BNB’s Beacon Chain experiences a temporary halt; here is the aftermath

BNB’s Beacon Chain experiences a temporary halt, and this is how BNB reacted

- BNB’s Beacon Chain witnessed a temporary halt that lasted for about 30 minutes.

- Negative sentiments around BNB dominated the market, and indicators looked bearish.

BNB Chain’s [BNB] Beacon Chain testnet witnessed a temporary halt on 26 April, 2023. As per the official tweet, the Beacon Chain testnet experienced a halt for approximately 30 minutes due to an unmarshal error. However, the issue was fixed quickly by developers.

The BNB Beacon Chain Testnet experienced a temporary halt today for approximately 30 minutes due to an unmarshal error.

Our team swiftly resolved the issue, and we're happy to report that there was no loss of data or funds on our Beacon Chain testnet. https://t.co/TdYSd8AvFG

— BNB Chain (@BNBCHAIN) April 26, 2023

Is your portfolio green? Check the BNB Profit Calculator

A glance at the BNB Beacon Chain

For starters, Beacon Chain is a blockchain developed by its community that implements the staking and governance layer of the BNB ecosystem. The chain uses Tendermint for consensus, and app logic is built upon the Cosmos SDK, which targets fast block times and others.

Interestingly, a few weeks ago, the BNB Smart Chain performed the ‘Plank’ hard fork. As part of the security upgrades, the hard fork strengthened the cross-chain bridge between the Beacon Chain and the Smart Chain by adding a number of features.

As of now, the Beacon Chain has processed a total of over 2 million transactions and has over 90,000 addresses.

Did the halt affect the BNB Chain?

The latest halt did not seem to have any impact on BNB Chain’s metrics, which was a positive signal. On the contrary, growth was noted on a few fronts.

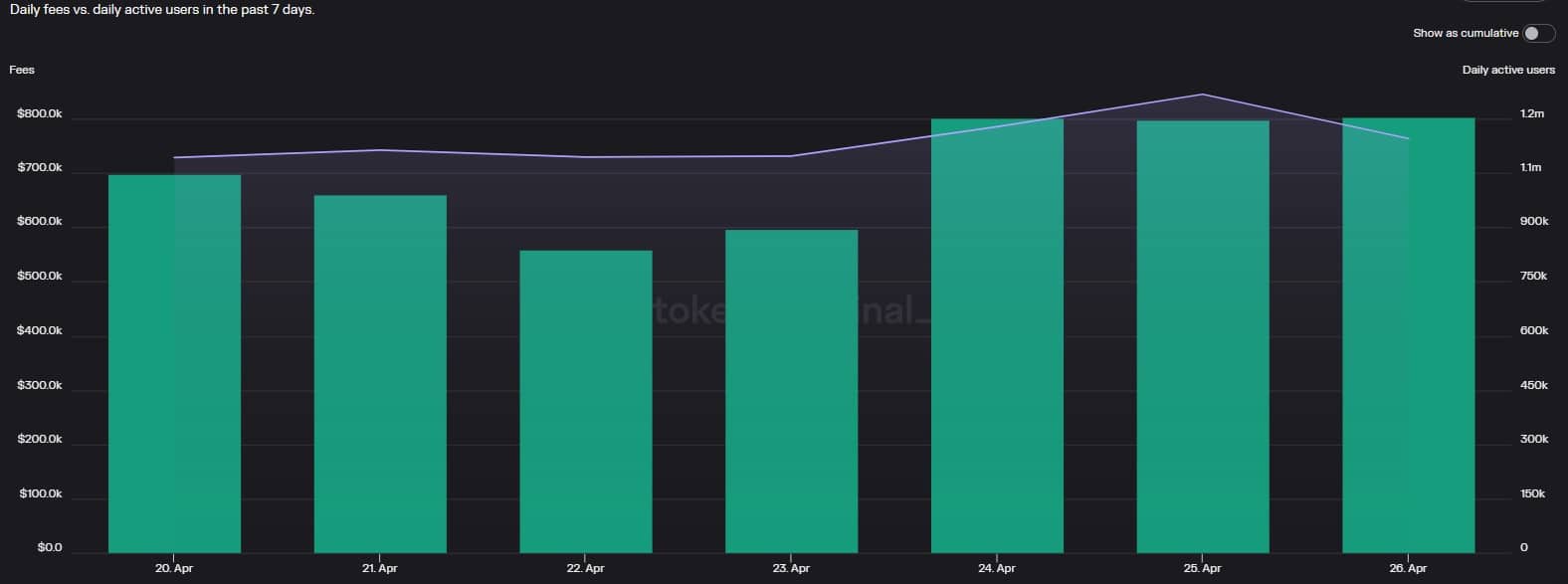

Token Terminal’s data revealed that BNB’s daily active addresses and fees increased slightly in the last few days, suggesting higher usage of the network.

BNB goes down

Though BNB Chain’s stats remained unaffected, BNB, on the other hand, registered a decline in its price. According to CoinMarketCap, BNB was down by 2% in the last 24 hours at press time. But the decline can’t be directly attributed to the halt as other factors might have been at play.

For instance, BNB’s Binance funding rate was down substantially, reflecting decreased demand in the derivatives market. The crypto community’s confidence in BNB was low, as evident from the spike in its negative sentiment.

The whale transaction count also went down, which indicated less interest from the big players in BNB.

How much are 1,10,100 BNBs worth today

BNB might struggle to climb up the price ladder

A look at BNB’s daily chart revealed that the chances of a further price decline were high. The MACD displayed a bearish crossover. BNB’s Relative Strength Index (RSI) was hovering under the neutral mark of 50, which was an update in the sellers’ favor.

The Chaikin Money Flow (CMF) also registered a decline, further suggesting a southbound price movement in the near term. At press time, BNB was trading at $330.78 with a market capitalization of over $51 billion.