BNB: 85% dip in developer activity could mean trouble! – Analyzing…

- BNB Chain’s smart contract and developer activity have plunged, revealing overdependence on the DeFi sector

- Despite stable price and Open Interest, technicals show weak momentum and a disengaged builder community

Binance [BNB] is showing cracks beneath the surface.

Smart contract activity on BNB has fallen to its lowest point in a year. Recent data reveals an unhealthy reliance on DeFi and DEX sectors, both of which are now retreating sharply.

In contrast, other ecosystems are expanding into gaming, NFTs, and broader developer innovation. BNB’s limited diversification may be exposing it to greater long-term risks.

Overreliance leaves BNB Chain exposed

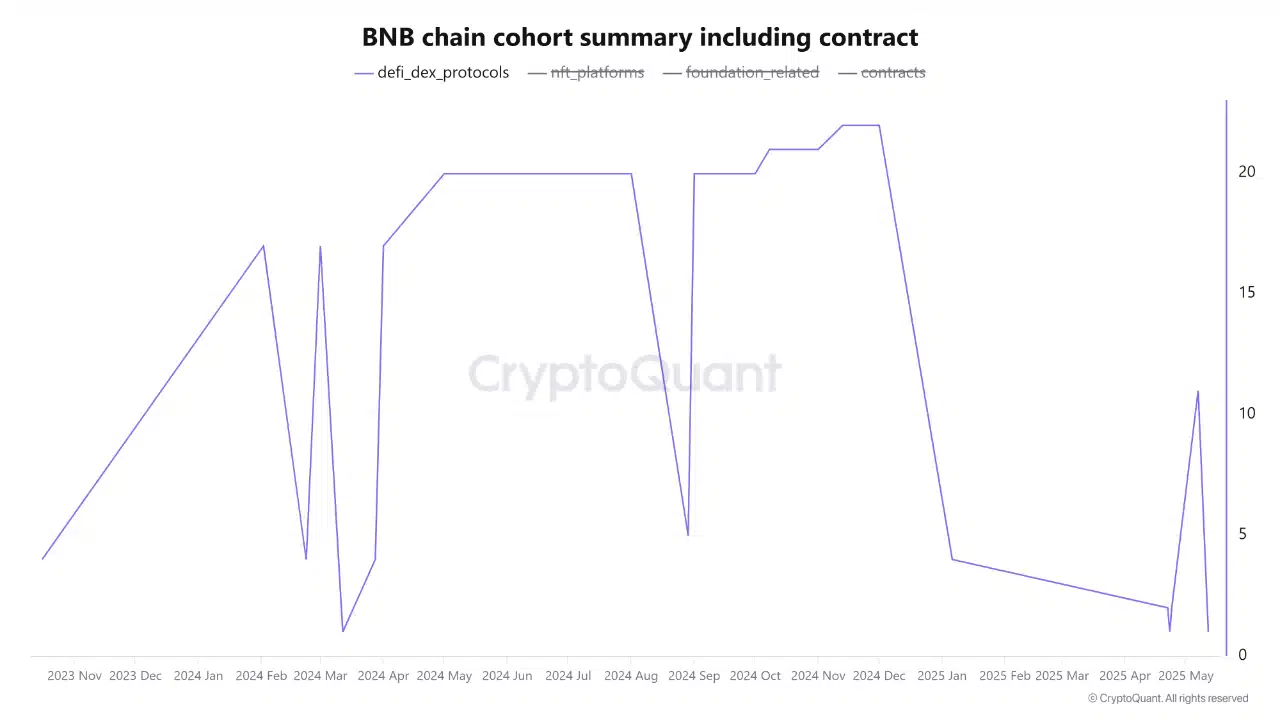

BNB Chain’s latest cohort data reveals a concerning collapse in active smart contracts, falling to year-long lows.

A closer look at the breakdown shows nearly all on-chain activity is concentrated in the DeFi/DEX sector, with other verticals, such as NFTs, foundation-backed projects, and gaming, registering virtually no traction.

The network’s recent decline directly mirrors the drop in DeFi activity. This lack of diversification now poses a serious systemic risk.

With no meaningful growth in other sectors to offset this slump, BNB Chain is left dangerously exposed to volatility in a single sector, making it highly sensitive to downturns, migrations, or confidence shocks.

Open Interest holds, but development vanishes

Despite stable Futures Open Interest, on-chain developer activity on BNB has plunged over 85% in the past month.

This highlights a stark gap between speculative interest and real builder engagement. While traders appear to be staying put, developers are stepping away.

With development activity now nearing YTD lows, there’s an obvious disconnect between market sentiment and underlying network health.

Without renewed developer engagement, the long-term sustainability of BNB’s ecosystem could be at risk, regardless of what Futures data implies in the short term.

Momentum stalls with indicators flashing neutral – but is that part of the problem?

Technical signals on BNB’s daily chart show indecision.

At press time, the RSI hovered near 51, showing neither strength nor weakness. MACD lines were flat and barely crossing into positive territory, showing a lack of meaningful momentum.

Meanwhile, OBV remained steady at around 574 million, showing no clear accumulation or distribution.

This neutrality is a sign of a market in limbo, where price holds steady, but conviction is absent.

With fundamentals deteriorating and developer activity collapsing, the muted signals from traders show that the ecosystem’s deeper issue is not panic, but indifference.

![Cronos [CRO]](https://ambcrypto.com/wp-content/uploads/2025/07/Gladys-33-400x240.webp)