BNB set to surge to $900 IF two key breakthroughs occur

- Analyst predicted that if BNB can break through the current falling wedge and a significant resistance, it could reach a new peak.

- On-chain metrics, however, signal that these critical breaches necessary for a new ATH may be delayed.

While Binance Coin’s [BNB] price movement has recently slowed, showing a 1.34% decrease in price and a 10.78% decrease in trading volume, analysts interpret this lull as a common precursor to a forthcoming rally.

Additionally, AMBCrypto has discovered insights that could potentially stall BNB’s progress further.

BNB set for $900 rally, pending two key conditions

Crypto analyst Carl Runefelt anticipates that BNB could reach a new all-time high of $900, contingent on two major conditions as indicated by his analysis: overcoming the falling wedge and breaching a historic resistance line.

Of these conditions, one is reportedly close to being met. Runefelt expressed optimism, stating, “It’s only a matter of time before we break out of this 1W Falling Wedge!“

Once the historic resistance formed at previous all-time highs in 2021 and 2024 is surpassed, likely through substantial buying pressure, BNB faces no further obstacles trading to $900.

However, AMBCrypto has noted that the breakout from the wedge pattern and the challenge of the major resistance might experience slight delays.

Retail trader activity impacts BNB

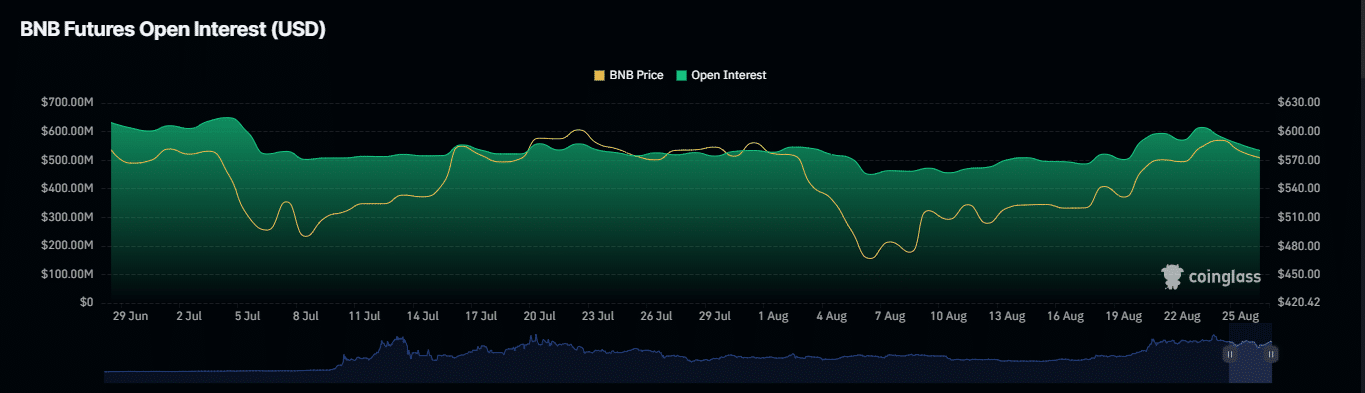

Some retail traders’ efforts to drive a bullish trend in BNB have diminished and countered, as evidenced by notable declines in both Open Interest (OI) and market liquidations unfavorable to long positions.

Open Interest, representing the total number of unsettled derivative contracts on BNB, has seen a downturn. Currently, futures and options OI over the past 24 hours are down by 4.90% and 54.68%, respectively.

A continuous negative trend in OI suggests traders are closing positions, which could lead to decreased market liquidity and a potential weakening of current price trends.

Additionally, BNB liquidations have not been favorable for long traders. In the past 24 hours, $340 thousand has been liquidated from the market, with long positions accounting for $272.21 thousand of that total.

This pattern indicates strong selling pressure and negative market sentiment. If sustained, it could further depress BNB prices.

Falling TVL on BSC Network, yet optimism persists

The total value locked (TVL) on the Binance Smart Chain (BSC) network, where BNB is native, has decreased from $4.616 billion on August 24th to $4.533 billion at press time.

TVL measures the total assets deposited in decentralized finance (DeFi) protocols and reflects the overall health and adoption of DeFi projects.

A decline in TVL, as observed with BNB, indicates that more assets are being withdrawn from DeFi protocols, suggesting an increase in selling pressure and concurrent price drops.

Realistic or not, here BNB’s market cap in BTC’s terms

Despite the short-term challenges, a broader view reveals a positive trend; since August 5th, the TVL has steadily risen, adding nearly $1 billion.

This upward trajectory provides a glimmer of hope and suggests that the BNB price may be set for a rally, potentially overcoming major obstacles in the near term.