BNB bears euphoric after driving prices below $265, where to next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- A strong downtrend was in progress.

- The $285 mark could be important on the shorter timeframes in the next few days.

The U.S. Securities and Exchange Commission (SEC) sued Binance and its CEO Changpeng Zhao on Monday on charges of violating federal securities law on Monday. The crypto market took a downward turn after this news emerged.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Bitcoin fell to $25,350 but was trading at $26.4k at the time of writing. However, the BTC market was dominated by bears. Binance Coin was no different and was even more strongly bearish.

The trend was bearish once more after the swift drop below May lows

After the rally from $220 to $338 from December to February, the market had a bullish leaning. This became an uptrend when BNB formed a higher low at $265 and pushed to the $346 level in March.

This bullish structure was broken on 8 May when the bears blasted beneath the $315.3 support from April. This showed the market favored the sellers once more. But the bears did not stop there. They were able to push prices beneath the $299.5 mark as well.

This highlighted the strength of the sellers in the market. This reflected the sentiment in the market and the fear around Binance and its battle with the SEC. The RSI was in oversold territory with a reading of 23, and the OBV has taken a sharp hit over the past two months.

The fall beneath $299.5 meant a downtrend was in progress. The daily session close beneath $265 suggested that BNB was likely headed toward $220. Short sellers can look for an entry in the $285-$300 region, but it was uncertain if this would materialize.

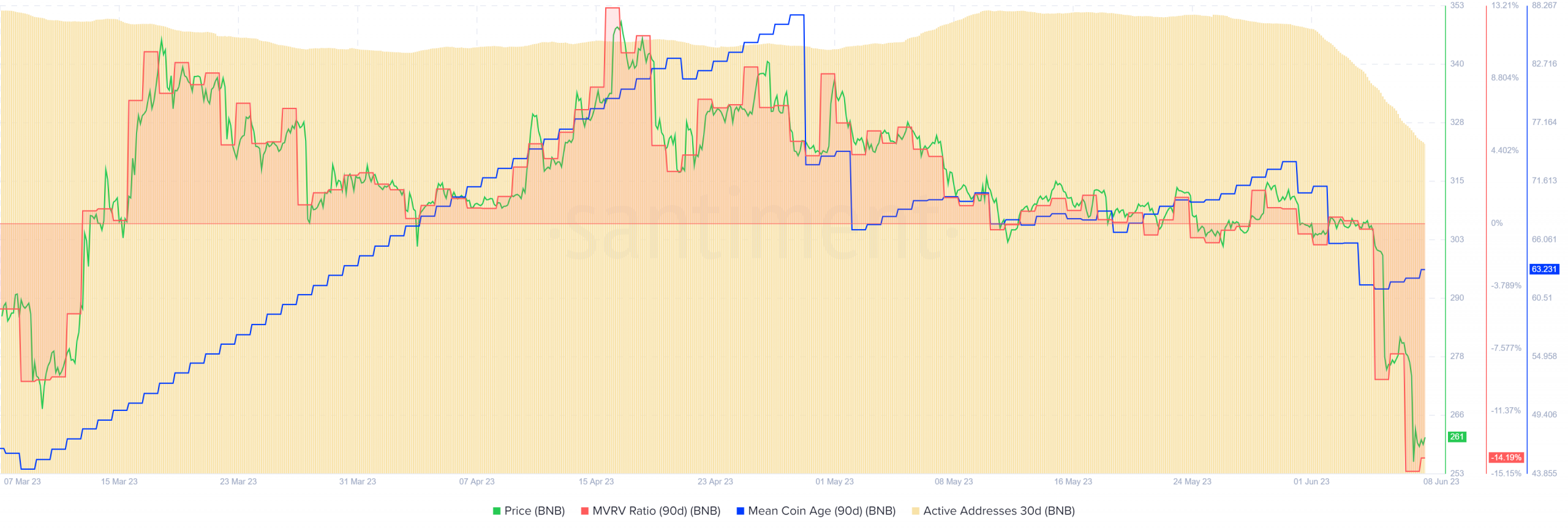

Mean coin age began to fall in early May as hopes of accumulation were dashed

Source: Santiment

In late April the 90-day mean coin age began to experience a sharp drop. In May, Binance Coin exhibited a lower timeframe range formation between $301 and $315. During this time, the mean coin age saw a small increase but not a continuous uptrend like it saw in March.

Realistic or not, here’s BNB’s market cap in BTC terms

This signaled a lack of accumulation of BNB in wallets, and highlighted jittery investors. The recent move also saw the MVRV ratio plummet. Overall, the seller dominance was clear to see. This might not relent in the coming days. A move back above $317 would be necessary to shift the daily structure to bullish.