BNB GameFi space declines despite increased popularity – Exploring why

- BNB’s GameFi active users registered a decline, while overall users increased.

- Binance Coin’s price action continued to support the sellers and indicators were bearish.

BSC Daily, in its 26 February tweet, brought up Binance Coin’s [BNB] GameFi growth in 2023 and beyond. The tweet highlighted several potential BNB Chain GameFi projects and affirmed that the ecosystem was far from dead.

?Potential @BNBCHAIN #GameFi Projects in 2023?#BNB GameFi on blockchain has huge potential in 2023, with its innovative combination of Games & DeFi?

It offers unique opportunities for users to earn, invest & participate in a thriving virtual economy

Powered by @Chainplaygg pic.twitter.com/gm5cdIn9zM

— BSCDaily (@bsc_daily) February 26, 2023

Read Binance Coin’s [BNB] Price Prediction 2023-24

GameFi’s popularity was yet again established by DappRadar, as it showed that, despite being listed recently, PlayZap became one of the top 10 dApps on the BNB Chain. However, a look at the key metrics provided by Dune suggested that the reality might be different.

GameFi and NFT ecosystems declined

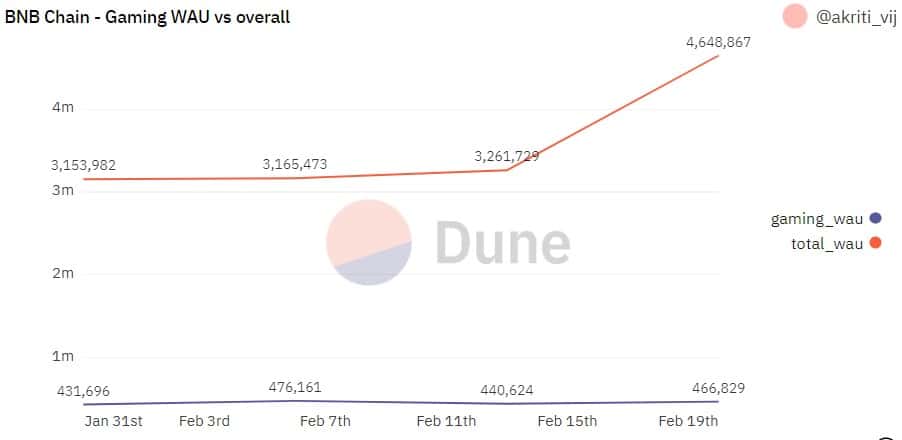

Asper Dune’s data, while Binance Coin’s overall active users continued to increase, the opposite for true for the chain GameFi space. BNB GameFi’s daily and weekly active users registered a decline in the past two weeks, which did not look good.

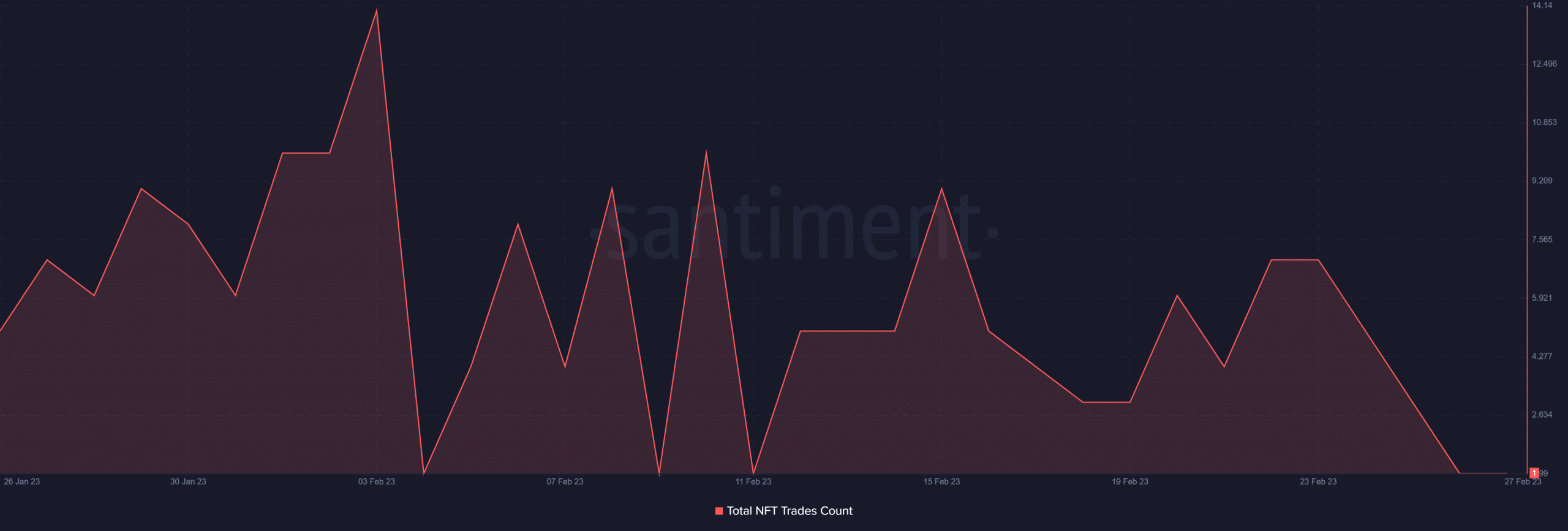

Another point of concern was the performance of the network’s NFT ecosystem, which plummeted over the last few months, alongside its monthly NFT trade volume. Santiment’s chart also highlighted that its total NFT trade counts also registered a downtick in the last 30 days.

Nonetheless, the multiple declines did not seem to have much of an effect on BNB. Token Terminal’s data showed a continuous increment in BNB Chain’s revenue, which was an encouraging development. Not only that, but the total number of transactions on the network also increased, suggesting more usage of the blockchain.

How is Binance Coin doing?

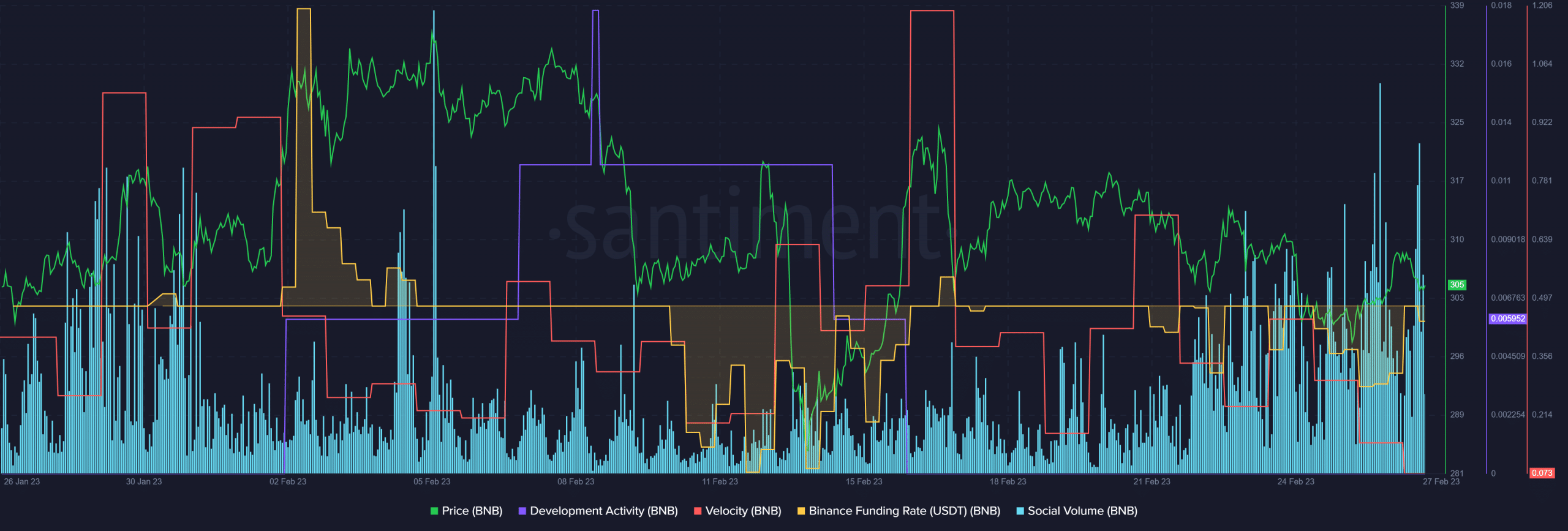

Though BNB was doing well in terms of active users and revenue, its on-chain performance was not the best. For instance, BNB’s development activity declined, which was a negative signal. The network’s velocity registered a spike in mid-February but later went down.

BNB also failed to remain in demand from the derivatives market as its Binance funding rate was relatively on the negative side. However, BNB’s popularity has increased lately, as was evident from the increased social volume.

Is your portfolio green? Check the Binance Coin Profit Calculator

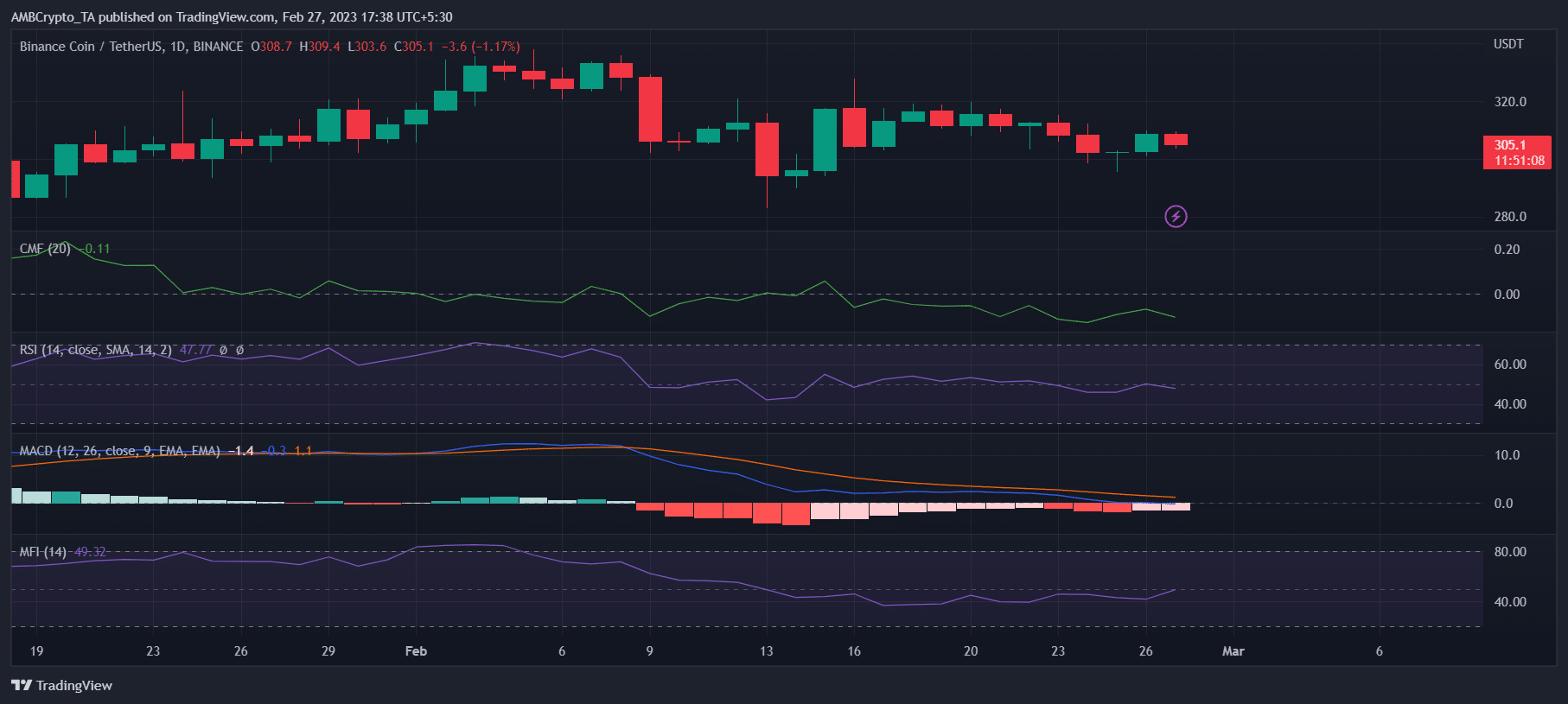

The negative metrics were also reflected in BNB’s price action, which was not in investors’ favor. According to CoinMarketCap, BNB’s price declined by 4% in the last week, and at press time, it was trading at $305.13 with a market capitalization of over $48 billion. Nonetheless, BNB’s price action went green in the last 24 hours, but the market indicators suggested that the bullish trend may not translate in the long term.

BNB’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered downticks and were resting below the neutral mark. The MACD’s data suggested that bears were leading the market, minimizing the chances of an uptrend. BNB’s Money Flow Index (MFI) was bullish, as it increased slightly.