Here’s what ‘happy’ BNB sellers mean for the market

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

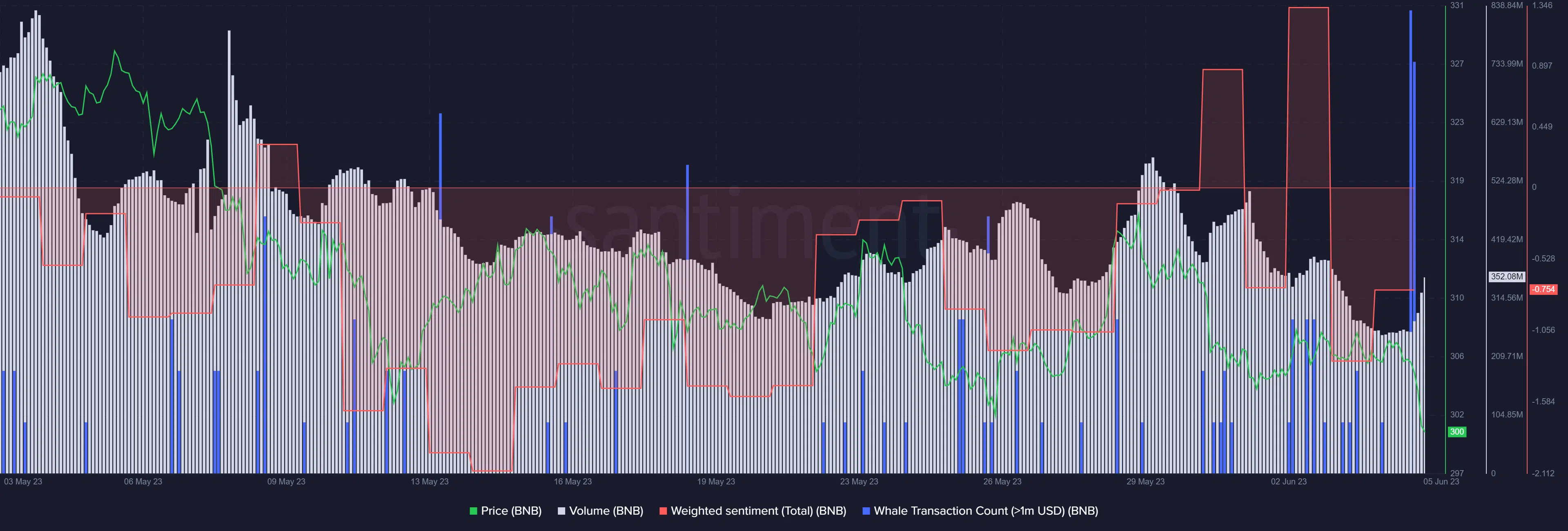

Binance Coin [BNB] sustained more losses after inflicting a bearish breakout over the weekend. It has been trading between $315.5 – $303 for the past three weeks. The weekend downswing followed Bitcoin’s [BTC] sharp drop from $27k to around $26.8k at press time.

A weak BTC means that sellers could continue to overrule BNB’s market, unless BTC changes course during the week.

When will bulls see reprieve?

Since mid-April, BNB has been in a downtrend momentum on the lower timeframe charts, specifically the 4-hour chart. The second half of May set BNB into an extended price consolidation within $315.5 – $303.

The short-range formation extended into early June, but sellers shredded the range low of $303 after BTC lost hold of $27k on 4 June. In addition, a trendline resistance stretches from mid-April, indicating BNB is yet to reverse its downtrend momentum.

With the higher timeframes also firmly bearish, sellers could continue to control BNB. Southwards, the $294 and $286 levels are worth watching if the $300 psychological and support level cracks.

Alternatively, bulls could regain a little leverage if BNB comes close above the range low of $303. However, they must clear the confluence area of the mid-range and trendline resistance near $309 to target the range high of $315.5. Such an upswing could be likely if BTC reclaims $27k and surges.

Meanwhile, RSI hit the oversold zone while OBV dipped, highlighting a considerable decline in buying pressure and demand.

Negative sentiment amidst whale actions

Is your portfolio green? Check out the BNB Profit Calculator

BNB recorded over 15 whale actions transacting >$1 million each between weekend and press time. Moreover, whale action coincided with BNB’s sharp drop from $307.8 to below $300, seen before press time.

Similarly, trading volume has declined significantly since the end of May, dropping from over $550 million to below $400 million at press time. Sentiment also registered fluctuations in the same period but was deep in the red at press time, denoting investors’ bearish outlook.