Blur, OpenSea- What does the current state of NFT market look like

- In the wake of the SVB saga, Blur’s market share declined by 70%.

- Nevertheless, BAYC and MAYC witnessed consistent interest and a rise in sales.

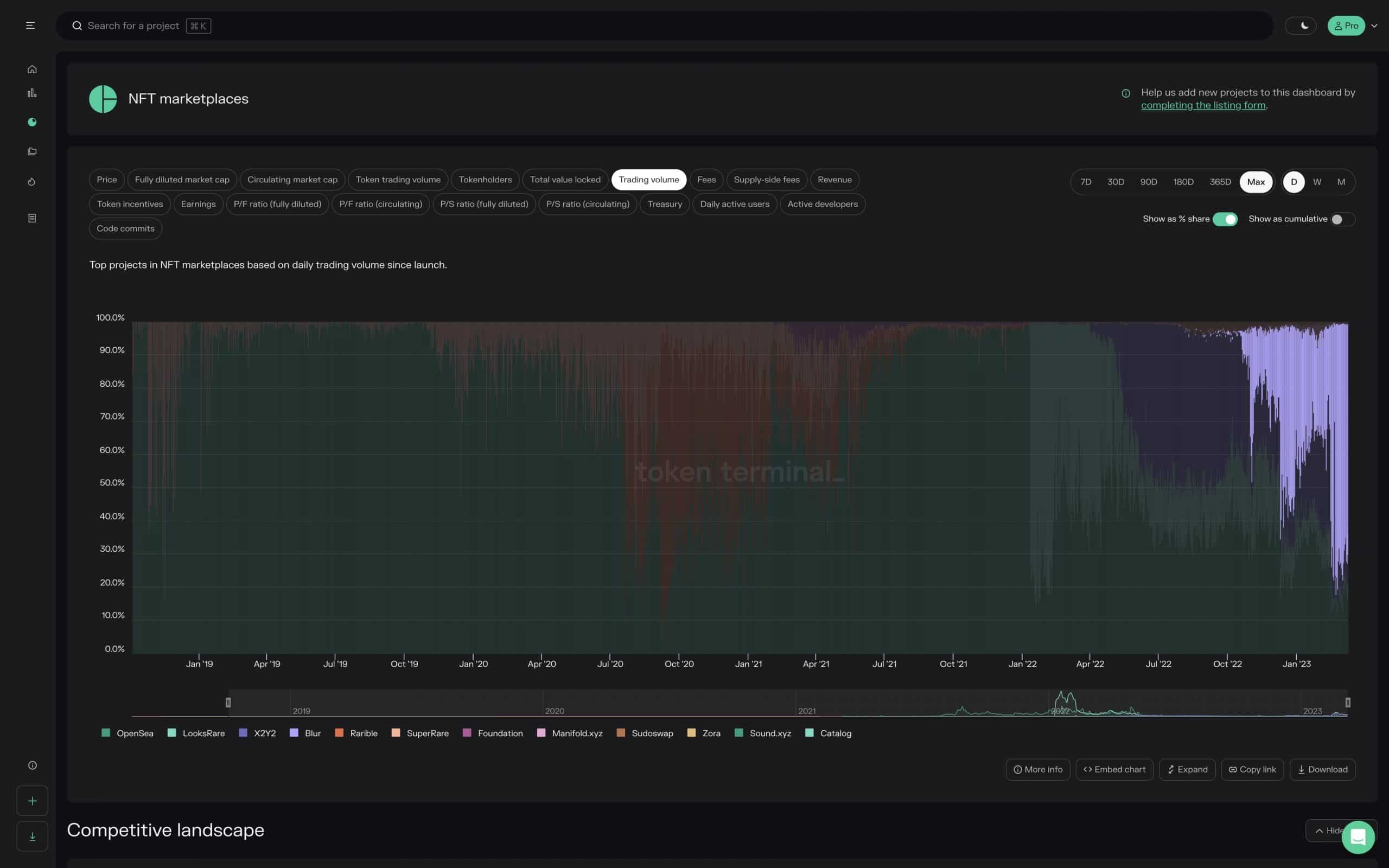

In recent times, the NFT market has witnessed some major shifts in the dominance of key players.

By now, it’s a well-known fact that OpenSea has been a significant player in the market for a long time. However, Blur, a new entrant, is giving tough competition to it.

Setting the record straight

However, the tides have turned once again, and according to the token terminal, Blur’s market share has taken a major hit, falling by a whopping 70%.

One reason for this decline could be the decrease in the number of trades on the Blur protocol, which has gone down from 3.3 million to 2.5 million in just one month, according to data from Dune Analytics.

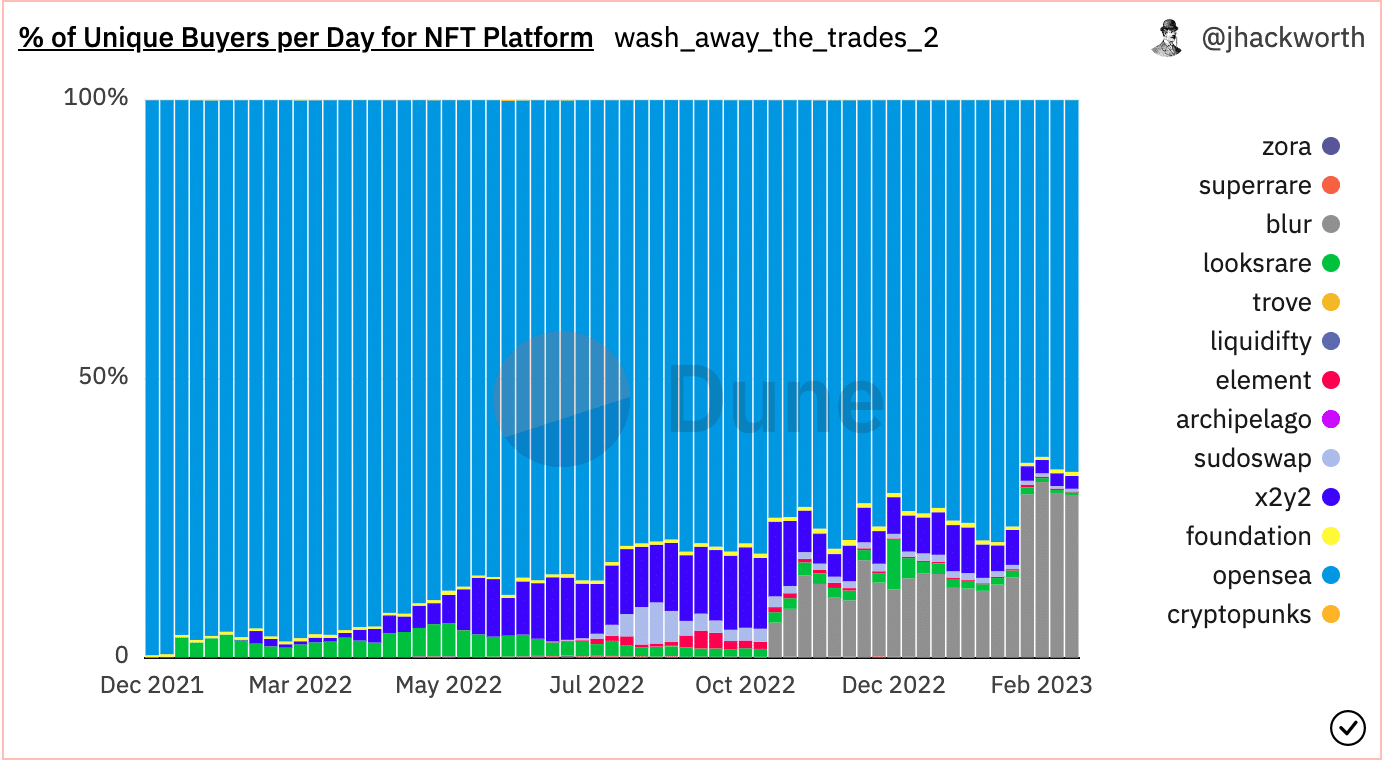

In contrast, OpenSea has been seeing an increase in the percentage of unique buyers per day. This means that more people are coming to the platform to buy and sell NFTs, and traders continue to flock to the platform, keeping its market share steady.

At press time, the percentage of unique buyers on the OpenSea platform was 66.66%. Blur, on the other hand, had only managed to capture 29.1%.

The troubles for Blur, however, didn’t end there.

Blue chip blues

Major players in the NFT market have been dumping their Blue Chip NFT collections, such as Moonbirds NFT, on the Blur platform, further contributing to the decline in its market share.

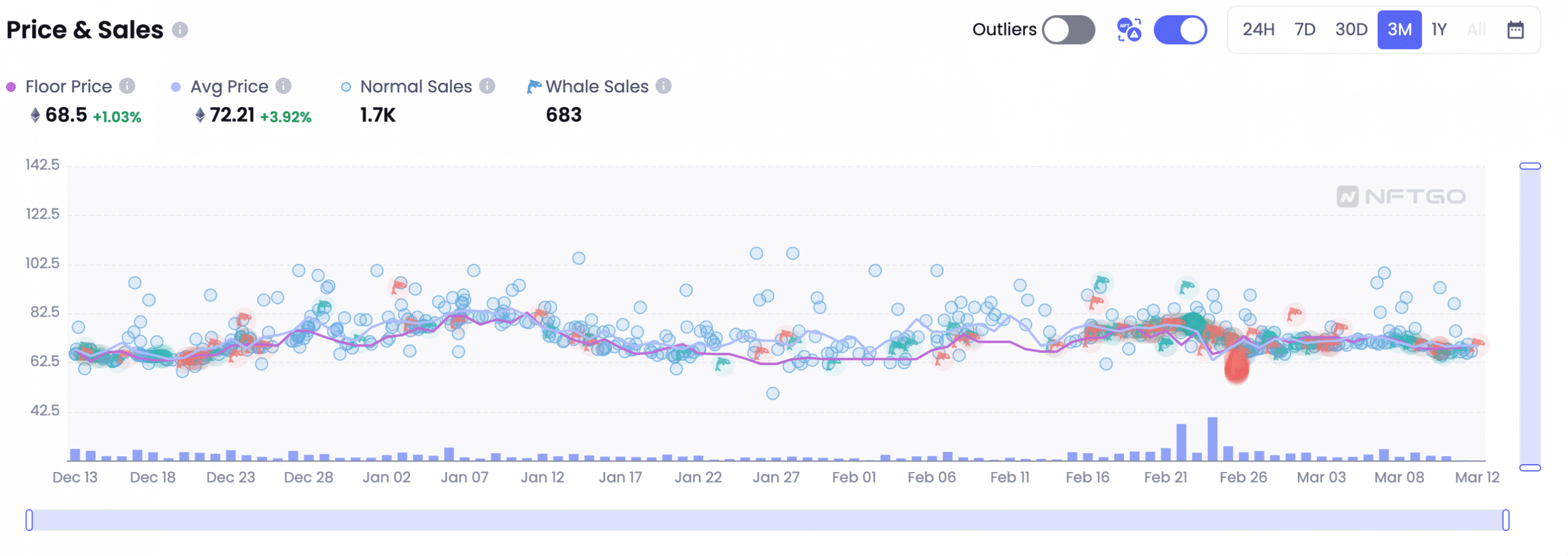

However, one platform that has remained consistent in terms of interest is Yuga Labs NFT. Despite the fluctuations in the market, Yuga Labs NFT has continued to attract buyers, suggesting that it has carved out a niche for itself in the market.

As of the press time, 500 Moonbirds were liquidated and the floor price of the collection fell by 23.86% in this period.

On the other hand, the strength of the BAYC and MAYC collections remained consistent in the market. Over the past few days, these collections have seen a renewed interest, as their volume and sales figures have gone up significantly.