Blur [BLUR]: A tale of dearth and neglect despite a resounding hold of…

![Blur [BLUR]: A tale of dearth and neglect despite a resounding hold of…](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-23T082728.991.png)

- Funds flowing into the Blur liquidity pools were sparse in supply.

- While the project’s engagement with NFTs stayed relevant, investors were overlooking the BLUR token.

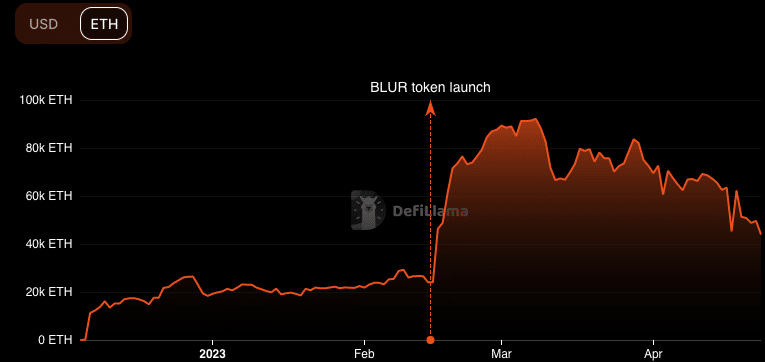

Regardless of excelling as a unique NFT aggregator, Blur [BLUR] was deprived of liquid input in its bid pool. According to DeFiLlama, Blur lacked demand and as such new funds entering into the protocol were less than 50 ETH. In consequence, this affected its Total Value Locked (TVL) and overall health.

Read Blur’s [BLUR] Price Prediction 2023-2024

Managing the “BLURry” vision

The struggle to gain traction meant that investors resisted locking tokens into smart contracts to facilitate trade in a permissionless manner. Interestingly, this was the opposite of what happened when Blur launched its native governance tokens on 14 February and distributed incentives to early users.

At the time, Blur’s TVL continued to rise till it topped at $145.9 million. A few months down the line, the token activity was plagued with slow development and a lack of attention from exchanges and investors.

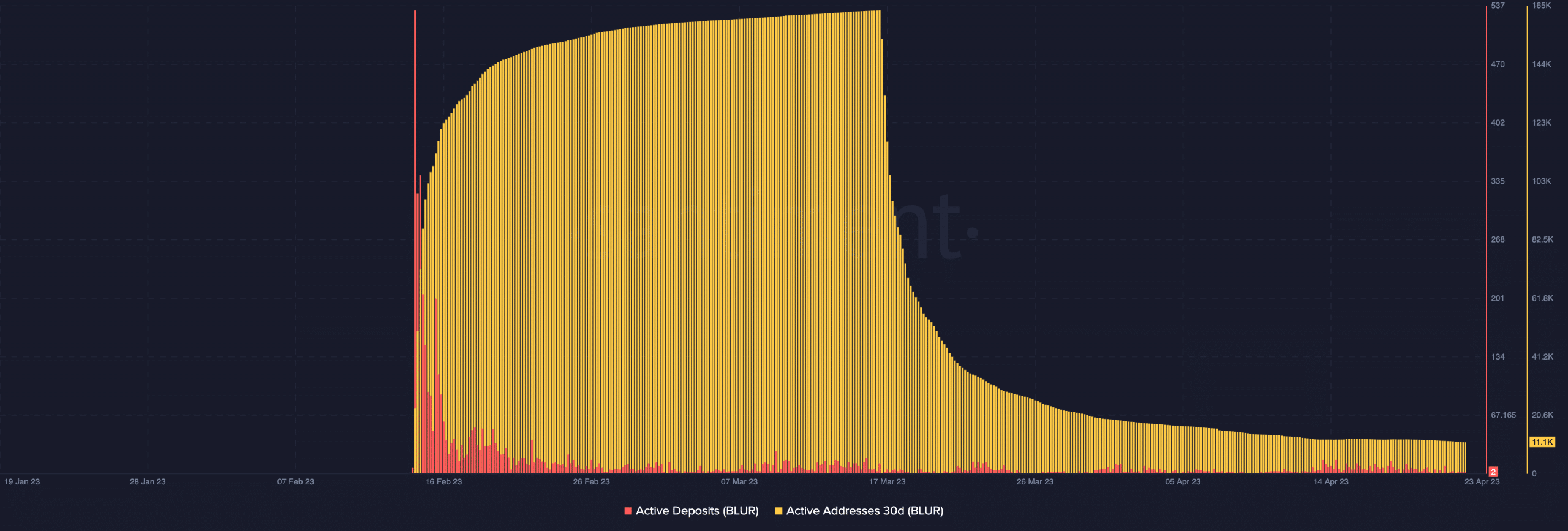

A further assessment of on-chain hurly-burly showed that the interest in trading BLUR token was discouraging. At press time, the active deposits on exchanges were extremely minimal, and nowhere near the aura exhibited on the launch day.

The metric shows the number of unique deposit addresses participating in transactions. Therefore, low active deposits implied that BLUR has become increasingly less popular.

In addition, the 30-day active addresses followed in the same line. At the time of writing, the metric was at 11,100 from its peak of 162,000 on 16 March. An explanation of this circumstance pointed to a deficiency in crowd interplay and speculation around the token.

The initiator gets their way, not the token

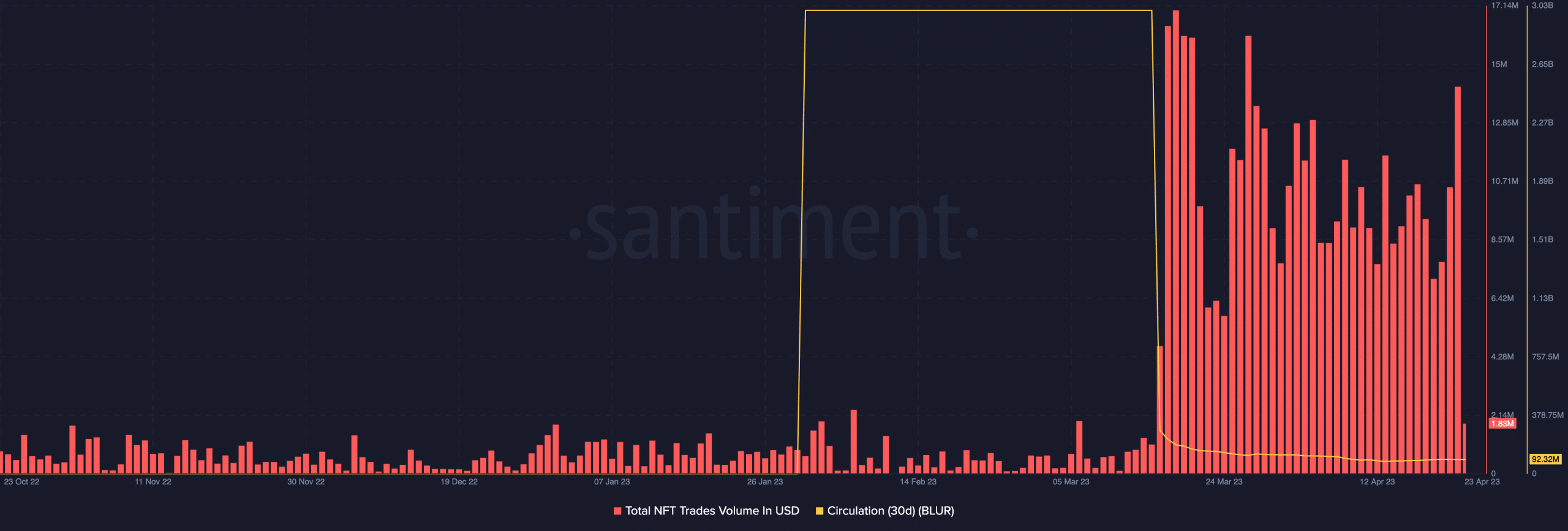

However, Blur remained relevant with respect to the NFT marketplace dominance. Since it stripped OpenSea off the top position, it has managed to keep its place at the top despite the latter’s recent upgrade.

This was evident from the volume of NFT trades within the Blur creator system. As of 23 April, the NFT trades volume hit a monthly high of $14.16 million. Although there has been a shortfall in this number, the hike represents the surging interest in marketplace usage.

But taking a look at the token circulation showed a similar outlook as that of the active addresses and exchange deposits. Circulation shows the number of unique tokens used within a specific period.

How much are 1,10,100 BLURs worth today?

So, if a cryptocurrency lacks active transactions, it is only expected that the circulation will also dwindle. For BLUR, it was a massive dump to 92. 32 million.

At press time, the token’s performance failed to live up to the hype and trend of its underlying ecosystem. In the last 90 days, BLUR’s value decreased by 87.75 % even as it attempted to close the gap with a 4.21% hike in the last 24 hours.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)