Bonk

BONK declines 30% as profit-taking intensifies – Key levels to watch for bulls

Whales were net negative on Binance exchange after clearing their long BONK positions and taking profit.

- BONK shed nearly 30% after hitting a new all-time.

- Whales led the profit-taking and cleared their long positions; will recovery be delayed?

Memecoins were top weekly losers during the past week, as large and mid-cap altcoins took center stage amid renewed altcoin season calls. Bonk [BONK] led the top losers as profit-taking intensified after reaching a new high of $0.000062.

As of this writing, BONK was down 29% from its new all-time high. While this could be a larger trend of capital rotation, here are key levels bulls could track.

Evaluating BONK’s pullback

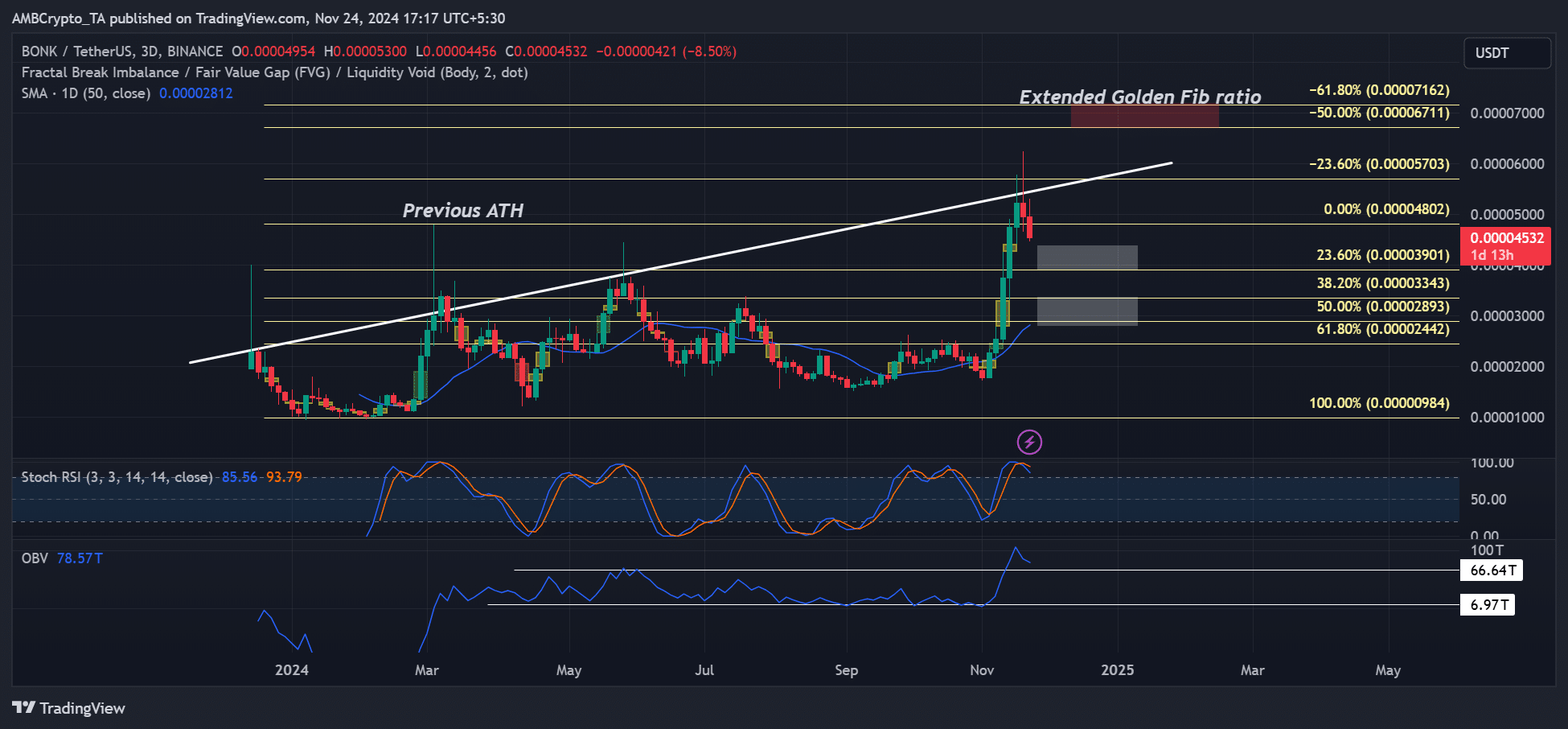

Although the new ATH was slightly short of hitting the extended golden Fibonacci ratio (around -61.8%), the level can be overruled as the next bullish target in case of an upswing after the pullback.

That said, the uptrend left key price imbalances at two white zones (fair value gaps FVG). The immediate price imbalance level was above 23.60% Fib, while the second was at 50% Fib.

The latter also coincided with the 50-day SMA (Simple Moving Average), suggesting it could be stronger support if the pullback dropped below $0.000039. So, if the bull momentum continues, these could act as key re-entry points for bulls.

Given the elevated and oversold Stochastic RSI, BONK could still be primed for an extra pullback if short sellers extended profit taking.

Demand tanked

In the first half of November, spot market demand (rising spot Cumulative Volume Delta—CVD) drove the rally, which was later picked up by the Futures market (surge in Open Interest).

However, demand in both the Futures and spot markets tanked, as shown by south-bound movement on OI and spot CVD.

This could further complicate a strong recovery unless the meme coin narrative reclaims dominance again.

Another bearish indicator was whale de-risking. Whales on the Binance exchange have been steadily clearing the long positions since mid-November, as shown by the negative reading on Whale vs. Retail Delta.

Read Bonk [BONK] Price Prediction 2024-2025

Historically, reduced large players have led to muted or price consolidation. This could hit BONK in the short term.

For a likely price reversal, traders can track the critical levels alongside potential whale re-entry, which could signal likely recovery for BONK.