BNB drops to this key confluence area but can bulls inflict a pivot?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- BNB’s RSI was below 50 on H4 at press time, confirming bears’ leverage

- Aggregated CVD spot and liquidations data confirmed the short-term bearish sentiment

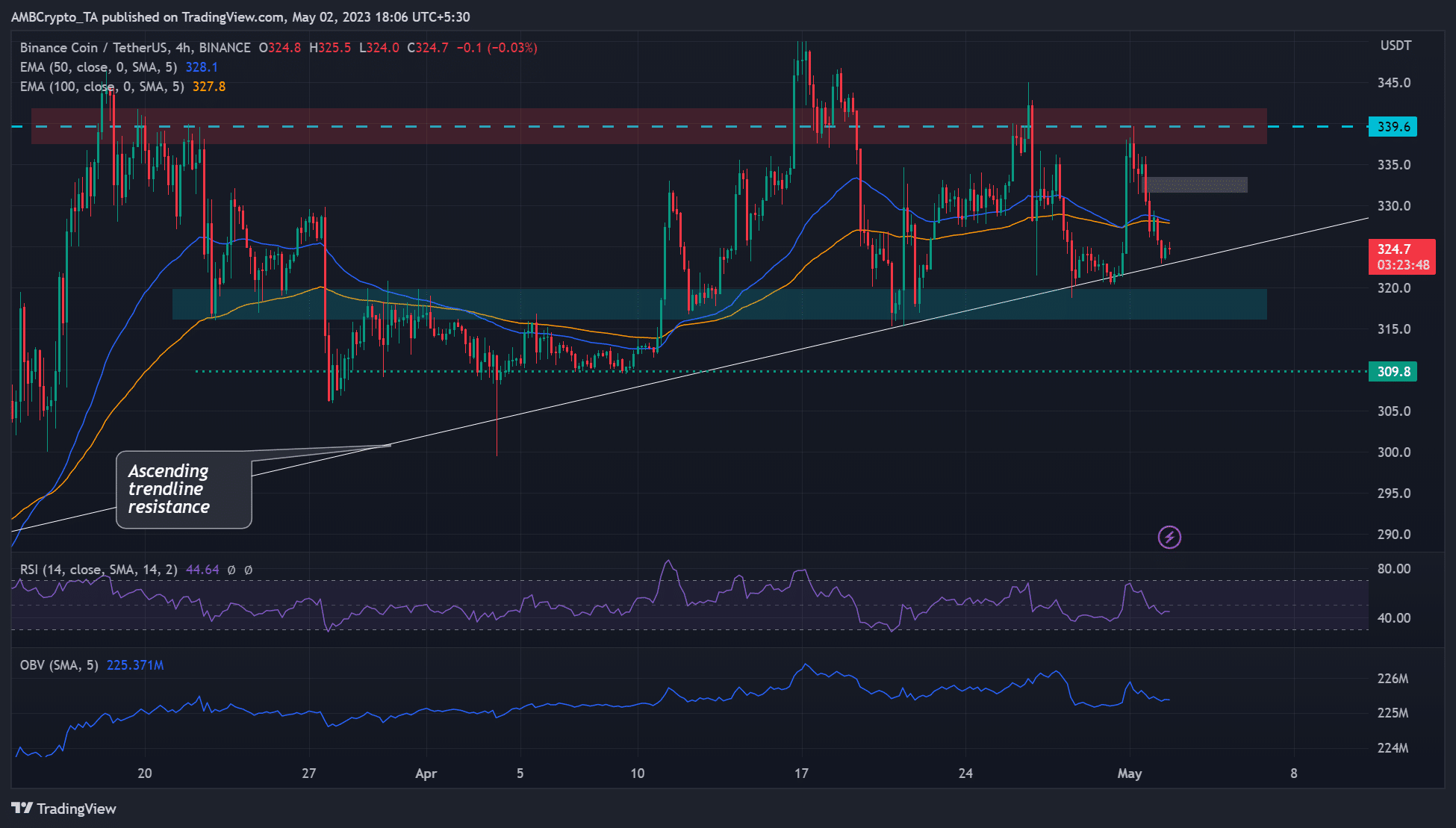

Binance Coin’s [BNB] press time level was a good position for trend players. Notably, BNB faced correction after hitting the bearish order block of $339.6, giving sellers a good reason for entry.

But the drop hit a key confluence area of an ascending trendline and bullish order block, which could inflict a price reversal if demand increases.

Is your portfolio green? Check BNB Profit Calculator

However, Bitcoin [BTC] struggled to stay above $28k at press time on the first day of the FOMC meeting. As such, BNB could witness more downward pressure until markets firmly price in the FOMC announcement.

Will the support hold?

The support zone of $315 – $320(cyan) is a bullish order block on the daily timeframe. The level was a crucial support in late March before it was flipped to resistance on 27 March. It maintained its position as a resistance level for three weeks before it was flipped again to support on 11 April.

In the second half of April, the level was retested thrice as support, ending with price rejections near the bearish order block of $339.6. If the trend repeats, a fourth retest could inflict another price reversal and rally toward $339.6.

It is worth noting that the ascending trendline resistance also aligns with the level and could offer more resistance to sellers. However, an FVG (fair value gap) zone between $332 – $334 (white) may offer slight resistance to a likely recovery.

A close below the confluence area could set BNB to aggressive selling, especially if BTC drops below $27k. But the plunge could ease near $309 or $300. Meanwhile, RSI and OBV retreated lower, reiterating that the buying pressure dipped.

CVD and liquidations favored sellers, but …

Read Binance Coin’s [BNB] Price Prediction 2023-24

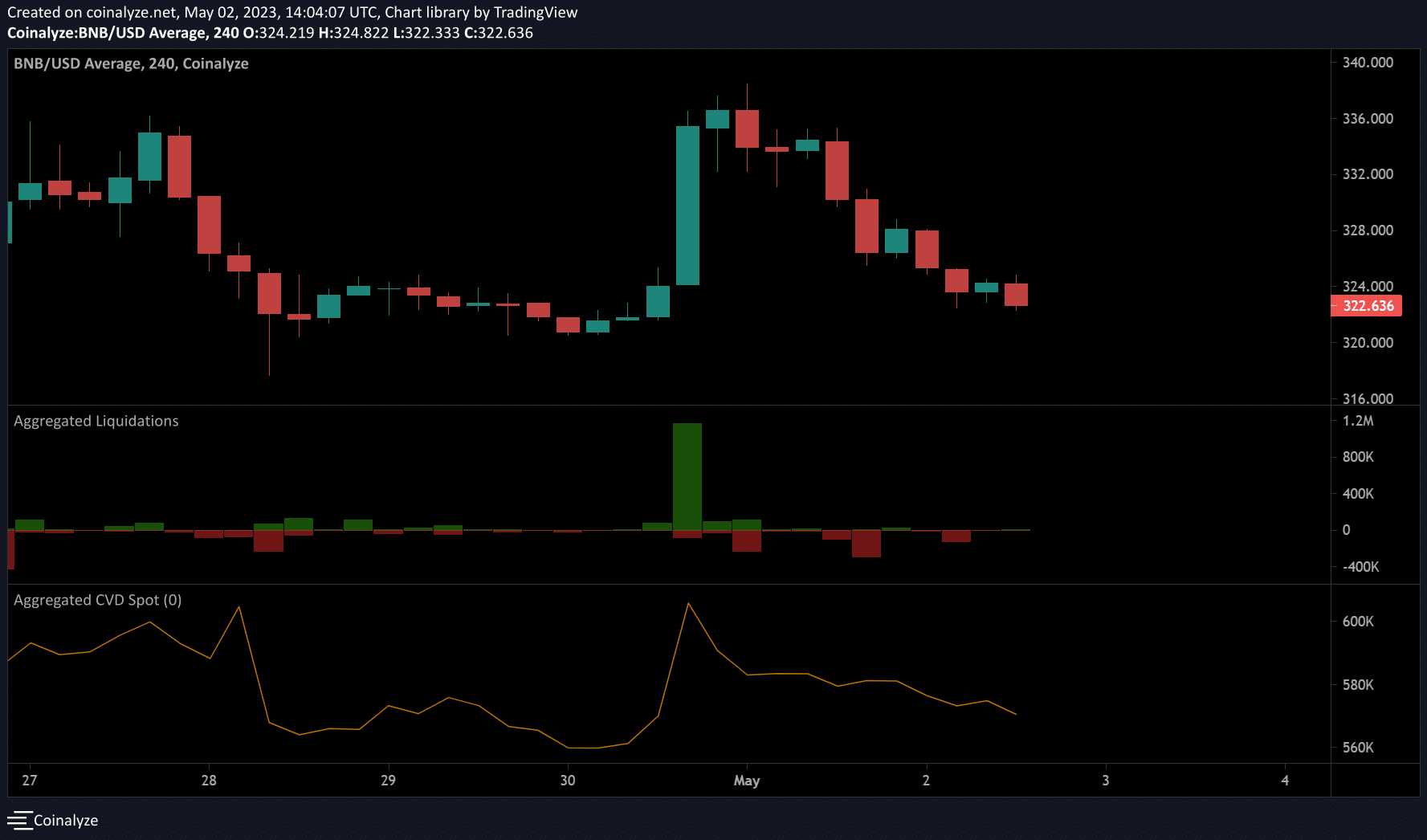

At press time, the aggregated CVD (cumulative volume delta) spot dipped lower, confirming sellers still had more leverage. The CVD spot tracks sell and buy aggressors alongside trading volumes to measure sentiment within the spot market. Thus, the sentiment was bearish at press time.

Similarly, there were $531k liquidated long positions compared to only $26k worth of short positions wrecked in the past 24 hours, according to Coinalyze. It confirmed the prevailing bearish sentiment.

However, in the past four hours before press time, liquidations stood at $32k for longs and $25k for shorts, as per Coinglass data. It shows the gap closing faster and could signal a possible reversal.

However, investors should track BTC price movement and overall sentiment amidst the ongoing FOMC meeting before making moves.

![Binance Coin [BNB] liquidations](https://ambcrypto.com/wp-content/uploads/2023/05/BNB-liquidations.png)