BNB to $700? Here’s why it’s possible and here’s why it’s not

- Altcoin’s price moved from $593 to $607 after the Open Interest added almost $100 million

- Momentum seemed bullish, indicating that the price could climb close to $700

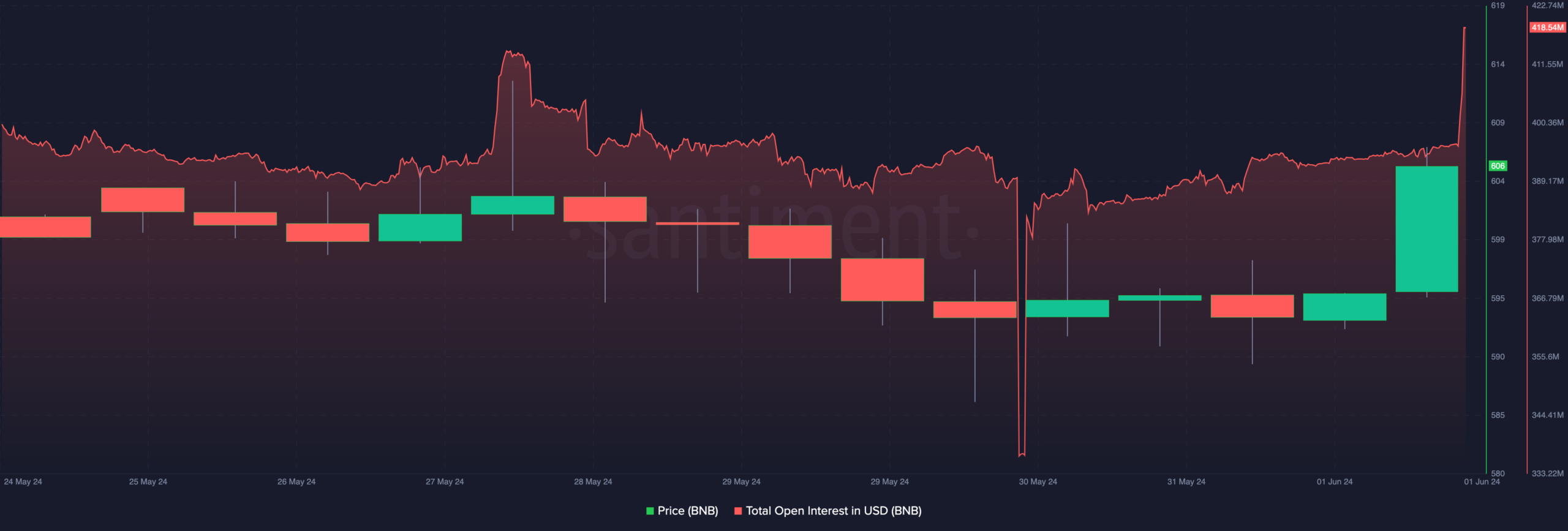

Despite registering a lower value a few days back, Binance Coin’s [BNB] Open Interest (OI) has risen. On 30 May, for instance, the OI was down to $335 million on the charts.

However, press time data obtained from Santiment revealed that the metric soon climbed to $418.54 million. Here, Open Interest is a sign of whether more money is flowing into contracts related to a cryptocurrency or not.

The “god candle” appears

Whenever the OI increases, it means that traders are adding liquidity to the market. However, a decline in OI suggests increased position closure and an exit of liquidity from the market.

For BNB, it was the former. A rising OI could serve as a strength for the price action. At press time, BNB’s price was $607.57.

Here, it’s worth noting that according to AMBCrypto’s analysis, the candlestick that led the price higher was a “god candle.”

In crypto-terms, a god candle is a too-good-to-be-true price hike that occurs within a short period. From the chart attached herein, one can clearly observe that BNB’s price was $593, a few hours before this incredible surge.

This surge was proof that rising interest in the coin has been backing the uptrend. Also, the last time BNB made such a move, the price of the token rallied to $641.

If bears reject the uptrend, the price could retrace as low as $585. However, if bulls break past the overhead resistance, the value of the coin could rally towards $686, as AMBCrypto predicted.

Negative sentiment can’t stop the move

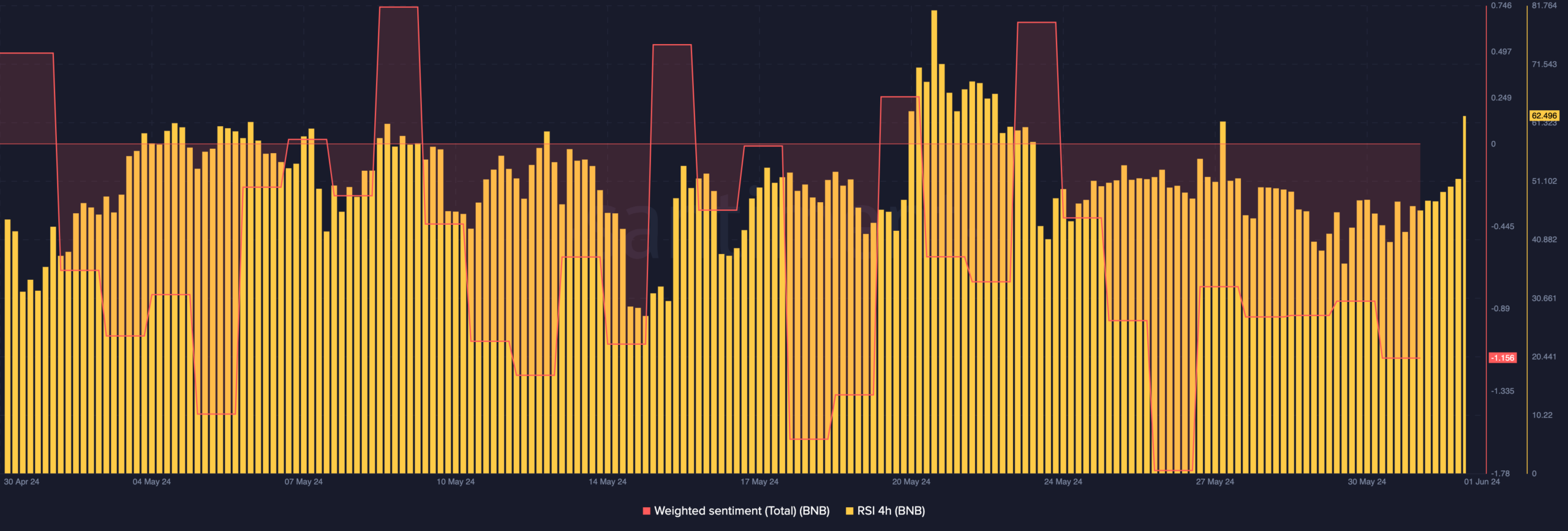

It’s also worth looking at the Weighted Sentiment around BNB. At the time of writing, the sentiment was down to -1.156, indicating that most comments about BNB were negative.

However, a further hike in BNB’s price could change the perception of the coin. And, once the sentiment started to become bullish, demand might hike too. In this case, the bullish price prediction could be validated.

Another indicator AMBCrypto examined was the Relative Strength Index (RSI).

The RSI tracks the momentum of a cryptocurrency. If the reading is at 30 or below, it means that the crypto is oversold. However, a reading of 70 or above indicates an overbought condition.

At press time, BNB’s RSI on the 4-hour chart was 62.49. This reading implied that buying momentum in the market increased.

If the momentum continues to move upward, then BNB’s price might follow. However, if the momentum slows down, the value of the coin might not get close to $700. Instead, it could slip below $600.

Realistic or not, here’s BNB’s market cap in BTC terms

By the look of things, traders might continue to open more BNB contracts. Going by the price action, most positions could tilt towards the long side. If this is the case and the price rises, longs might be rewarded soon.