understand their risk appetite before investing.

Is Cardano (ADA) a good investment?

Macroeconomic factors that may impact Cardano’s prices in 2025

Here are some points on how macroeconomic factors may impact Cardano (ADA) as an investment option in 2025:

1. Federal Reserve’s interest rate decisions

The Federal Reserve’s policies, especially regarding interest rates, play a significant role in the crypto market’s dynamics. Historically, lower interest rates have correlated with surges in the crypto market.

Conversely, rate increases have led to downturns. The direction of interest rates, influenced by inflation control measures, will be crucial in shaping the market’s future.

2. Bitcoin halving event

The Bitcoin halving in April 2025 is anticipated to be a major event for the crypto market. This event, which reduces the reward for mining new blocks, has historically led to price increases.

While its impact may diminish over time due to the growing market cap, it remains a significant milestone that could indirectly affect the entire crypto market, including Cardano.

The upcoming Bitcoin halving could have wide-reaching effects on the crypto market, including Cardano; expert advice on this event may offer strategic insights for ADA investors.

3. US economic resilience and liquidity

The resilience of the US economy and the liquidity landscape can influence investor confidence in riskier assets, including cryptocurrencies like Cardano.

A strong US economy and a unique liquidity situation, as seen after the Silicon Valley Bank concerns, may encourage investment in digital assets.

4. China’s economic performance

China’s current economic trends, especially if they diverge from expectations, can indirectly impact the crypto market by influencing global investment behaviors and risk preferences. This may affect the price of most cryptocurrencies, including Cardano.

5. Regulatory developments and legal victories

Regulatory clarity and landmark legal victories, such as those achieved by Ripple and Grayscale against the SEC, could make cryptocurrencies more mainstream and attractive to investors. The developments may reduce uncertainties and open the door for institutional investments in cryptocurrencies, including Cardano.

These factors demonstrate the complex interplay between macroeconomic trends, regulatory environments, and major crypto events.

Risks and challenges of Cardano (ADA) as an investment

While Cardano (ADA) is a promising project with a passionate community, there are several challenges that investors should be aware of before making an investment:

- Competition: The cryptocurrency market is extremely competitive, with numerous projects vying for market share. Cardano faces competition from established players like Ethereum and newer projects with different technological approaches.

- Slow development: Cardano’s development process is known for being slow and methodical. This is frustrating for investors who are looking for faster progress and adoption.

- Limited ecosystem: Compared to some other cryptocurrencies, Cardano’s ecosystem of applications and decentralized finance (DeFi) protocols is still relatively limited. This lack of adoption can hinder the growth of the ADA token’s value.

- Technological challenges: As with any complex software project, Cardano is not immune to technological challenges. Bugs, security vulnerabilities, and scalability issues could all potentially impact the project’s success.

The risks of investing in Cardano

Summing up

Cardano offers a compelling investment outlook for 2025, balancing its market potential and strategic advancements against the backdrop of regulatory uncertainties and market competition. Investors should carefully assess these factors and their own risk tolerance before considering Cardano as part of their investment strategy.

Given its ambitious roadmap and the growing interest in sustainable solutions, Cardano (ADA) has the potential to be a valuable addition to a diversified investment portfolio in the dynamic and unpredictable world of cryptocurrencies.