Altcoins

Will Shiba Inu Recover? What Can SHIB Be Worth by 2030?

Exploring the future of Shiba Inu: Can SHIB bounce back from its lows? Uncover expert predictions and analysis on its potential worth by 2030 in our latest deep dive.

Published

1 year agoon

The cryptocurrency landscape is a theater of constant motion, where fortunes can pivot on the axis of innovation and sentiment. Within this digital arena, Shiba Inu (SHIB) has sparked interest and debate about its long-term viability. As investors and enthusiasts peer into the future, seeking signs of resilience or resurgence, the question looms large: Will Shiba Inu recover from its current ebbs and flows?

This blog ventures into the heart of SHIB’s ecosystem, examining the interplay of market trends. We aim to unravel the complexities that will define what SHIB could be worth by 2030, offering a forward-looking perspective on this enigmatic token’s trajectory.

Shiba Inu technical analysis: Will it recover?

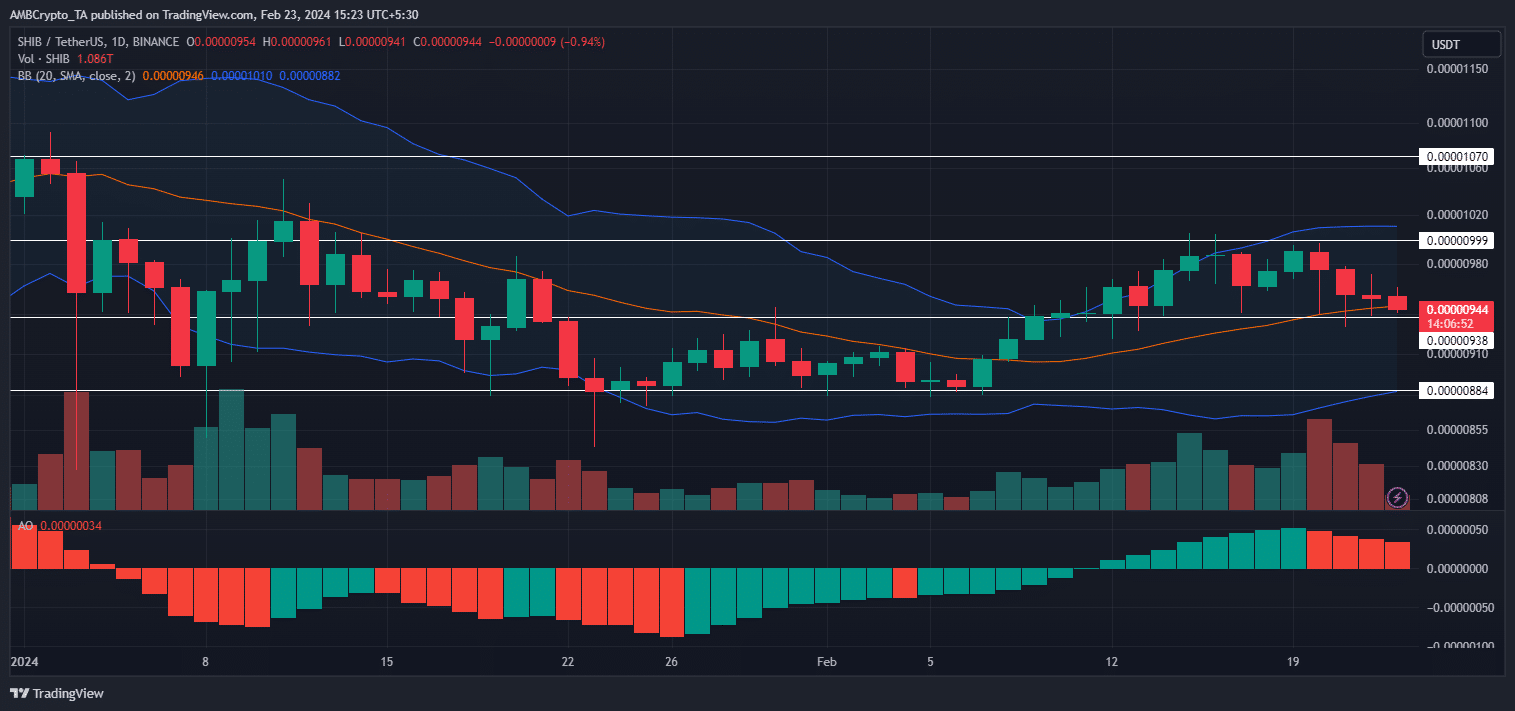

Examining whether Shiba Inu will recover – Image via TradingView

As 2024 entered, the cryptocurrency market experienced a significant downturn, affecting memecoins severely. SHIB also felt the impact, showcasing considerable volatility. The early rejection at $0.000010 initiated a persistent downtrend, with the price repeatedly testing its lower support level at $0.0000088 within the analyzed timeframe.

The pattern of forming lower highs and lower lows continued till the second week of February. Despite attempts by bulls to rally, resistance at $0.0000099 curbed any upward momentum, leading to further declines.

Due to this rally, SHIB’s value was up by around 10% over the last month. However, the recent days have seen a continuous dip, bringing its current trading price to $0.0000094. This represented a roughly 2% decrease in the last 24 hours and about a 5% drop over the past week. The current price reflected a phase of heavy correction, with bulls struggling to hold on to their gains.

Indicators to monitor SHIB

The trading volume, which saw a decline as prices approached their lowest, increased slightly during the February rally but fell again as the price continued to drop, mirroring the price trajectory.

Throughout the majority of the analysis period, the Awesome Oscillator (AO) remained below the zero line, indicating persistent bearish momentum. However, it eventually shifted into positive territory in conjunction with the market rally, a sign of changing momentum toward bullish behavior.

Despite this positive shift, there was a noticeable decline in the AO’s positive values, culminating in a value of 0.00000034 at the time of writing, pointing to a weakening of bullish strength.

Following the latest price rejection, the Bollinger Bands began to expand, indicating a rise in market volatility. This expansion coincided with prices approaching the 20-week moving average (MA) more closely and, at times, slightly surpassing it. This behavior suggested a potential change in the market trend or a reevaluation of the asset’s value in relation to its average performance over this period.

Dive into the specific metrics that hint at SHIB’s moonshot, providing data-driven insights into its future valuation.

Shiba Inu investment analysis – Image via Pixabay

SHIB’s weekly chart

On a weekly chart, SHIB experienced significant losses over the past year, with an approximate decrease of 29%. It faced a notable rejection at a resistance level of $0.000014 in February 2023, leading to continued declines.

Despite some mid-year rallies, the bearish trend prevailed. However, prices started to recover from October, only to face resistance again at $0.000010, reflecting the challenges seen on the daily chart.

For SHIB to recover, a substantial bullish effort is needed to push prices upwards. Fortunately, upcoming events such as the Bitcoin halving, potential approval of more crypto spot exchange-traded funds (ETFs), and improving sentiment towards cryptocurrencies could provide the necessary momentum for SHIB’s price recovery. Monitoring the current support and resistance levels can be helpful in tracking future price movements.

Before moving on to 2030, find out SHIB’s short-term prospects for 2024.

Shiba Inu price prediction 2030

Predicting the future value of cryptocurrencies like SHIB is inherently speculative and should be approached with caution. However, our artificial intelligence (AI) and machine learning (ML) predictive models have some insights.

SHIB’s future price forecast

The AI/ML prediction models provide a wide range of potential values for SHIB by 2030, with an average price of $0.000067, a low of $0.000054, and a high of $0.000081. These projections indicate a moderate growth trajectory from its current market position.

Furthermore, surpassing the all-time high (ATH) of $0.000086 post-2030 appears to be within the realm of possibility, particularly if the network experiences increased adoption and SHIB successfully broadens its utility beyond its original status as a memecoin.

The good news is that Shiba Inu is already on its path to achieving that. By focusing on decentralized finance (DeFi) and gaming, SHIB is striving for real-world utility. Moreover, Shibarium aims to reduce transaction costs and increase scalability for SHIB, BONE, and LEASH tokens. The success of these efforts in attracting users could lead to increased demand for SHIB, potentially boosting its price.

Explore the workings of the Shibarium blockchain and its implications for the SHIB ecosystem in this informative guide.

Is Shiba Inu a good investment?

Things investors should keep in mind

Here are some general tips for investors considering SHIB or any other cryptocurrency:

Before investing

- Do your own research: Understand SHIB’s fundamentals, roadmap, and potential risks. Don’t rely solely on social media hype or influencers.

- Understand your risk tolerance: Cryptocurrencies are inherently volatile, and SHIB is no exception. Be prepared for significant price swings.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different crypto and traditional assets to mitigate risk.

- Set realistic expectations: Don’t expect overnight riches. Focus on long-term potential and avoid chasing quick gains.

- Explore staking: Staking can provide additional returns on your holdings through interest or rewards, but they come with their own set of risks and complexities.

- Consider the impact of token burns: For tokens like SHIB that have undergone significant token burns, understand how these actions affect the tokenomics. A reduced supply can potentially increase value but also might impact liquidity.

Investing in SHIB

- Start small: Begin with a small investment to test the market and gain experience before committing larger amounts.

- Consider dollar-cost averaging (DCA): DCA is a specific investment technique where an investor allocates a fixed amount of money to invest at regular intervals, regardless of the asset’s price. The core principle is to reduce the impact of volatility in the investment’s price over time.

- Use reputable exchanges and wallets: Choose secure platforms with good reputations and user reviews to store your SHIB.

- Stay informed: Keep up with news and developments in the SHIB ecosystem and the broader cryptocurrency market.

- Prepare for tax implications: Understand the tax implications of buying, selling, and holding cryptocurrencies like SHIB in your jurisdiction. Tax laws vary by country and can affect your investment strategy and returns.

Weigh Shiba Inu’s pros and cons, which could influence whether it will recover and rise soon.

The long-term potential of SHIB – Image via Pixabay

The takeaway

Predicting SHIB’s future in 2030 is like navigating a foggy path. While various possibilities exist, the ultimate answer depends on a multitude of factors, some within the Shiba Inu ecosystem’s control and others influenced by external forces.

For investors, approaching SHIB with a cautious and informed perspective is crucial. Ultimately, SHIB’s story will unfold over time, with its success hinging on its ability to adapt, innovate, and deliver real value.

Disclaimer: This blog represents the author’s personal opinions and should not be taken as financial advice. Please consult a qualified financial advisor and evaluate your individual circumstances and risk tolerance before making investment decisions.