BONK on the brink: Will it skyrocket this week? What you need to know!

- BONK price surged by 8% in 48 hours after retesting a key support level.

- Short-term momentum is bullish but wedge pattern suggests caution.

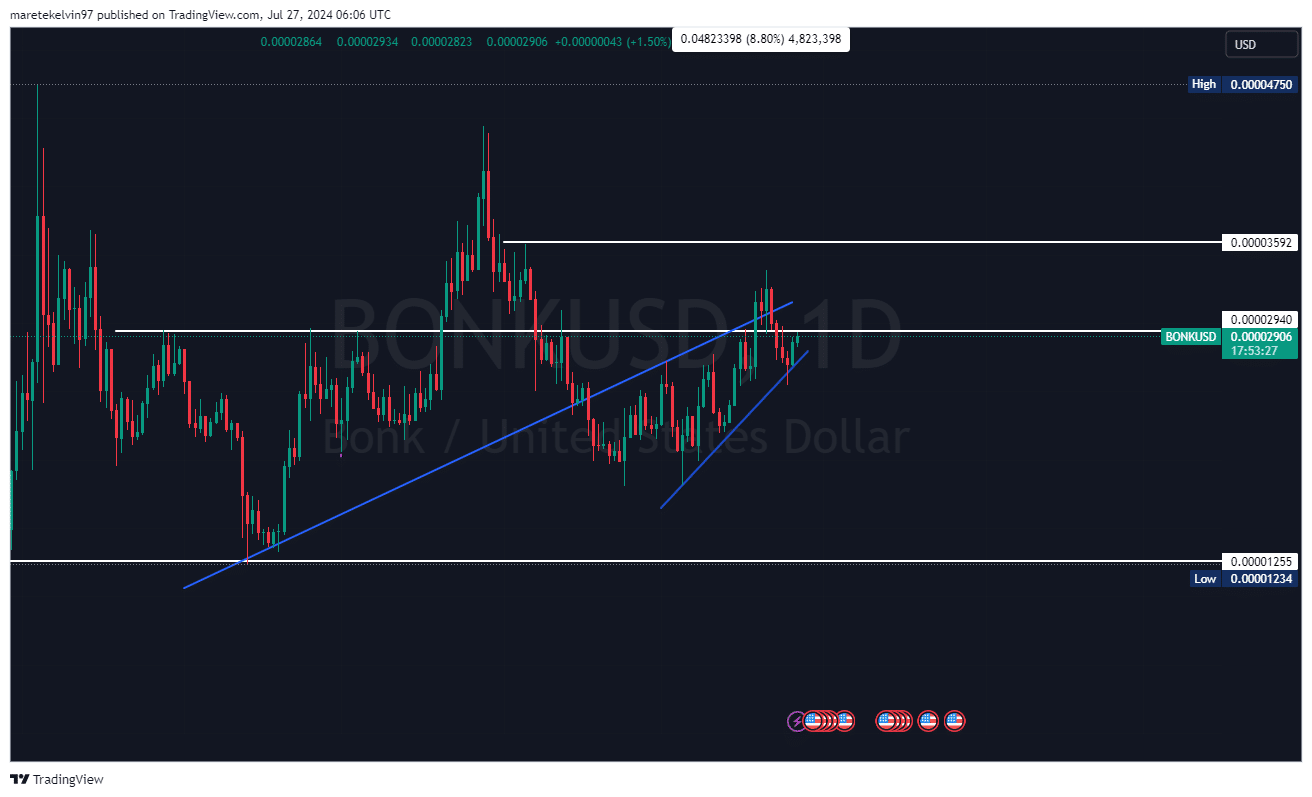

BONK was consolidating within a rising wedge pattern recently, a formation that often precedes a breakout. At press time, BONK price was trading at $0.00002906 after surging by 8% since retesting the wedge 48 hours ago.

The rising wedge support level provides a launchpad for BONK to build its current bullish rally. The prices bounced at $0.00002823 after a 23% sudden dip. The next resistance level to watch is the $0.00003592 resistance level.

Currently, BONK is testing a key level of $0.00002940. This level acted a strong resistance zone before being invalidated recently on 19th July.

A potential breakout above this level suggests a bullish rally to the next resistance level at $0.00003592.

Volume and liquidations paint a mixed picture

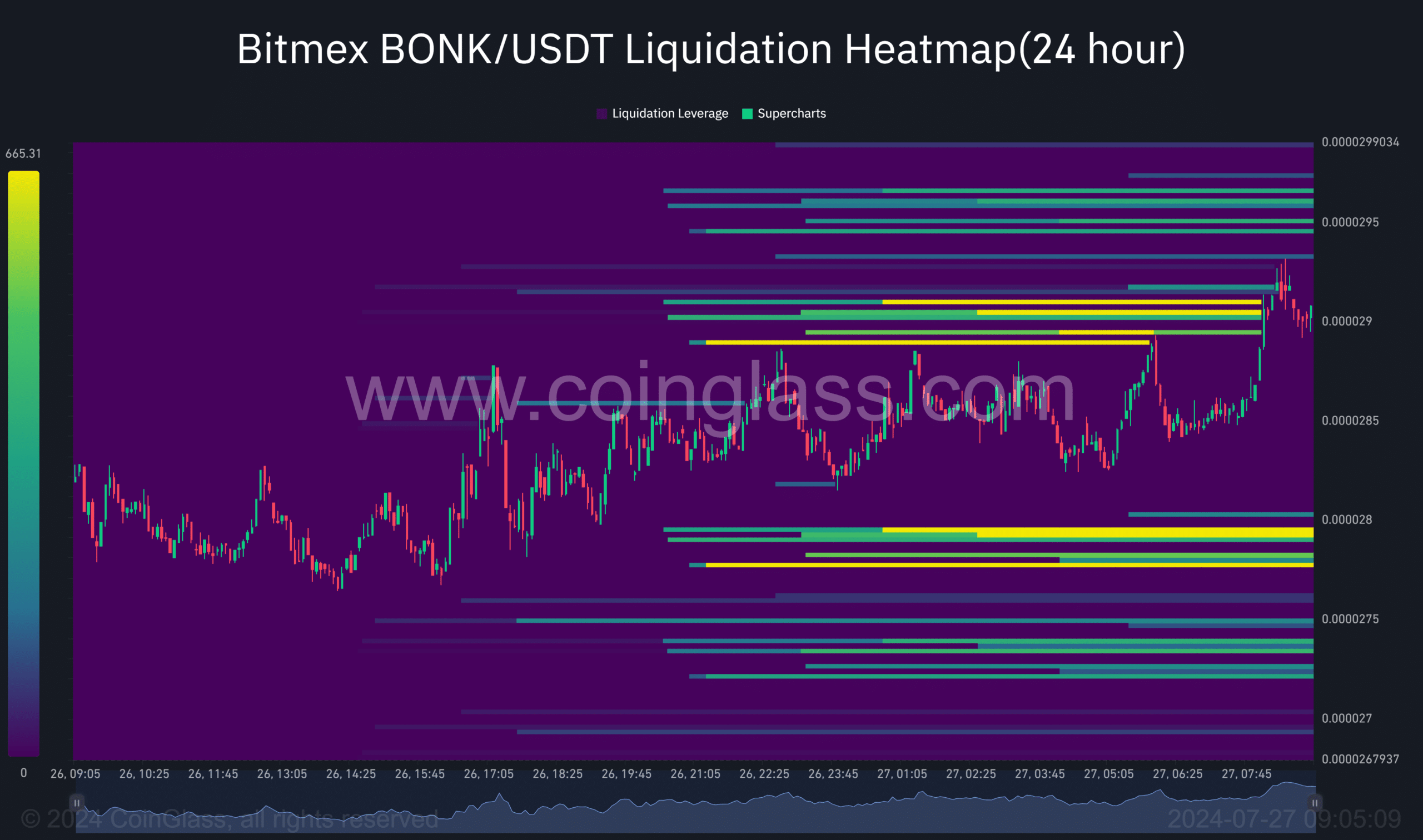

AMBCrypto’s analysis of Bitmex liquidation heatmap, based on Coinglass data, indicates that the majority of trading liquidations are located around these price levels.

This proves that many investors have positioned their stop-loss orders at these levels, a fact that might increase market volatility.

This increase in BONK’s liquidations, especially short positions, probably contributed to some of the upward price movement.

AMBCrypto goes on to provide further clarification of the open interest-weighted funding rate data and its significance in market sentiments. According to the Coinglass data, the funding rate has been strongly volatile for two months.

Currently, the funding rate is at an equilibrium level of zero, indicating neutral market sentiment in terms of the funding rate.

Realistic or not, here’s BONK’s market cap in BTC’s terms

What’s next for BONK?

Given the existing technical outlook, Bonk’s price was a critical point. The rising wedge pattern is a bearish indicator that can imply a lower breakout.

However, it might be invalidated as a bearish pattern if BONK breaks beyond the rising wedge resistance level and shifts to a bullish breakout. The sharp 8% rise from support levels demonstrates strong short-term buying pressure.