BNB: Evaluating effects of BEP-95 auto-burn on price

It is common knowledge that cryptocurrency projects perform periodic coin burning as a deflationary mechanism to reduce the total supply of their coins and drive up their prices.

Well, the control of the supply of BNB, the coin that powers the BNB and BSC ecosystems, was initially done through quarterly BNB burns. The quarterly BNB burns were based on the coin’s trading volume on the Binance exchange.

However, in November 2021, with the introduction of BEP-95, Binance announced that the new BNB auto-burn mechanism would help burn BNB tokens faster. With this mechanism, a portion of BNB coins used to pay for transactions on the Binance Smart Chain is destroyed.

Now, the question is- Has the BNB coin seen any substantial growth in price with its auto-burning in the face of the general downturn of the cryptocurrency market so far this year? Let’s take a look.

Price has been burning

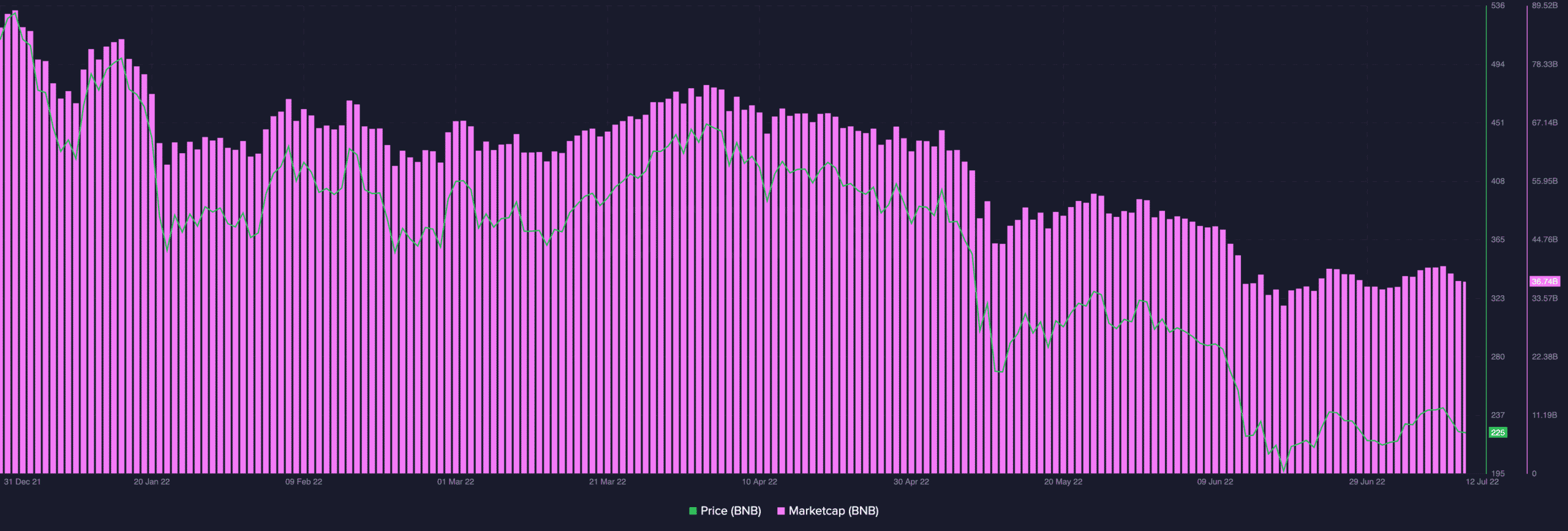

Since the implementation of the BEP-95 burning mechanism, BNB coins worth $22,932,378.62 have been destroyed. With the bearish takeover of the cryptocurrency market since the beginning of the year, the price of the BNB coin is yet to see any positive impact from the BEP-95 burning.

At the beginning of the year, the coin marked its spot at an index price of $512. Currently, trading at its February 2021 level, the price of the BNB coin has registered a 56% decline so far this year. At press time, the coin traded at $224.93.

As expected, its market capitalization declined from $85.35 billion in January to $36.70 billion by press time.

On-chain analysis

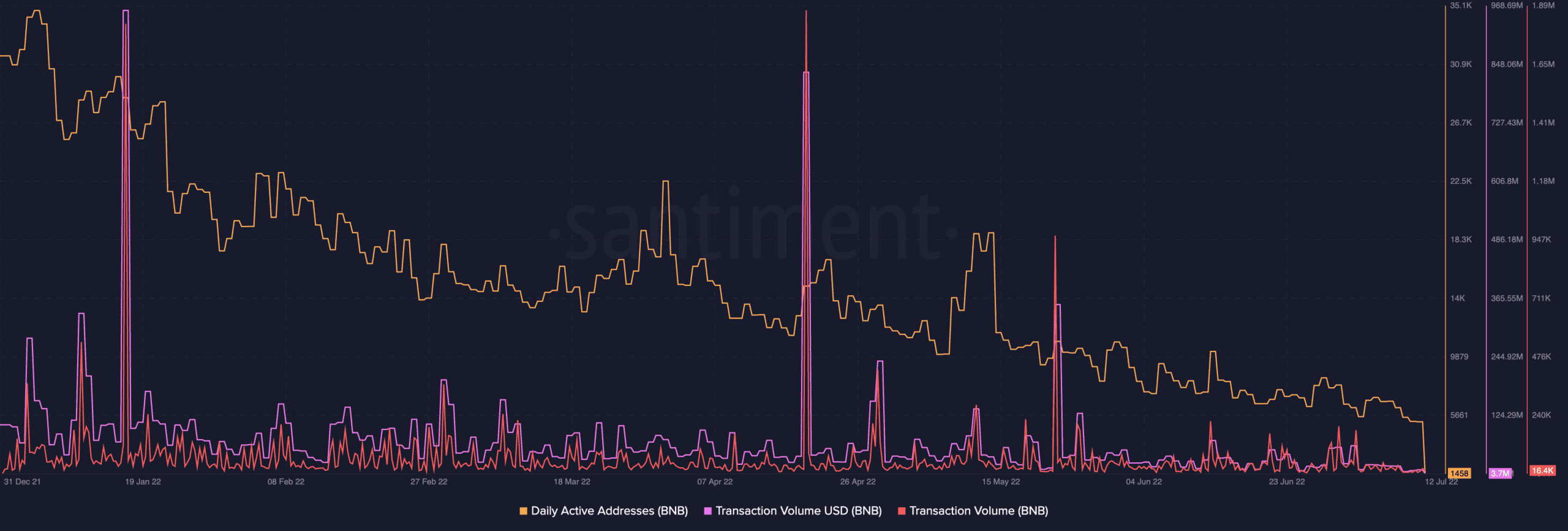

According to data from Santiment, within the period under review, the number of unique addresses transacting the BNB coin steadily declined as the price fell.

In the last 192 days, the count for the daily active addresses that have transacted the BNB coin declined by 94%. Similarly, after the transaction volume for the BNB coin saw a high of 1.98 million on 19 April, it decreased by 99%. Valued in USD, this declined from $831.65 million to $3 million.

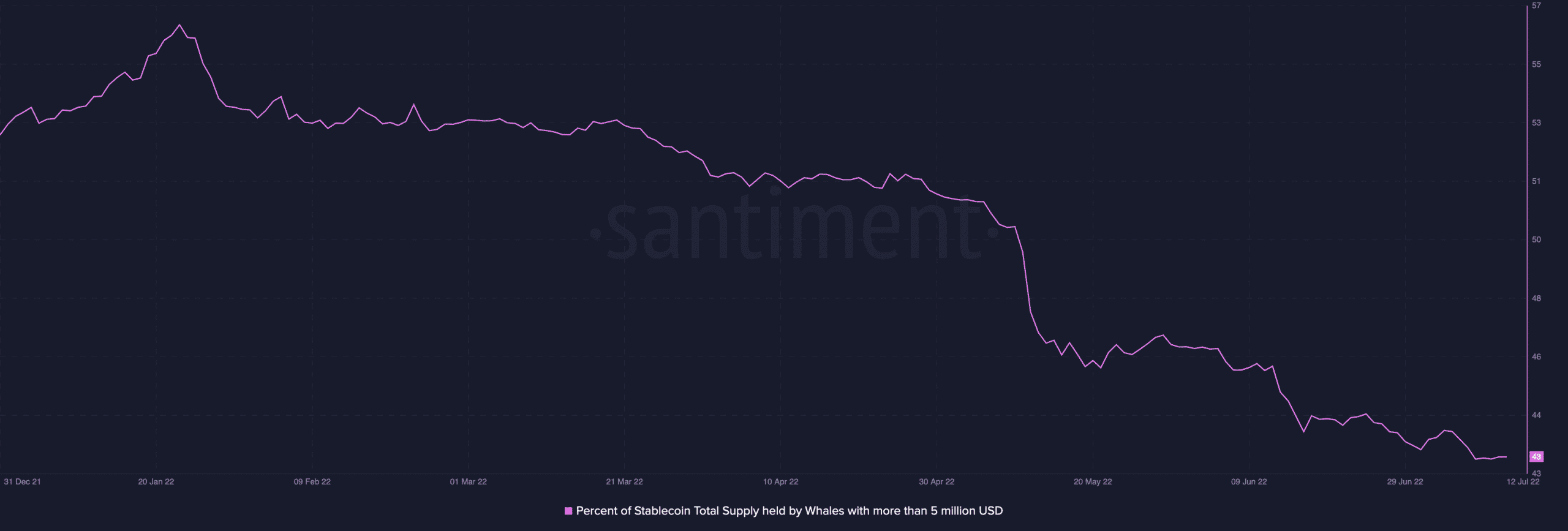

Further, within the period under review, the percentage supply of the BNB coin held by whales saw a 19% decline.

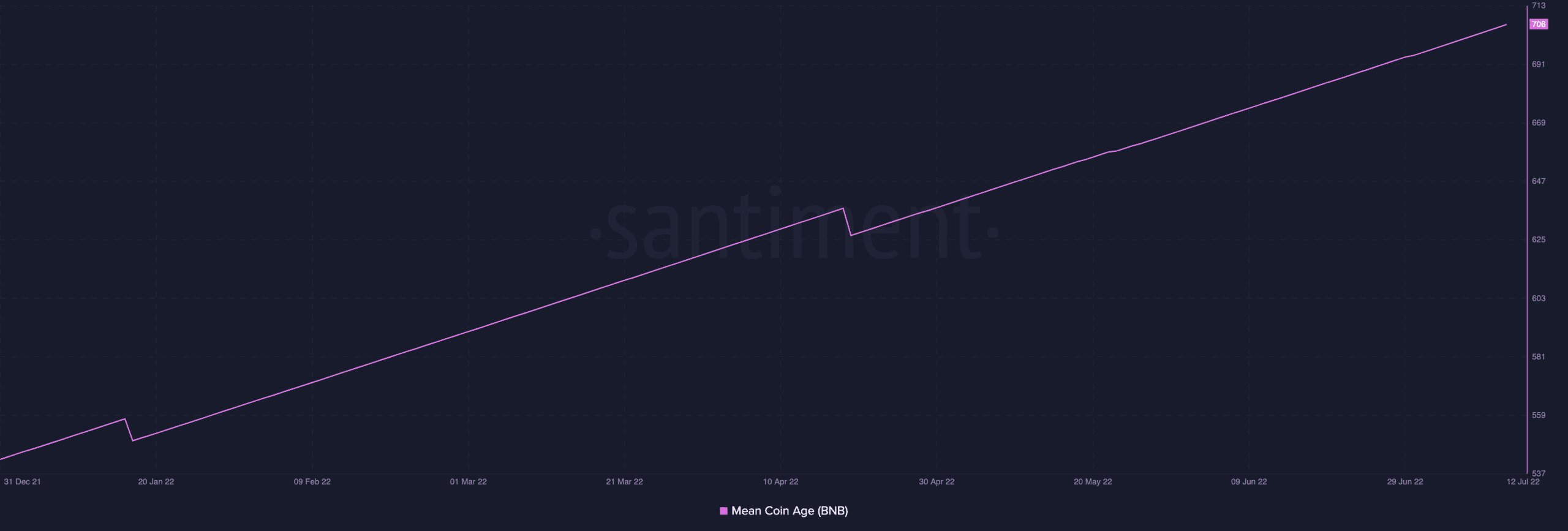

Interestingly, since the beginning of the year, despite a price drawdown, investors remain bullish as the mean coin age for BNB maintained a rising slope. This signals a network-wide accumulation trend.