BNB price doubles as Binance chain logs billions in transactions

- BNB chain led the way with one of the highest transactions in H1.

- The BNB price is almost double its value from what it was at the start of the year.

The Binance chain concluded the first half of the year with impressive activity, registering one of the highest numbers of transactions among blockchain networks. Additionally, the Total Value Locked (TVL) on the Binance Chain experienced a notable move during the same period.

Binance leads transaction trend

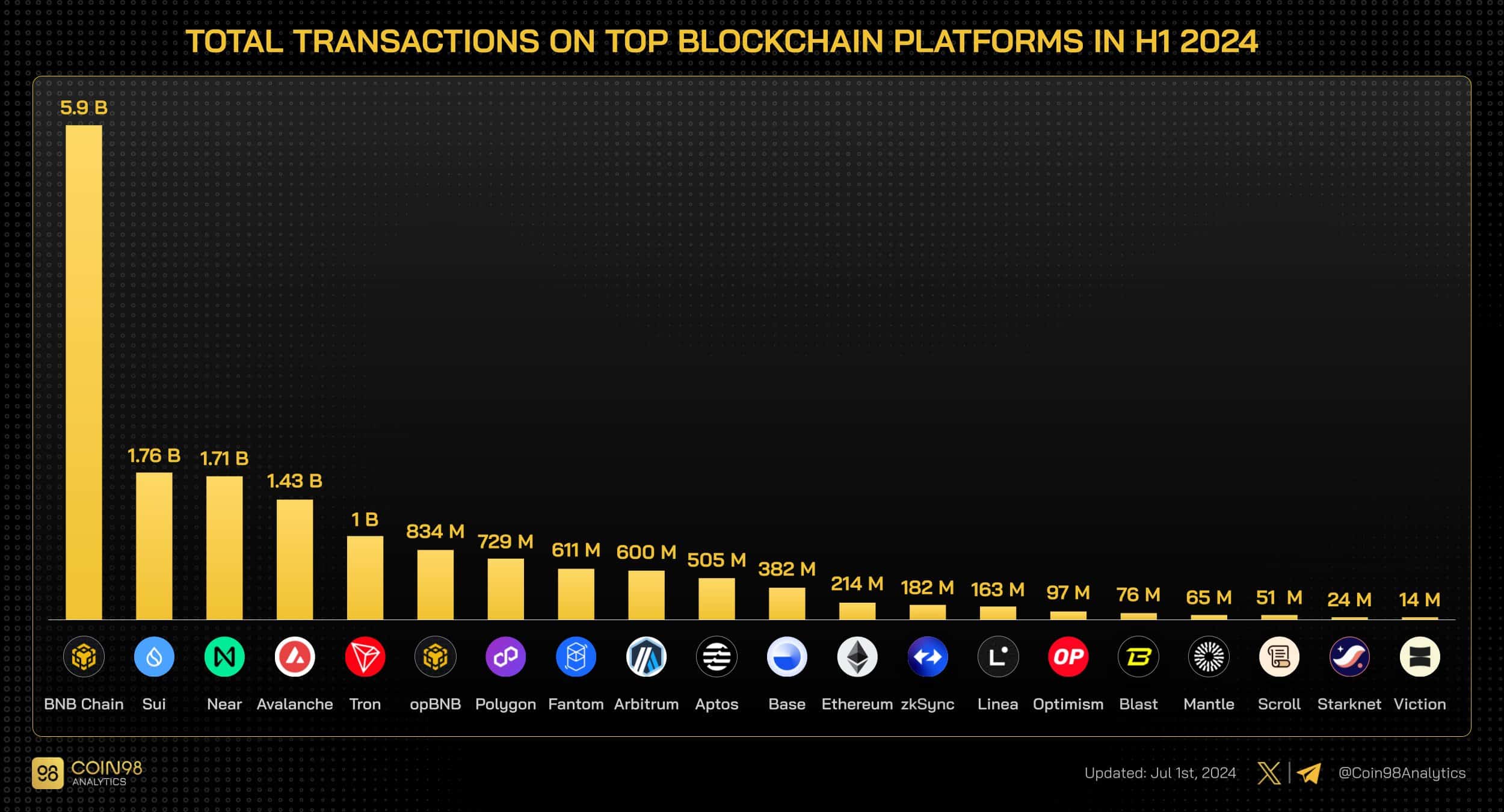

According to the latest data from Coin 98 Analytics, the Binance chain has had significant transaction activity in the first half of the year.

It secured the position of having the second-highest number of transactions among all blockchain networks. Although Solana led the chart, Binance Chain recorded nearly 6 billion transactions during this period.

This level of activity underscores the high usage of the chain and its dominance in the blockchain space. Impressively, the volume of transactions on the Binance Chain surpassed the combined total of the next four chains in the ranking.

This activity level also suggests strong network health and ongoing growth in user engagement, which are positive indicators for the network.

Binance sees remarkable TVL growth

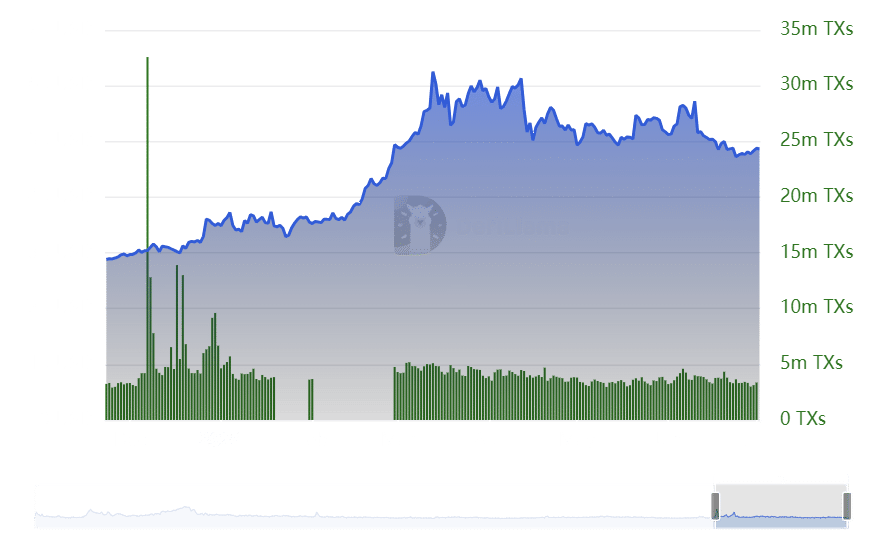

The analysis of the Total Value Locked (TVL) on the Binance chain, as reported by DeFiLlama, indicated substantial growth over the past few months.

Starting the year with a TVL of around $3.5 billion, the chain has exhibited a steady increase in value locked. As of this writing, its TVL was over $4.8 billion.

While still short of reaching its all-time high, this growth marked a significant improvement from the beginning of the year. It also reflected a robust accumulation of assets within its decentralized finance (DeFi) ecosystem.

Additionally, the transaction activity on the Binance Chain has remained consistently high. The data showed that daily transactions consistently stayed at over 3 million for most months.

As of this writing, the figures reached over 3.3 million transactions.

These trends in TVL and transaction volume suggest that the chain continues to attract and maintain significant capital and user engagement.

Improved price but declining trend

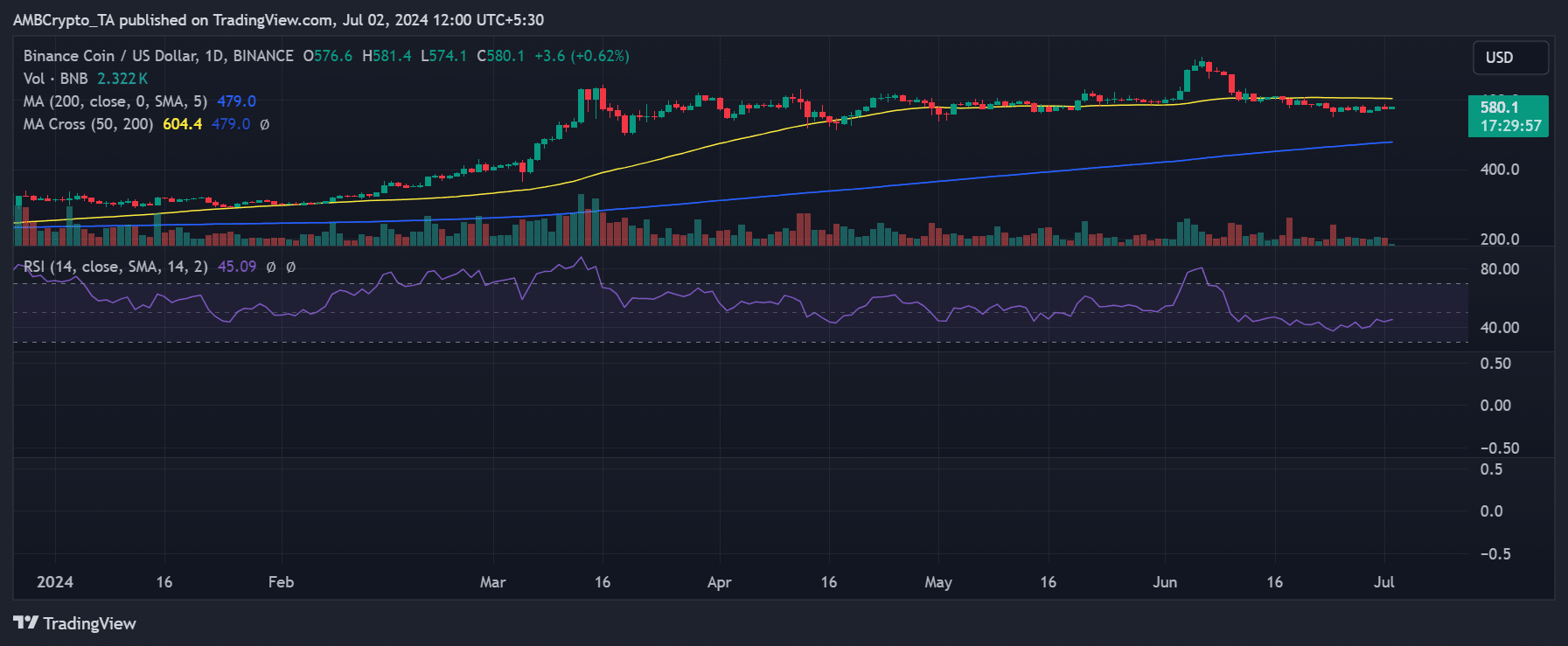

The analysis of the Binance Coin (BNB) price trend on a daily time frame chart revealed a notable increase in its value from the start of the year.

As of this writing, it was trading at around $580, slightly increasing by less than 1%. With the current price, BNB has almost doubled from its starting price of around $300 at the beginning of the year.

Is your portfolio green? Check out the Binance Profit Calculator

Despite this impressive price rise, the current market analysis suggests that BNB is on a bear trend, as indicated by its Relative Strength Index (RSI).

The RSI was below the neutral line of 50 as of this writing. This positioning signals that the overall momentum is bearish, potentially due to investors taking profits after the significant rise or broader market conditions affecting sentiment.