BONK Price Prediction – Short-term targets traders should look out for are…

- Divergence between the price and the accumulation/distribution charts hinted at an uptick

- Convergence of market indicators further supported the likelihood of an rally

Over the past week, BONK has registered a decline of over 8.31%. In fact, in the last 24 hours alone, the memecoin lost over 3.5% of its value, with the crypto trading at $0.00001812 on the charts. This was accompanied by a 31.75% decline in trading volume – A sign that bearish pressures are still at play.

Despite this, however, AMBCrypto’s analysis found that BONK’s prevailing price action might merely be a temporary downturn.

Potential sell relief on the horizon

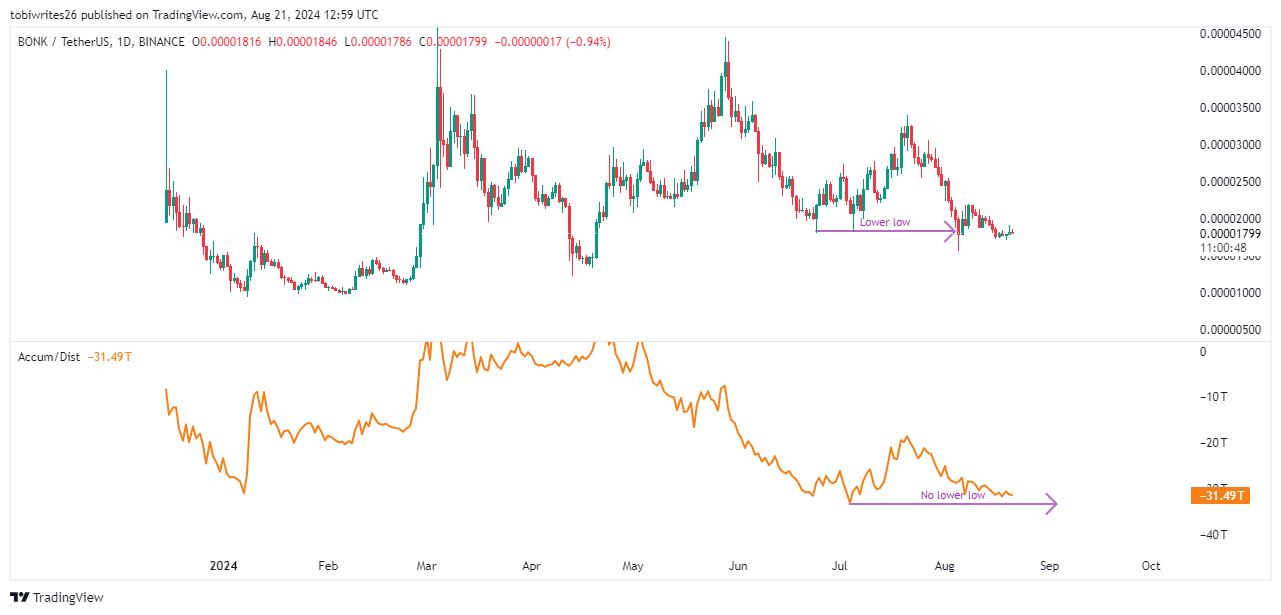

At the time of writing, BONK’s price had recorded a new low. And yet, the Accumulation and Distribution line showed more resilience, with the same not mirroring the aforementioned decline yet.

This discrepancy suggested that the downward movement in price hasn’t been fully backed by the trading volume – A sign of sustained buying interest or reduced selling pressure than was initially apparent.

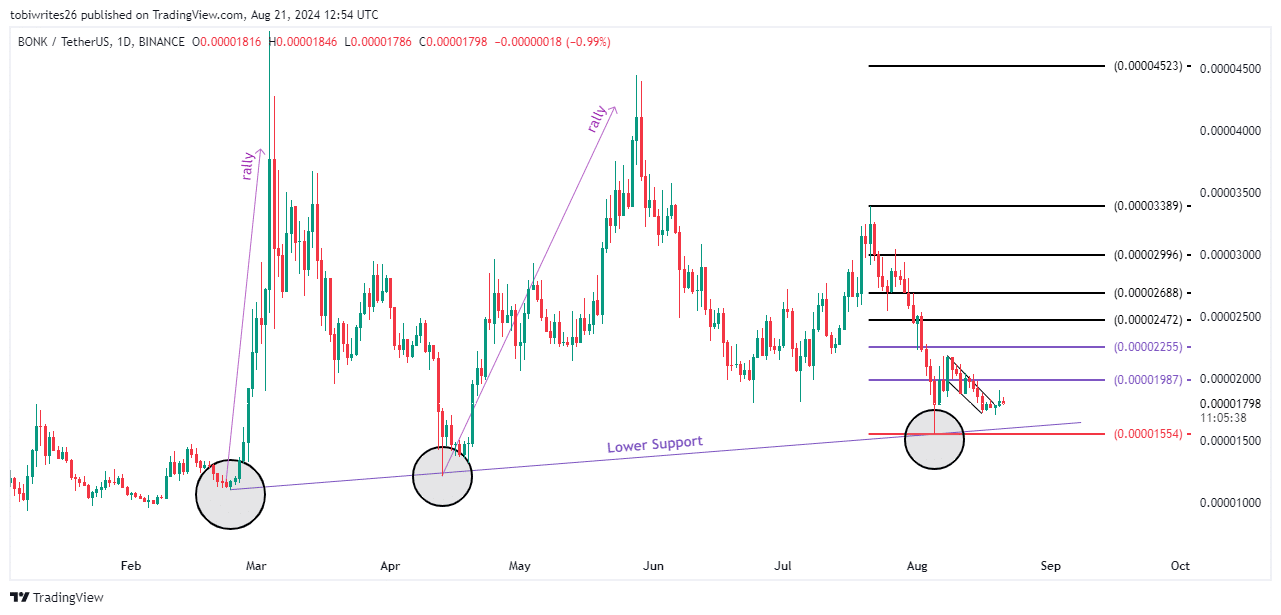

Further insights revealed that BONK has been bouncing back from a key support level (shown in the image below). This level is historically known for triggering upward rallies, adding to the bullish outlook.

Expanding on this analysis, AMBCrypto also used the Fibonacci Retracement tool to identify potential future price levels as BONK prepares for a rally.

Now, two critical levels were identified – The initial resistance at $0.00001987, where the price may stabilize before gathering bullish momentum.

If this momentum is strong enough, BONK could target the next significant resistance at $0.00002255 – A zone associated with notable selling pressure.

Should buyer interest wane, however, the price could retreat to $0.00001554 as indicated by the Fibonacci Retracement line.

Retail traders and whales anticipate a BONK rally

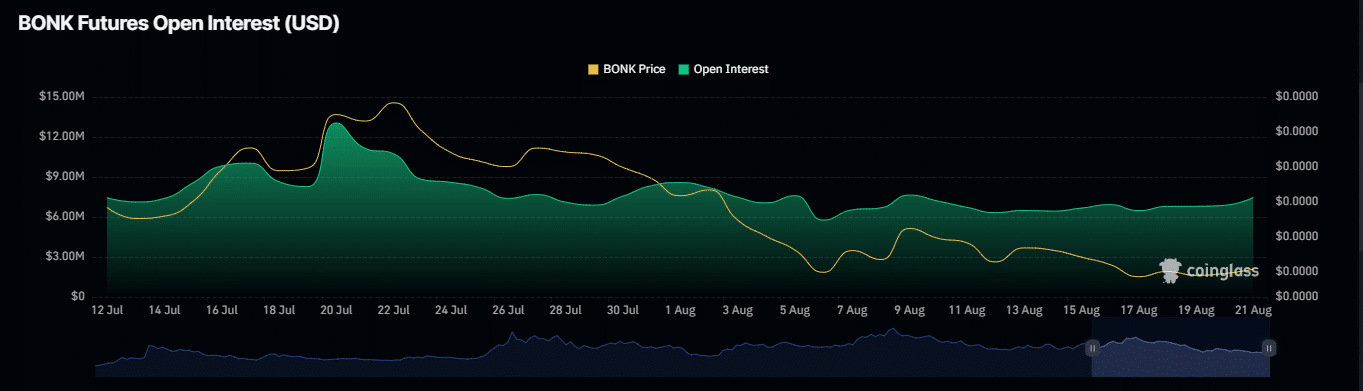

Recent data from Coinglass indicated that both whales (large volume buyers) and retail traders are optimistic about BONK’s prospects for an upward move.

In fact, Open Interest (OI), which represents the total number of unsettled derivative contracts, saw a $1.13 million hike between 12 August and 21 August, signaling growing interest among traders.

A rising OI means heightened market participation and potential upward momentum – A sign of strong buyers’ commitment.

Moreover, negative inflows indicated that more BONK tokens are being withdrawn from exchanges than deposited. This reinforces investor confidence and bullish sentiment by reducing the supply available for trading.

Given these indicators, a BONK price rally seems imminent, pending the continuation of this bullish trend.