BNB eyes $700 as bullish trendline signals rally ahead

- BNB is trading on an upward trendline, with potential to break $615 resistance and surge to $700.

- Technical indicators like RSI and open interest suggest further price movement, signaling a possible rally ahead.

Binance [BNB], the native cryptocurrency of Binance Exchange, has been on an upward trend since the start of October. After facing fluctuations throughout September, including a dip to as low as $477, the token has rebounded and is recovering its earlier losses.

This recovery has been fueled by a bullish trend that has strengthened BNB’s position in the market.

Over the past two weeks, BNB has seen a 5.5% increase in value, with a 2% rise in the past week alone. However, despite this positive momentum, the token experienced a 1.9% pullback in the last 24 hours, bringing its current price to $595.

Prior to this, BNB hit a 24-hour high of $610.

Despite this slight dip, BNB’s recent market performance suggests the possibility of a stronger rally in the coming weeks.

Technical indicators point to further upside

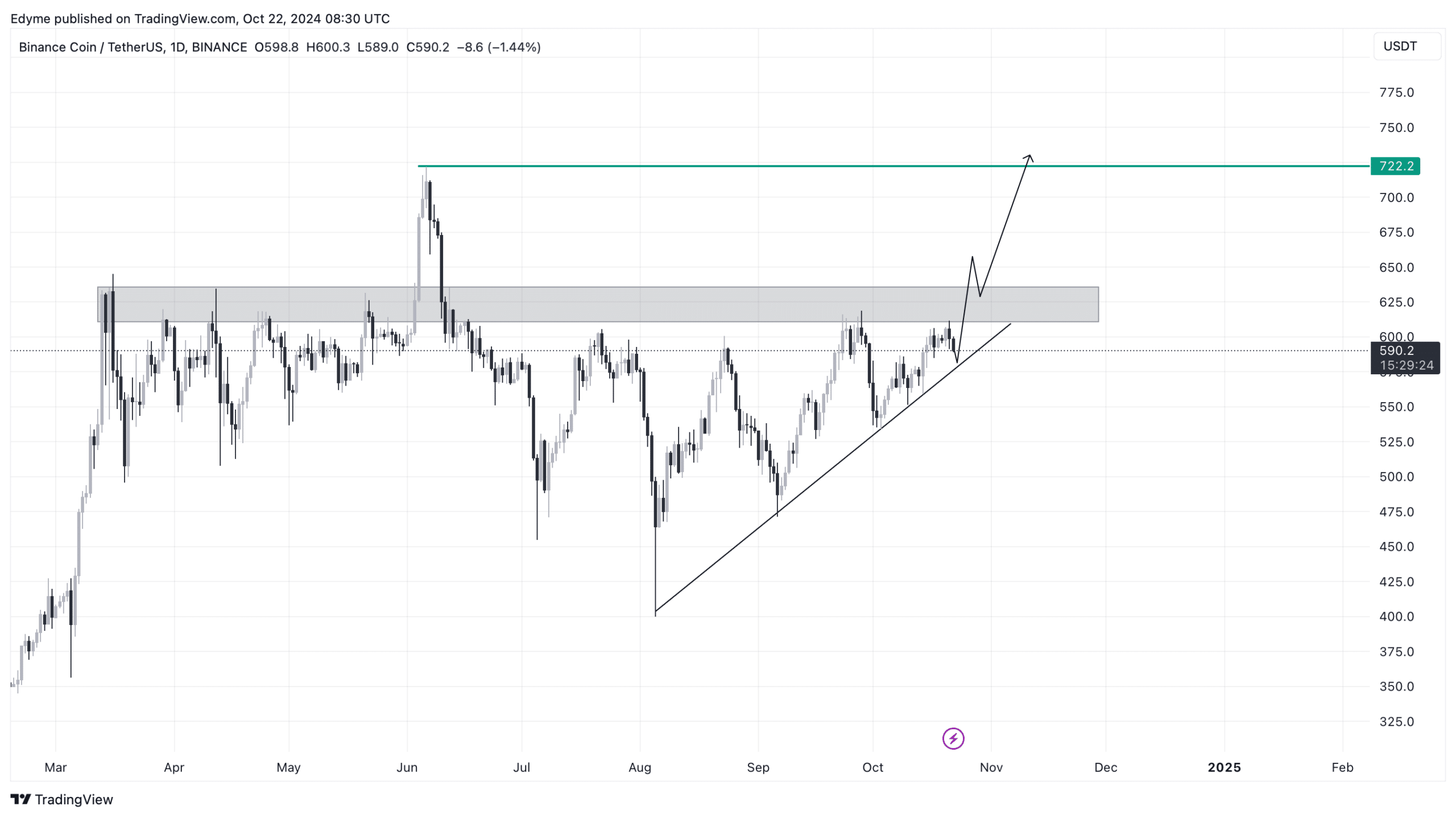

The daily price chart of BNB indicated that the asset has maintained an upward trendline, which typically signals continued growth. This trendline has acted as a solid support level, as BNB’s price has not fallen below it in recent weeks.

If the asset maintains this trajectory, BNB could challenge its next major resistance level at $615, a critical zone where the price has previously faced rejection.

A successful break above this level could open the door for the asset to surge as high as $700, potentially reclaiming its June peak of $722.

An upward trendline, like the one observed in BNB’s current market behavior, is a key technical pattern indicating a bullish market. It reflects consistent higher lows, suggesting that buyers are stepping in at increasing price levels to support the asset.

When a cryptocurrency’s price consistently follows an upward trendline, it indicates that the asset is experiencing sustained buying pressure, which could eventually lead to a breakout above resistance levels.

In BNB’s case, this trendline has been in place for several weeks, indicating the potential for continued growth.

Fundamental outlook on BNB

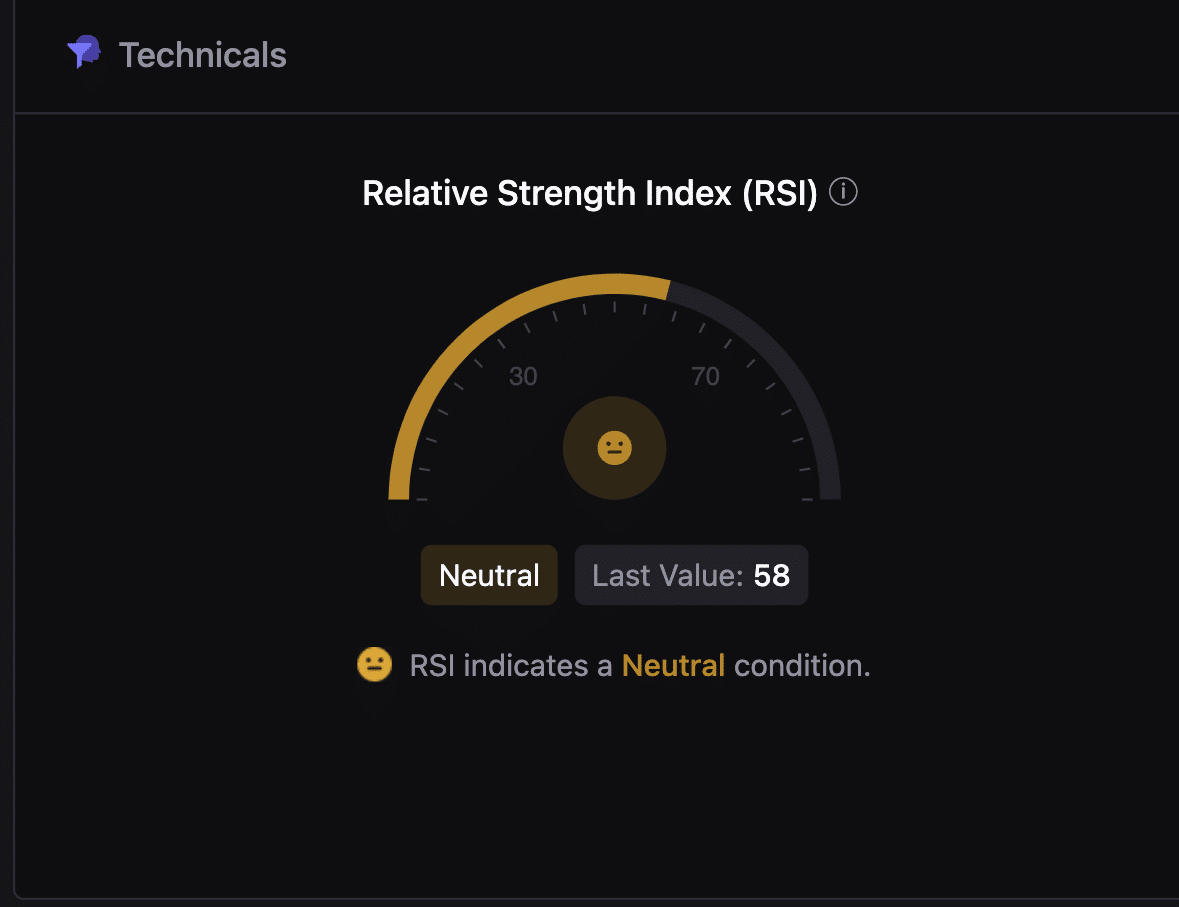

In addition to technical patterns, other indicators also point to the potential for further gains. One such indicator is the Relative Strength Index (RSI), a momentum oscillator used to measure the speed and change of price movements.

The RSI ranges from 0 to 100, with a reading above 70 generally considered overbought and a reading below 30 considered oversold. BNB’s current RSI, sitting at 58, suggests a neutral market condition.

This level indicates that while the Binnacle Coin is not in overbought territory, it still has room to move higher without facing significant selling pressure.

Further supporting this positive outlook is data from Coinglass, which shows mixed signals regarding BNB’s open interest.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

While BNB’s open interest—representing the total number of outstanding derivative contracts—has decreased by 3.27% to $541.43 million, its open interest volume has surged by 38.94%, reaching $645.18 million.

This increase in open interest volume signals a growing number of market participants and increasing activity, suggesting that traders are positioning themselves for potential future price movements in BNB.