Blur [BLUR] investors have reasons to rejoice, but the scenario might change as…

![Blur [BLUR] investors have reasons to rejoice, but the scenario might change as...](https://ambcrypto.com/wp-content/uploads/2023/04/BLUR.png)

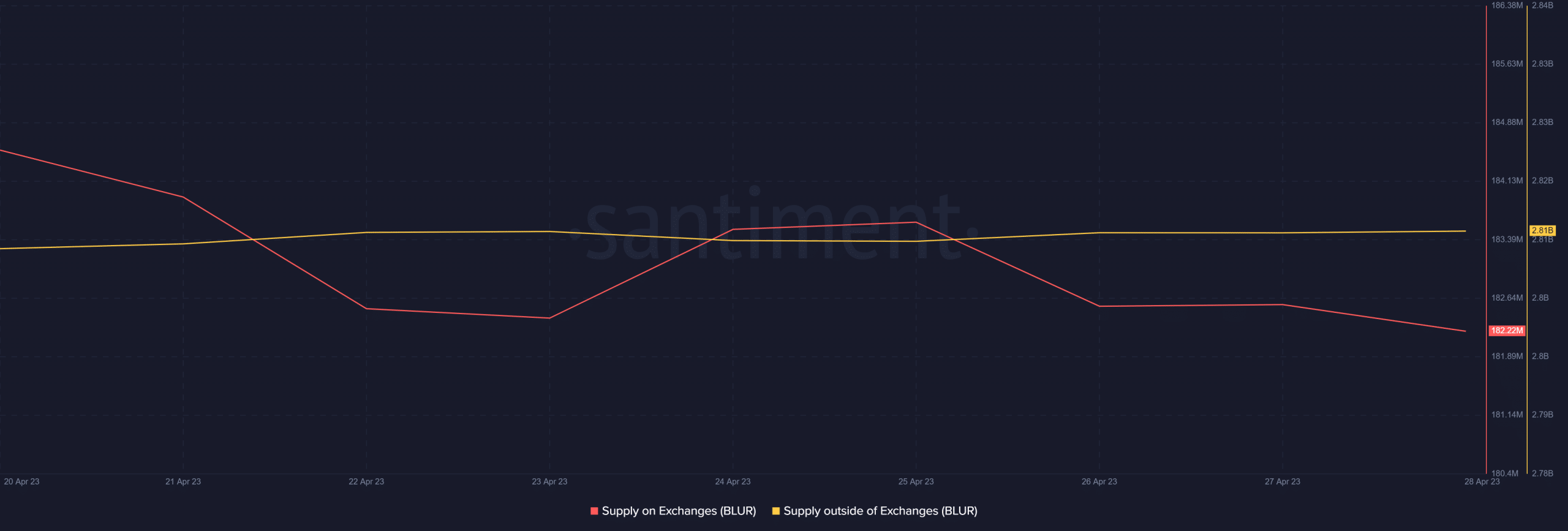

- Whale interest in BLUR showed a spike while the token’s supply on exchanges declined.

- The metrics were supportive of a continued surge, except for the RSI indicator.

Blur [BLUR] stole the limelight recently as its price registered a double-digit growth in the last 24 hours alone. According to CoinMarketCap, BLUR was up by 11% and 15% in the last day and week, respectively.

Realistic or not, here’s BLUR market cap in BTC‘s terms

The hike was legitimate as it was accompanied by an increase in volume. At press time, it was trading at $0.7175 with a market capitalization of more than $323 million.

Binance is behind the surge

The development that propelled this sudden growth was a Binance announcement. Binance Futures will launch the USD-M BLUR perpetual contract on 28 April, with up to 20 times leverage.

As per the official announcement, Binance may adjust the specifications of the BLURUSDT Perpetual Contract from time to time, which include the tick size, maximum leverage, etc.

Is the surge sustainable?

As BLUR’s price continued to rise, LunarCrush revealed yet another bullish signal, suggesting a further price pump. According to the tweet, BLUR hit the #1 LunarCrush AltRank, which was an update in the buyers’ favor.

Based on relative combined social + market activity, $blur has hit the #1 LunarCrush AltRank™.

24-hour activity

Price +12.044% to $0.7178

Social volume 41,391

Social engagements 81,190,568https://t.co/vHlsH3R0LA pic.twitter.com/i5Kaeyg22R— LunarCrush (@LunarCrush) April 28, 2023

Not only that, Lookonchain also pointed out a few interesting whale activities since the price hike. A whale bought 1.39 million BLUR tokens with 1 million USDC at an average price of $0.72.

Are whales buying or selling $BLUR after the announcement of launching $BLUR perpetual on #Binance?

Whale 0xed06 bought 1.39M $BLUR with 1M $USDC at an average price of 0.72 USD 3 hrs ago.

And luggis.eth sold 1.77M $BLUR for 1.2M $USDC at 0.68 USD 7 hrs ago and lost ~$295K. pic.twitter.com/3kTvAynESL

— Lookonchain (@lookonchain) April 28, 2023

This purchase indicated that buying pressure was increasing. Santiment’s chart also suggested a similar scenario. BLUR’s supply on exchanges registered a decline and went below the supply outside of exchanges.

Metrics also supported the hike

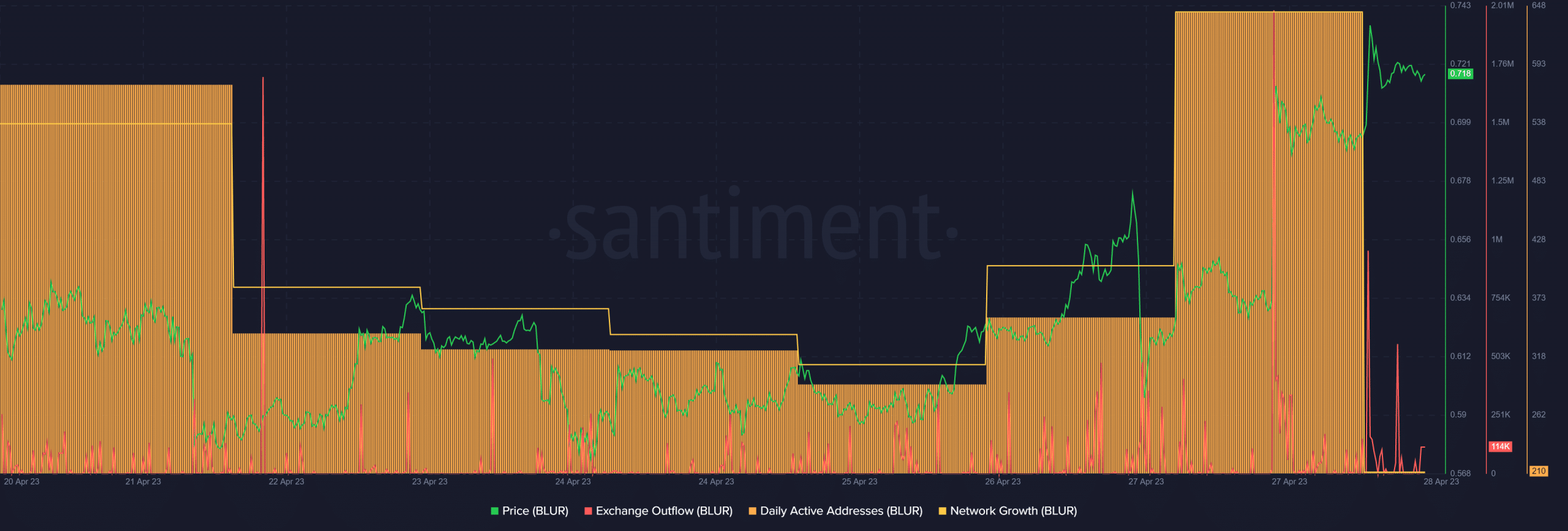

The token’s on-chain performance also suggested that the good days might continue. BLUR’s daily active addresses surged considerably during the uptrend.

Network growth was also high, which indicated that new addresses were used to transfer the token. Additionally, the token’s exchange outflow was soaring, which is a typical bull signal.

How much are 1,10,100 BLURs worth today

This is the catch

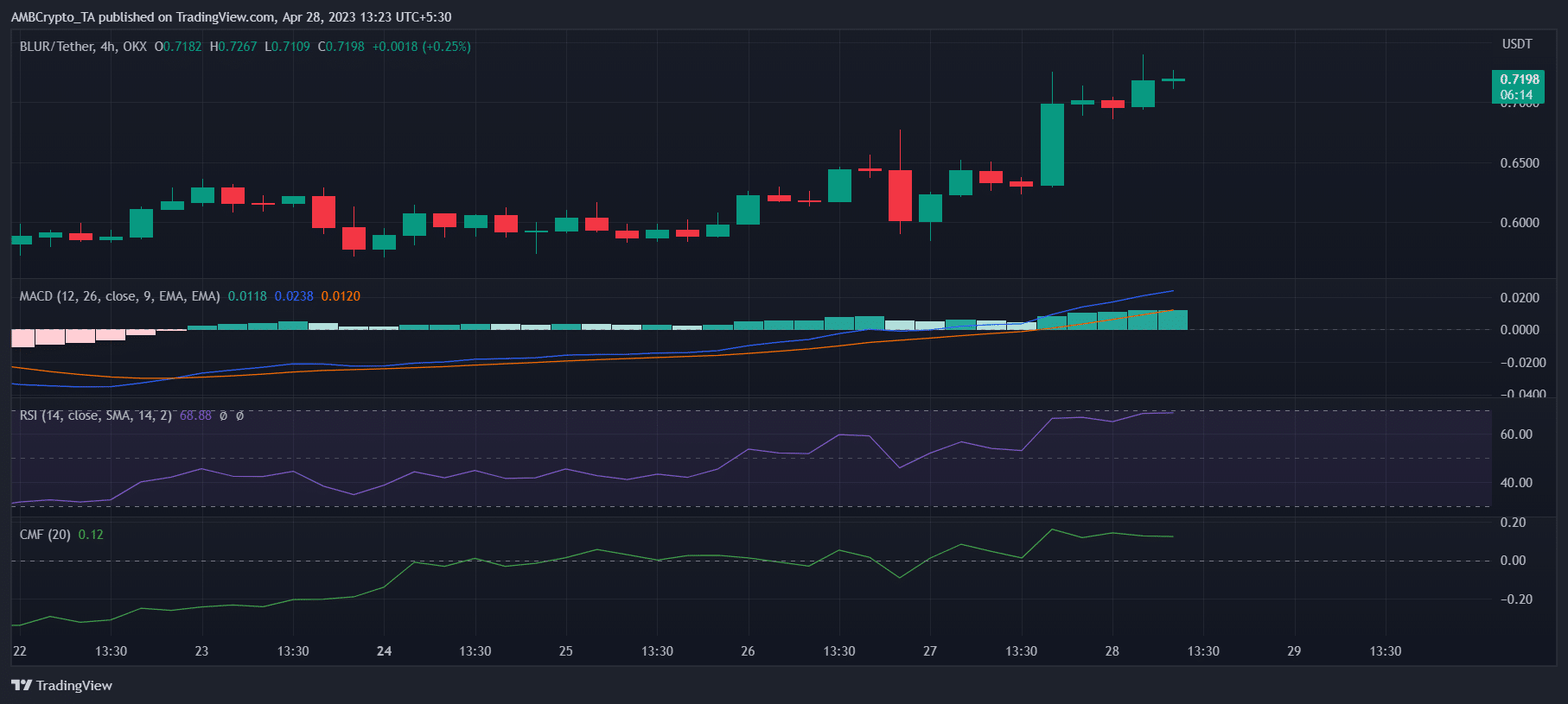

A look at BLUR’s daily chart revealed that most of the market indicators were in the bulls’ favor. For instance, the token’s MACD displayed a massive advantage for buyers in the market. The Chaikin Money Flow (CMF) was also positioned relatively high, increasing the chances of a continued northbound movement.

However, the token’s Relative Strength Index (RSI) hovered near the overbought zone. This could initiate selling pressure, which in turn can affect the token’s price.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)