BNB steady after a 7% plunge – bulls must now handle this fresh hurdle

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BNB could oscillate in a range in the next few hours/days.

- Short-term holders saw a sharp decline in profits after Tuesday’s sudden drop.

Bitcoin [BTC] dropped from $23k to below $22.5k on Tuesday, pulling the altcoin market into a short-term plunge. Binance Coin [BNB] declined by 9% in the same period, dropping from $323 to $293.

Read Binance Coin’s [BNB] Price Prediction 2023-24

However, bulls found steady support of around $297 and launched a price recovery. At press time, BNB’s value was $303.6o and could oscillate in the range below for the next few hours/days.

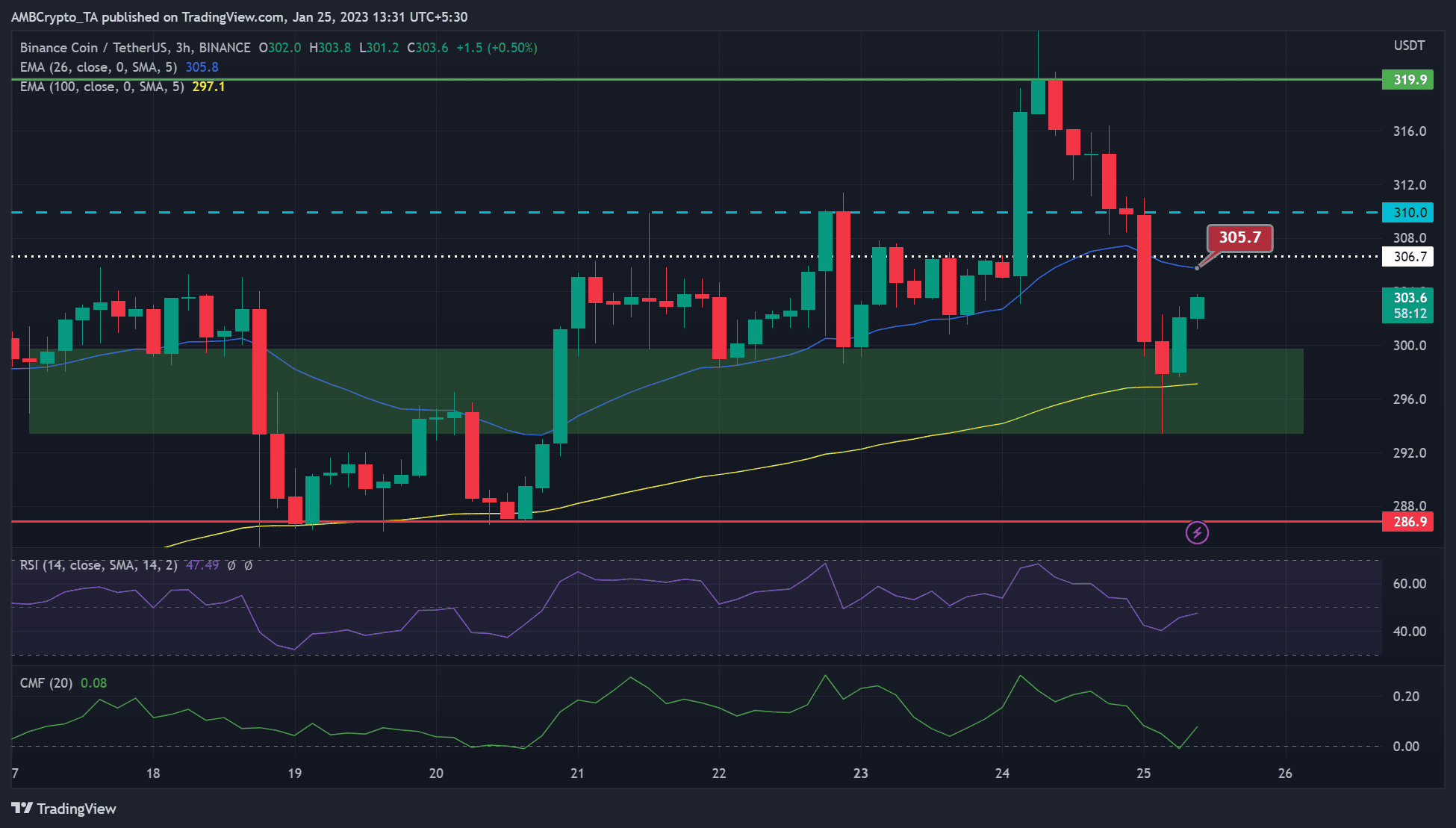

BNB remained steady at the $300 – $310 range

On the three-hour chart, the Relative Strength Index (RSI) rebounded from the 40 level and showed that buying pressure increased after dropping to the 40-mark.

In addition, the Chaikin Money Flow (CMF) was rejected at the zero mark, forcing it into an uptick on the positive side, which indicated that the BNB market was strengthening.

Therefore, BNB could oscillate between the demand zone ($293 – $300) and $310 in the next couple of hours. BNB has traded within this range since 21 January, only to witness a false breakout on 24 January. A retest of the $319 could also be likely if BTC reclaims the $23k zone.

However, BNB could drop below the demand zone if BTC breaks below $22.5k, invalidating the bias described above. But such a drop could settle on the 100-period EMA (exponential moving average) or $286.9 level.

Swing traders should therefore track RSI rejection at the 50-mark, CMF crossover, and BTC price action to minimize risk exposure.

Short-term holders’ profits tanked and sentiment flipped into negative

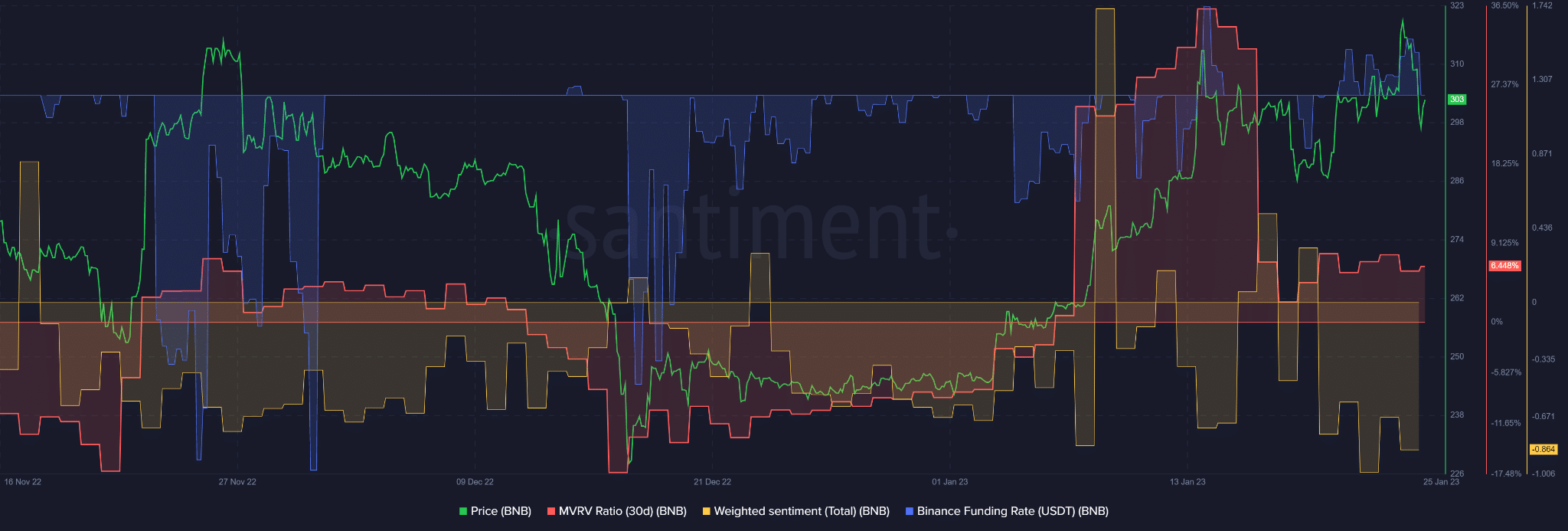

According to Santiment, BNB’s 30-day MVRV (market value to realized value) dropped from 36% to 6% at press time. Short-term holders’ profit tanked by 30% as BNB’s price correction wiped out recent gains.

How much are 1,10,100 BNBs worth today?

The price decline was also followed by an elevated negative weighted sentiment and a drop in demand in the derivatives market, as evidenced by the drop in the Funding Rate. However, the Funding Rate rested on the neutral line and any increment could boost BNB’s recovery.

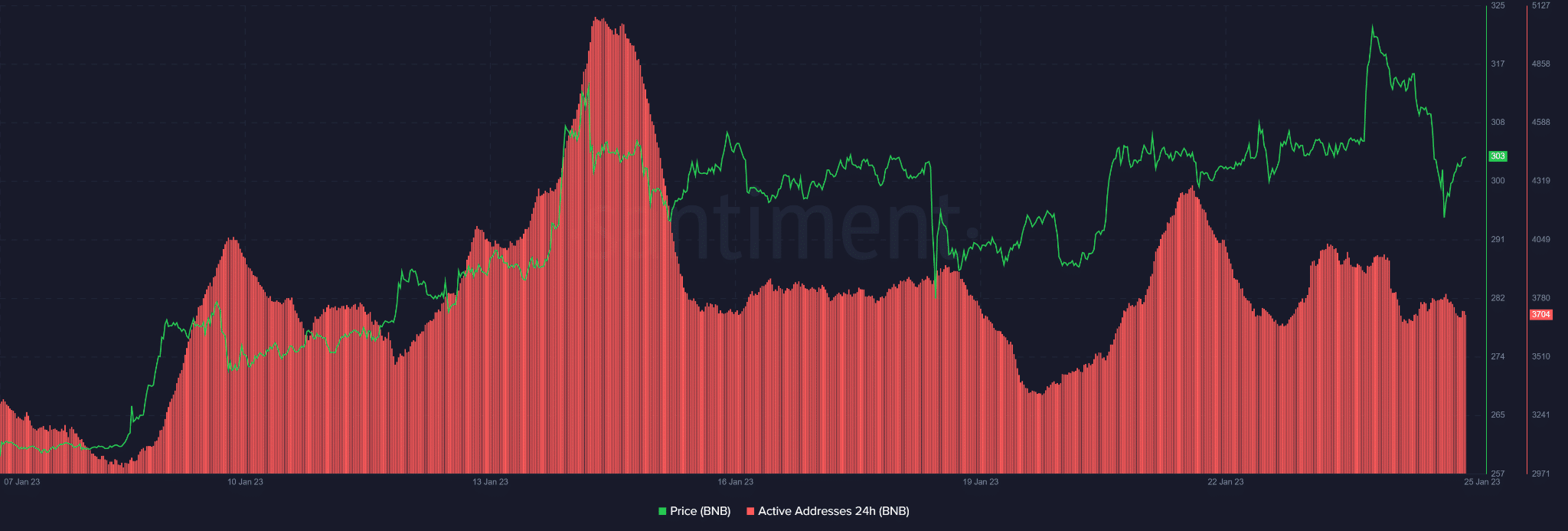

Alternatively, a further drop in the Funding Rate could set BNB to retest the demand zone below $300. Moreover, the active address in the past 24 hours also dropped, but there was a slight uptick at press time. Any further increase in active addresses could boost the recovery momentum.