BONK news today: Token burn proposal bumps the memecoin by 23%

- On-chain data showcased the community’s bullish sentiment toward BONK following the news

- The price might consolidate for some time, however, an approval could drive BONK higher.

Bonk’s [BONK] price jumped from $0.000021 to $0.0000026 in less than 24 hours between the 8th and the 9th of June. This happened after the news that Bonk DAO planned to burn another set of tokens.

DAO stands for Decentralized Autonomous Organization. On the 8th, it disclosed that it received a proposal to burn 84 billion tokens.

Token burns occur when a project intentionally removes a certain number of tokens from circulation.

This process typically involves sending tokens to public wallets, where they cannot be retrieved or accessed. However, this was not the first time BONK burned tokens.

The key to higher prices?

In April, the team behind the meme coin burned 278 billion tokens after getting a 99.99% approval from its community.

After doing that, the price of the cryptocurrency went from $0.000014 to $0.000041 in less than six weeks.

Though this time, the community has not yet approved, as they would have six days to vote on the proposal. DAO’s statement read that,

“BONK DAO is proposing a BURN of 83,917,950,070 BONK from its Treasury representing 100% of the BONK earned by BONK DAO from its revenue sharing agreement with BONKBot in Q2.”

If given the green light, the memecoin’s price might mirror the previous performance. Should that be the case, the value could revisit its all-time high.

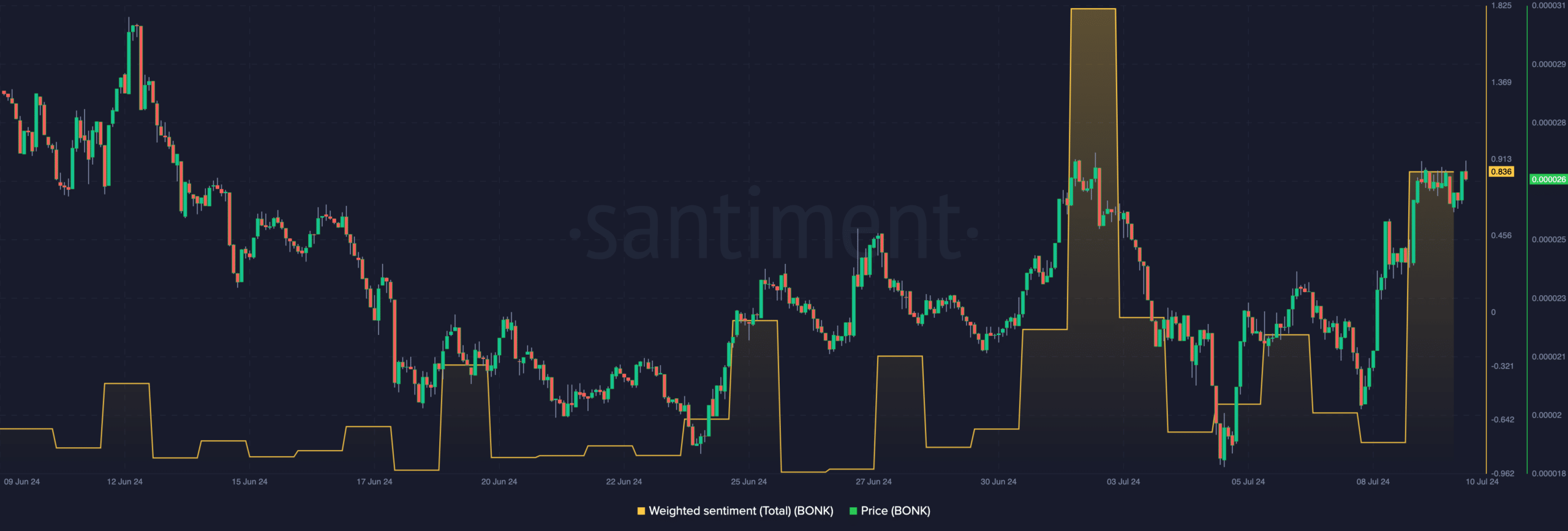

Following the development, the Weighted Sentiment spiked. Weighted Sentiment shows if the comments online about a project are positive or negative on average.

If the reading is positive, it means that broader perception is bullish. But a negative rating implies that market participants are not convinced about a good price action in the short term.

BONK slows down, but it’s not the end

At press time, the sentiment reading was 0.836, aligning with the first interpretation. Should this continue, demand for the cryptocurrency might increase. Eventually, it could also lead to an additional price increase.

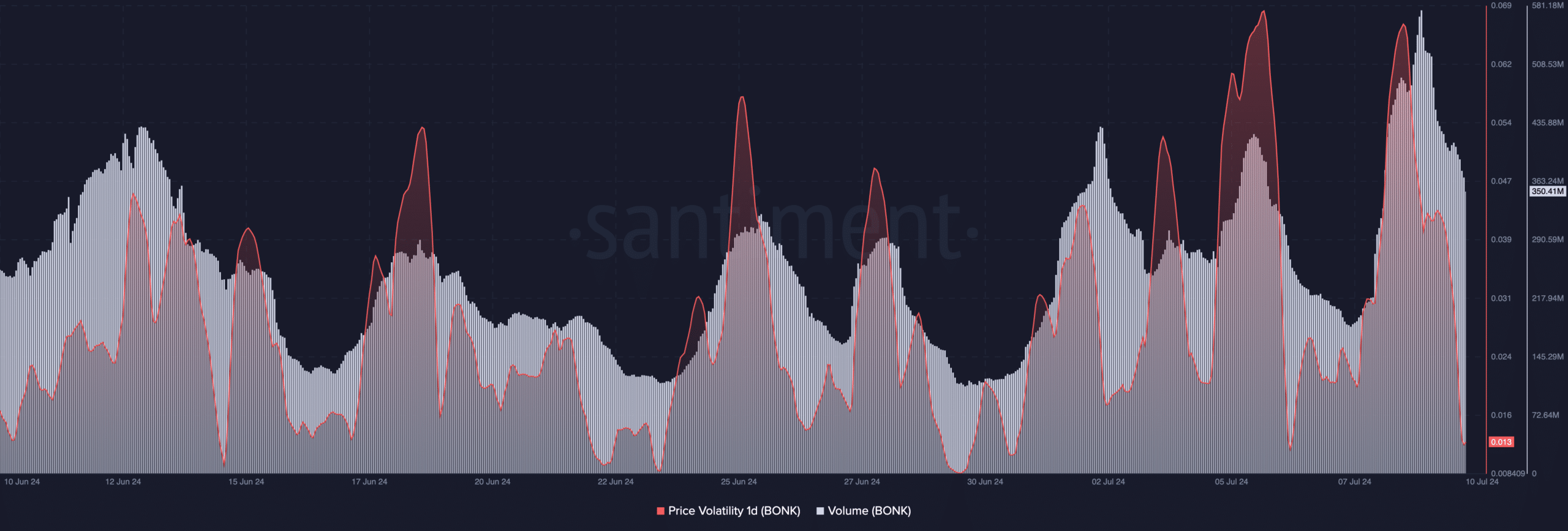

However, in terms of volatility, AMBCrypto observed that it dropped. Volatility shows how fast price can rise or fall. If high, the metric can cause price to jump within a short period as long as buying pressure is present.

Also, if selling pressure is intense with high volatility, prices can drop very fast. For BONK, the low volatility implies that the price might keep moving sideways until a breakout occurs.

The volume also gave a similar signal. Initially, BONK’s volume rose to $580.18 million. But at press time, it was down to $350.41 million, meaning that interest in the memecoin was waning.

Realistic or not, here’s BONK’s market cap in DOGE terms

Considering the fall in volume and rise in price, the uptrend might become weak for the time being.

However, if Bonk’s community grant the DAO the go-ahead after the voting process, the price might replicate the kind of move it made in April.