BONK price prediction: Is the memecoin preparing for a major move?

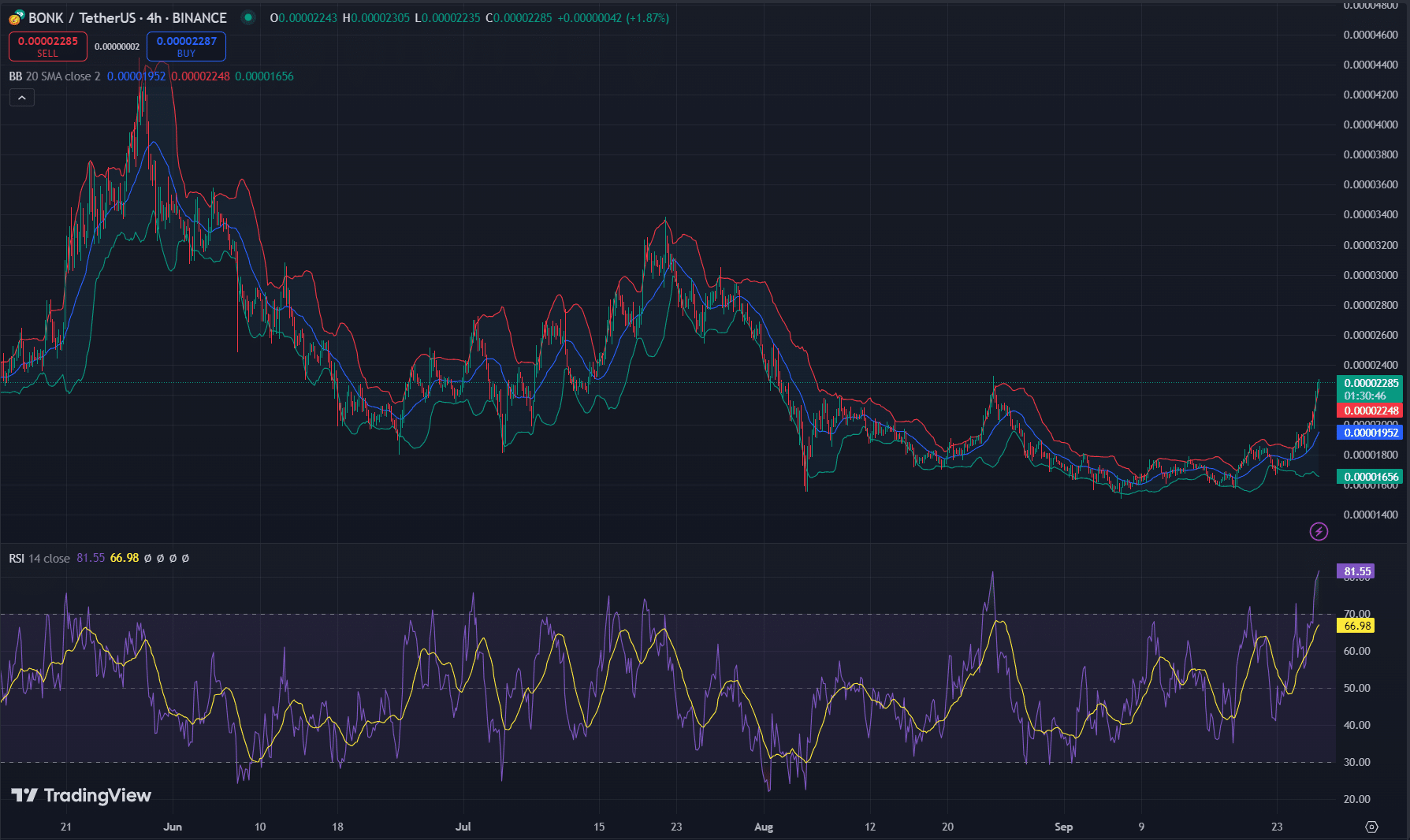

- Bonk tests key resistance at $0.00002250, while RSI signals potential overbought conditions.

- Volume and open interest surges suggest sustained market interest and potential for further gains.

Bonk [BONK] has captured significant attention, following an impressive 14.65% surge at press time, bringing the price to $0.00002287.

With strong market activity and growing community interest, many wonder if this recent rally could signal a larger breakout.

However, can Bonk hold key resistance levels and sustain this upward momentum? Let’s break it down.

Can Bonk break resistance?

The critical question traders are asking is whether Bonk can break through its resistance or face a pullback. Based on the technical analysis, Bonk was testing a key resistance level at $0.00002250 at press time.

The chart shows tightening Bollinger Bands, which often indicate a potential breakout.

However, Bonk has struggled to push beyond this level before. Failing to break above this resistance could lead to a short-term decline.

Additionally, the Relative Strength Index (RSI) is currently at 81.55, signaling overbought conditions.

Consequently, a correction might occur if Bonk cannot push higher from here.

Traders should, therefore, closely monitor the $0.00002200 level, as maintaining above this threshold could signal that the bullish trend will continue.

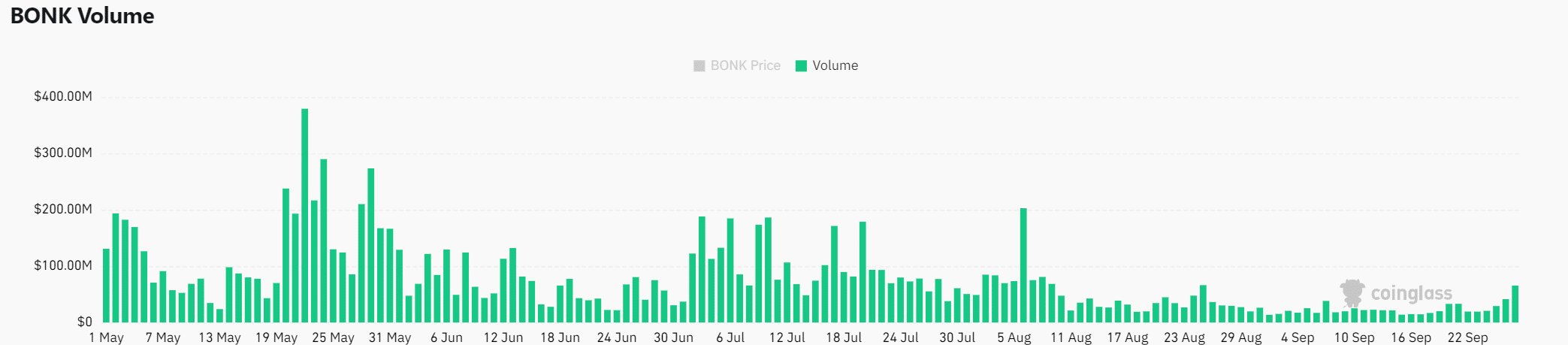

On-chain analysis: volume surge

Bonk’s trading volume has surged by a massive 96.26%, reaching $99.88M in just 24 hours at press time. This sudden increase in volume reflects heightened interest from traders.

Additionally, high volume paired with price increases often suggests strong confidence in the asset.

Therefore, Bonk’s volume surge could fuel additional price action if the trend holds. Consequently, the coin’s liquidity and market activity make it one to watch for the next phase.

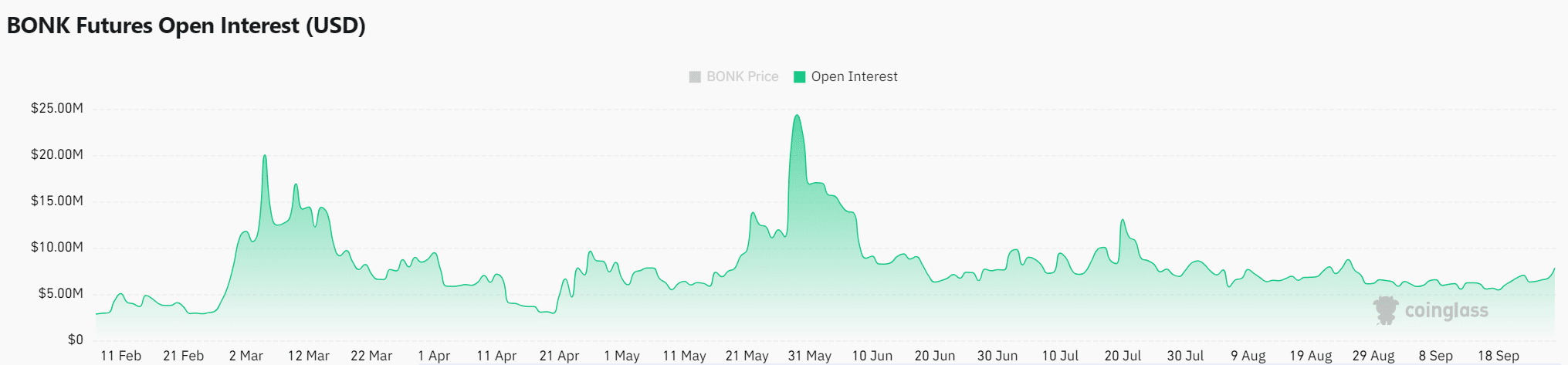

Open Interest: What does it mean for traders?

Open Interest in Bonk futures has also risen by 67.02%, now sitting at $12.87M at press time, according to Coinglass.

Open Interest measures the total number of active contracts, and this rise indicates growing speculation in Bonk’s future price.

Additionally, an increase in Open Interest often signals deeper market participation and stronger trader commitment.

Consequently, many believe Bonk’s recent rally may extend further, providing more opportunities for traders seeking long-term gains.

Bonk’s impressive surge, supported by increased volume and rising open interest, suggests the coin could be on the verge of a larger breakout.

Read Bonk’s [BONK] Price Prediction 2024–2025

However, if it fails to break resistance levels, a short-term pullback may follow. Therefore, traders should stay vigilant.

If Bonk holds strong, it could lead the next meme coin rally, driven by both market enthusiasm and technical indicators.