BONK poised for 240% rally? What key data suggests

- BONK’s Open Interest skyrocketed by 35%, indicating notable interest from traders.

- BONK’s Long/Short ratio stood at 1.002, indicating bullish sentiment.

Bonk [BONK], the popular Solana [SOL]-based memecoin, has gained significant attention from crypto enthusiasts after achieving an impressive 132% upside momentum over the past few days.

Despite this notable rally, the memecoin has formed a strong bullish price action pattern, indicating a potential buying opportunity and an upcoming price increase in the coming day.

BONK’s bullish outlook

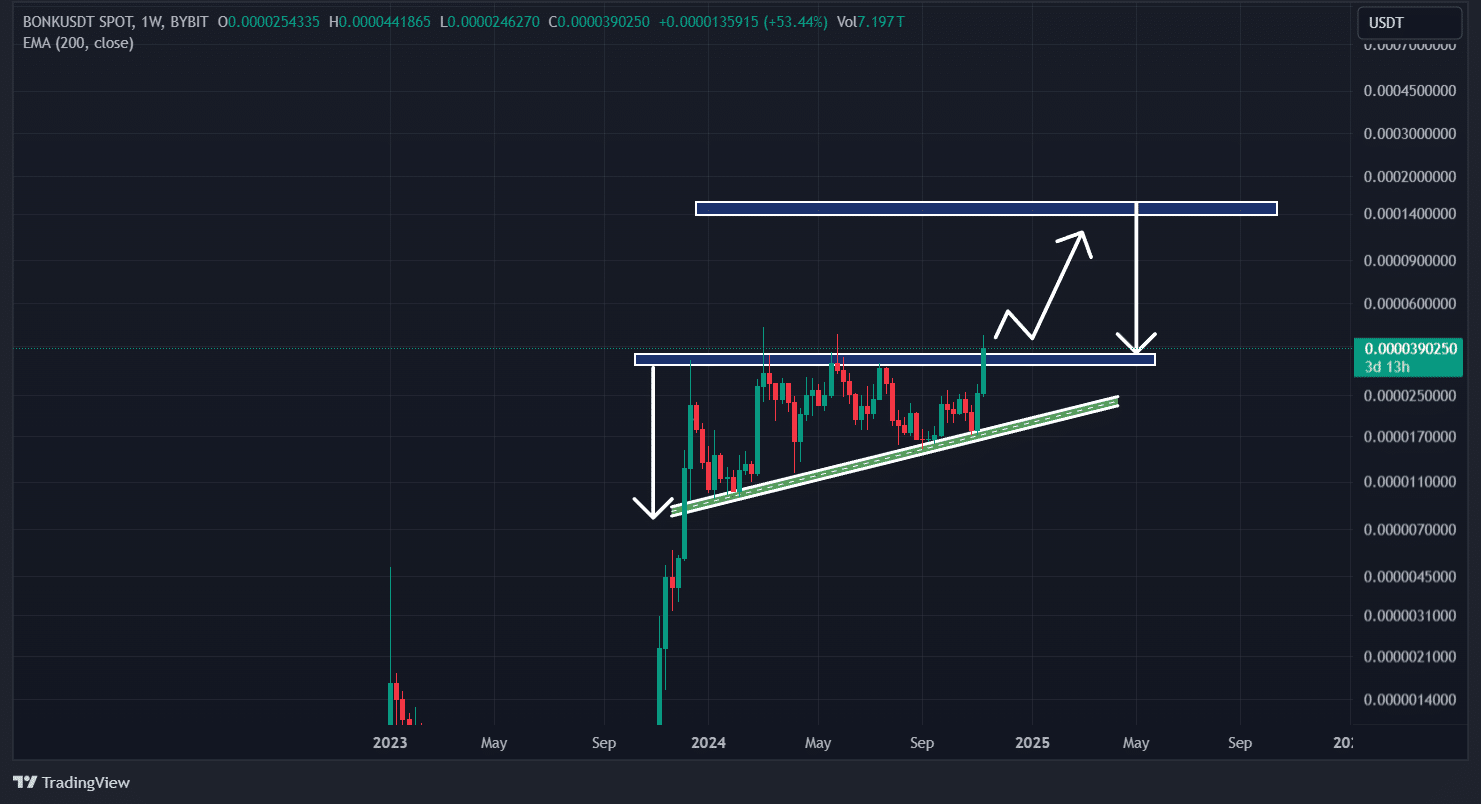

According to AMBCrypto’s technical analysis, BONK appeared bullish press time, breaking out of an ascending triangle pattern on the weekly time frame.

Based on recent price action and historical momentum, if the memecoin closes a weekly candle above the $0.000040 level, BONK could surge by 240% to reach the $0.00014 level soon.

However, achieving such a rally will not be easy for BONK. If market sentiment remains positive, the memecoin could reach the predicted level.

Bullish on-chain metrics

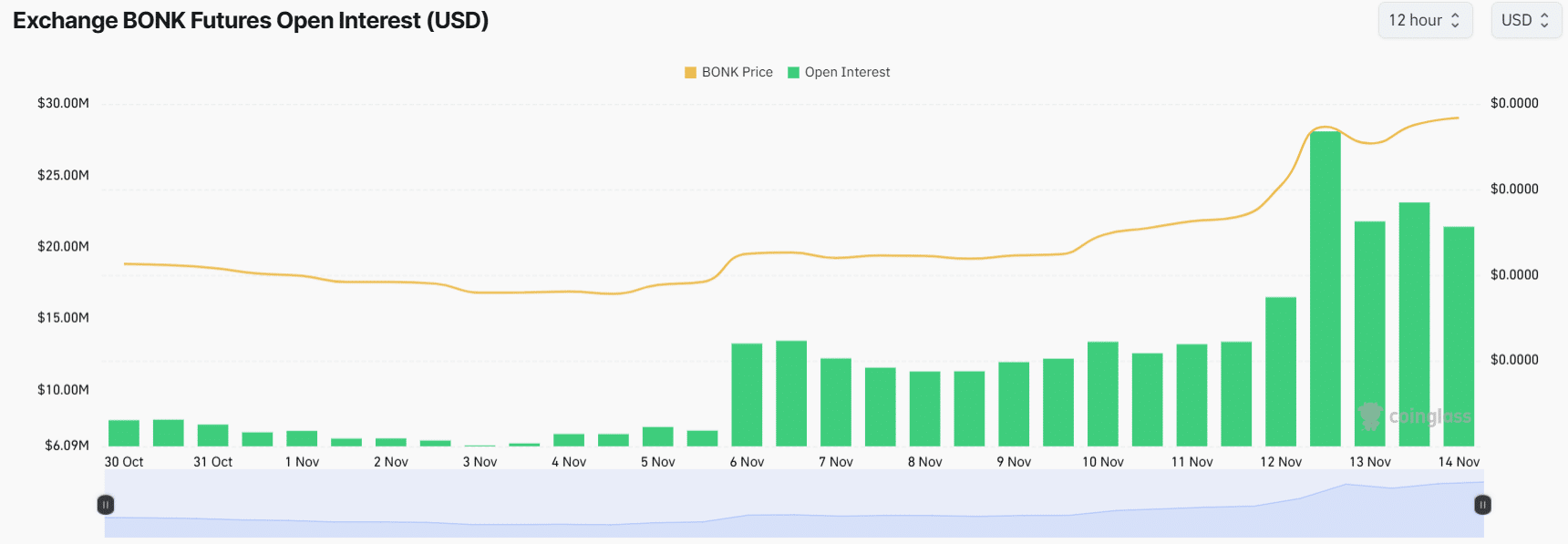

On-chain metrics further supported a positive outlook for the memecoin. According to the on-chain analytics firm Coinglass, BONK’s Long/Short ratio was at 1.002 at press time, indicating bullish sentiment.

Additionally, its Futures Open Interest surged by 35% in the past 24 hours and 14% in the past four hours.

This growing OI suggested notable interest from traders, as their open positions have significantly increased following the breakout of the bullish price action pattern.

The combination of these on-chain metrics with technical analysis suggested that bulls were stronger than bears and could support a significant rally for BONK in the coming days.

Read Bonk’s [BONK] Price Prediction 2024, 2025

Current price momentum

At press time, BONK was trading near $0.000040, after experiencing a price surge of over 25% in the past 24 hours.

During the same period, its trading volume increased by 30%, indicating heightened participation from traders amid the bullish price action pattern.