BNB faces correction after climbing 10% last week: New predictions?

- Market sentiment around BNB turned bearish in the last few days.

- In case of a bullish trend reversal, BNB might target $744 first.

Like most cryptos, BNB bulls also controlled the market last week by pushing the coin’s price up to double-digits. However, the bullish trend didn’t sustain as the coin fell victim to a correction in the last 24 hours. Will this put an end to BNB’s upward rally?

BNB’s 10% weekly surge!

CoinMaerketCap’s data revealed that BNB’s price rallied by 10% last week, pushing the coin’s price to $721. With this, the coin boasted a market capitalization of nearly $104 billion.

Meanwhile, Binance Research posted a tweet highlighting major developments in the crypto space.

The tweet mentioned the declining BTC dominance, and a 6% rise in the DeFi TVL sector. Apart from this, the tweet also mentioned that the crypto market entered the “extreme greed” phase as the fear and greed index had a reading of 80%.

This greed in the market had a negative impact on BNB’s price action. The coin’s value plummeted by over 2% in the past 24 hours.

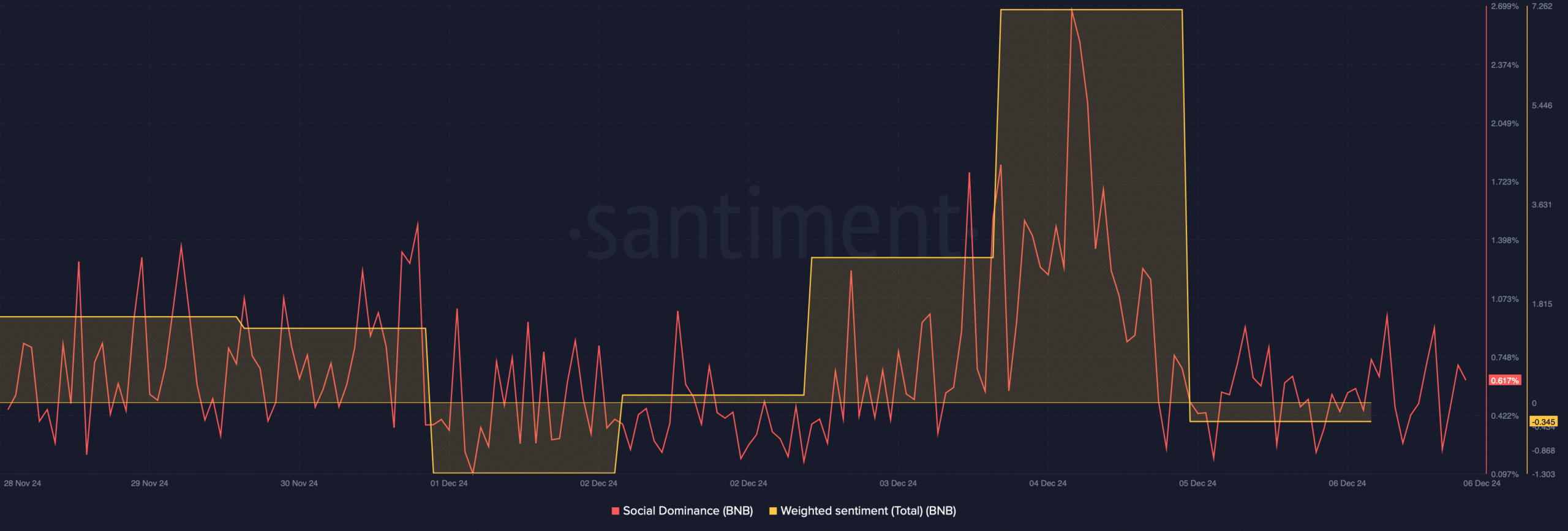

The recent bearish price action also had a negative impact on the coin’s social metrics. For instance, after a sharp increase, BNB’s social dominance fell, indicating a decline in its popularity.

A similar trend was also noted on its weighted sentiment graph — an indication of rising bearish sentiment in the market.

Will this downtrend continue next week?

To see whether BNB is poised for a continued price decline, AMBCrypto assessed the coin’s other datasets. We found that the coin’s long/short ratio registered a slight uptick in the 24-hour timeframe. This meant that long positions were increasing compared to short positions in the market, which usually signals a possible price rise.

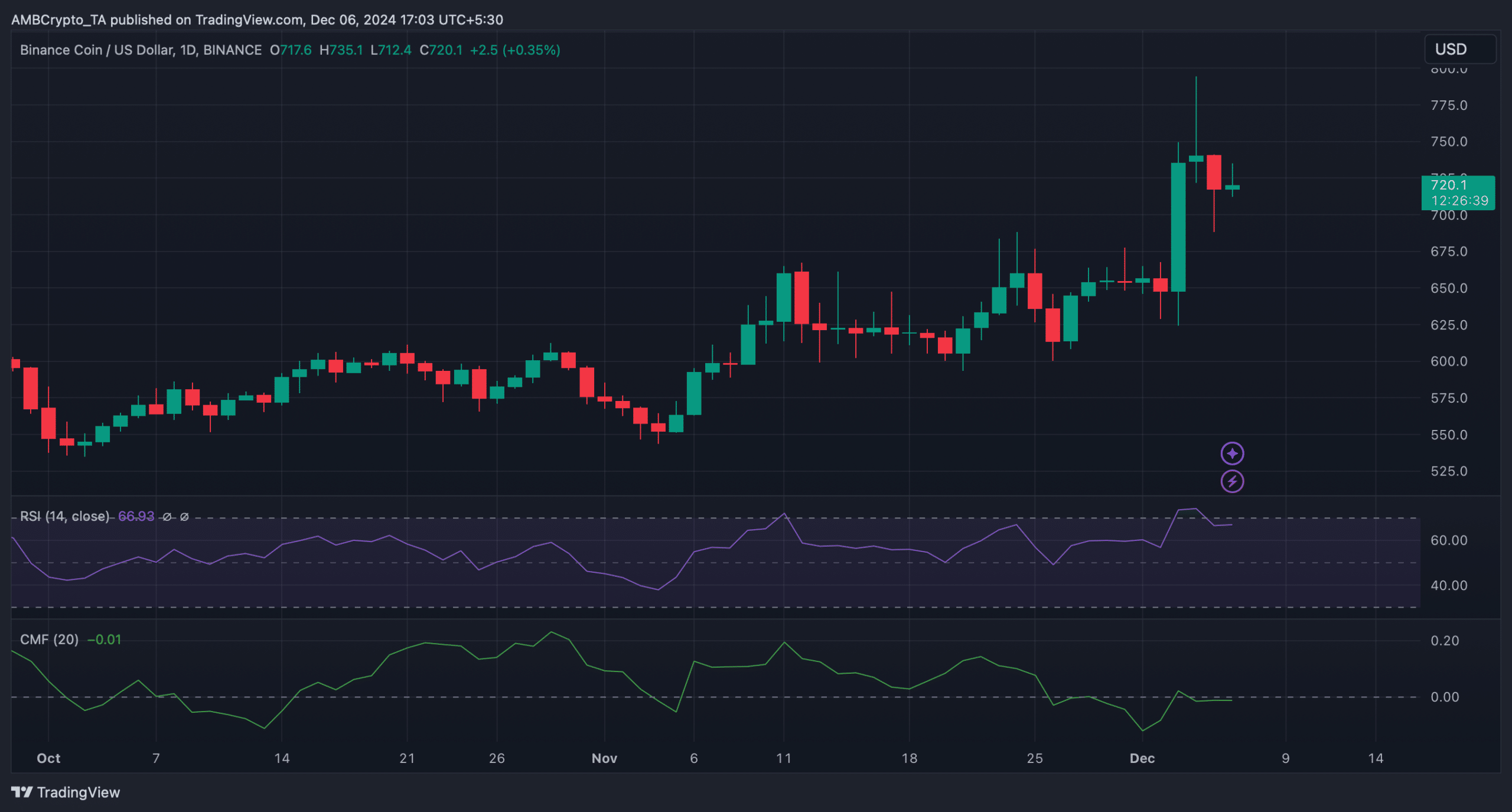

Additionally, the coin’s trading volume also dipped by 33% in the last 24 hours, which also suggested a bullish trend reversal in the coming days. However, not everything was working in the coin’s favor. BNB’s Relative Strength Index (RSI) moved southward.

Additionally, the Chaikin Money Flow (CMF) took a sideways path, meaning that no notable buying activity was happening. When such episodes happen, they hint at more days of slow-moving price action.

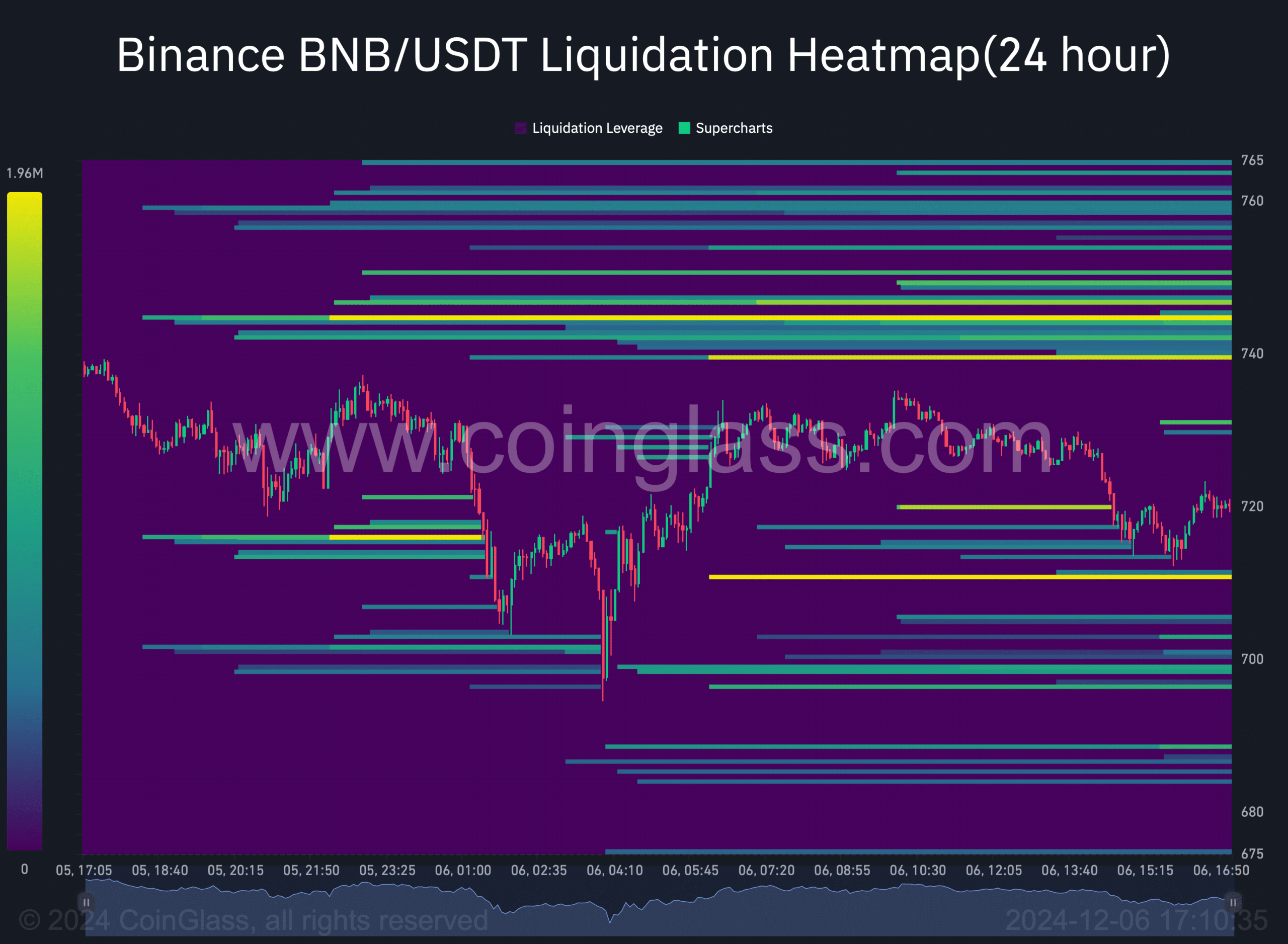

In case the coin’s price continues to decline, investors might witness the coin dropping to $710. However, if the bulls buckle up and lift the coin’s price up, it might touch $744 again. This was the case as BNB faces a strong liquidation barrier at that level.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Whenever liquidation rises, it often results in price corrections. Therefore, it will be crucial for BNB to go above that level in order to eye higher targets.