Altcoin

BNB Chain: Daily unique addresses drop, but it’s not all bad news

There has been a steady decline in BNB Chain’s daily unique wallets.

- Demand for BNB Chain has dropped since the year began.

- However, the monthly transaction count on the network has spiked.

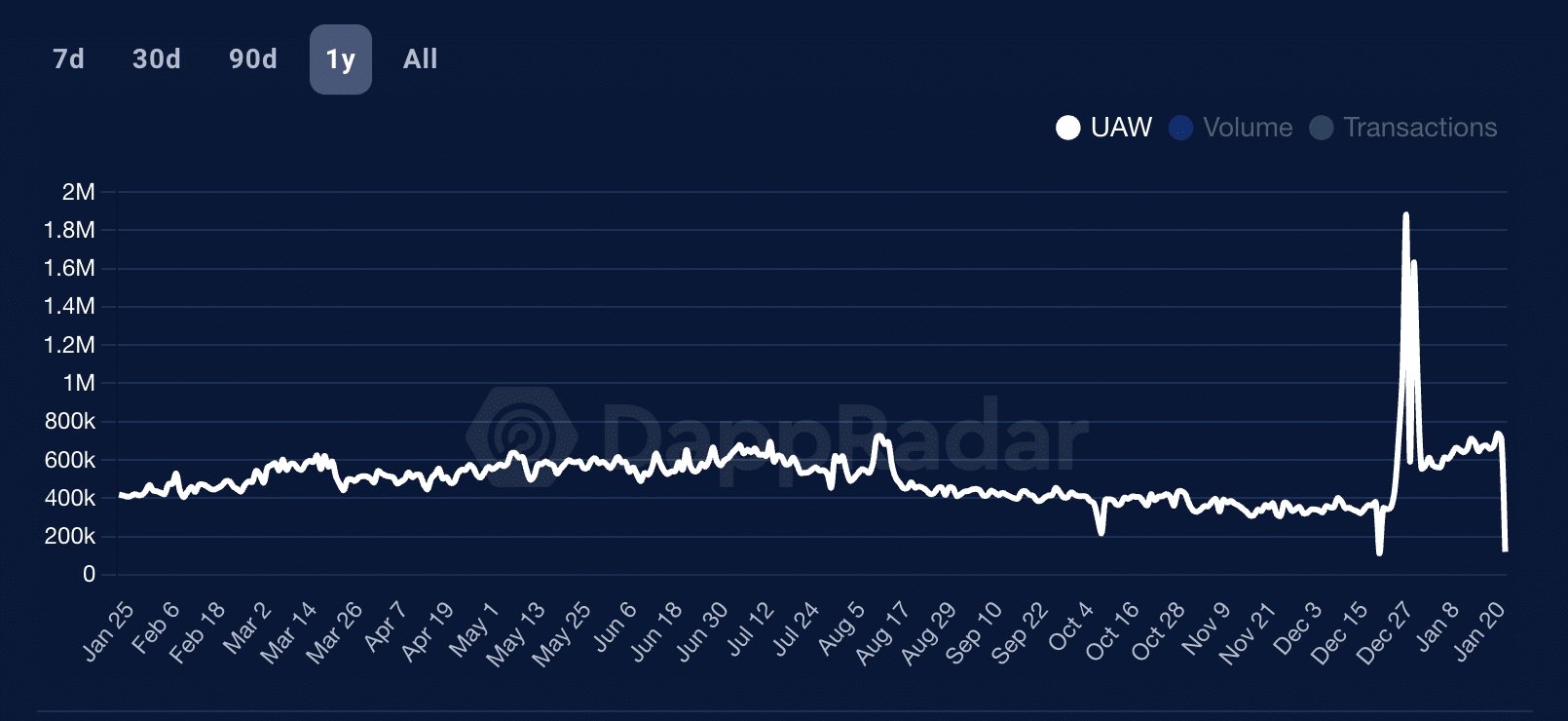

The daily count of unique active addresses on the BNB Chain [BNB] has plummeted to a one-month low, according to data from DappRadar.

Data from DappRadar showed that BNB Chain witnessed a decline in the daily count of active wallets on the decentralized applications (dApps) housed within the network since the 31st of December 2023.

On the 24th of January, the active wallet count on the BNB Chain totaled 119,400. This marked an 88% decline from the 1.01 million the network recorded in active addresses on the 1st of January.

Due to the fall in user count on the network, the number of transactions completed on it daily has seen a corresponding decline since the year began.

As of the 24th of January, the transaction count of BNB Chain totaled 209,170, representing an 87% decrease from the New Year’s Day high of 1.68 million transactions.

Not all bad news

Although BNB Chain has seen a dip in daily user and transaction count since the year began, the number of transactions completed on the chain measured over one month has exceeded that of any other blockchain network, AMBCrypto found.

In the last 30 days, a total of 45.36 million transactions have been completed on the BNB Chain, dwarfing Ethereum’s [ETH] 2.07 million transactions.

On a month-over-month (MoM) basis, the chain has seen a 142% rally in transaction count, per data from DappRadar.

Due to the hike in MoM transaction count on the chain, network fees and revenue have also spiked. In the last month, transaction fees on BNB Chain have totaled $18 million, rising by 21%.

Likewise, the revenue recorded from the same has amounted to $1.70 million, climbing by 20%, according to data from Token Terminal.

BNB price action

At press time, the network’s native coin traded at $290, logging an 8% price uptick in the last month.

Despite recent market troubles that have led to a decline in the values of many leading assets, BNB continues to enjoy sustained accumulation.

Its key momentum indicators observed on a weekly chart rested above their respective neutral lines, suggesting that traders continue to favor coin accumulation.

Is your portfolio green? Check out the BNB Profit Calculator

On the other hand, Futures market participants have adopted a bearish approach. According to data from Coinglass, the coin’s Open Interest has plunged by 21% since the year began.

Also, Funding Rates across exchanges have been only negative since the 15th of January, showing that traders have since placed bets in favor of a decline in BNB’s price.