BONK update: Rebound or retreat? Key indicators show mixed outlook

- BONK was at a critical juncture, having traded off two major support zones recently.

- However, recent metrics indicate mixed market signals, putting any potential rally at risk.

Bonk [BONK] has experienced a downtrend, losing 12.03% over the past week, though it has entered multiple overlapping support zones. While a sustained rally is uncertain, a 0.43% gain in the past 24 hours hints at a subtle resurgence in buying interest.

AMBCrypto’s analysis offers a comprehensive view of the present market dynamics and insights on what to expect next.

Multiple rally confluences surfaces for BONK

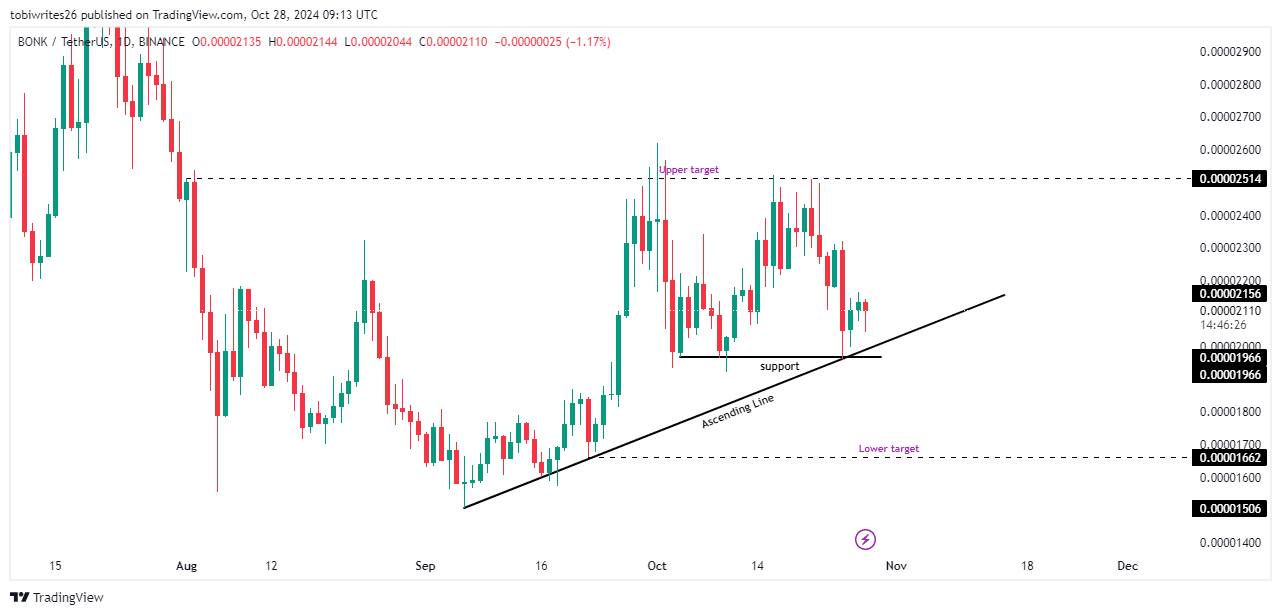

BONK recently rebounded off a support level at 0.00001966, which aligns with an ascending triangle pattern that reinforces bullish sentiment in the market. This confluence of supports could signal an upward move, though the outlook remains uncertain.

If this support level holds, BONK targets an initial resistance at 0.0002514—a short-term level that could set the stage for further gains.

Conversely, if the support fails, a pullback to 0.00001662 is likely, with additional selling potentially driving BONK back to the base of its current ascending line.

AMBCrypto’s analysis highlights that while these indicators suggest potential, a sustained rally is far from guaranteed.

Indicators signal bearish sentiment for BONK

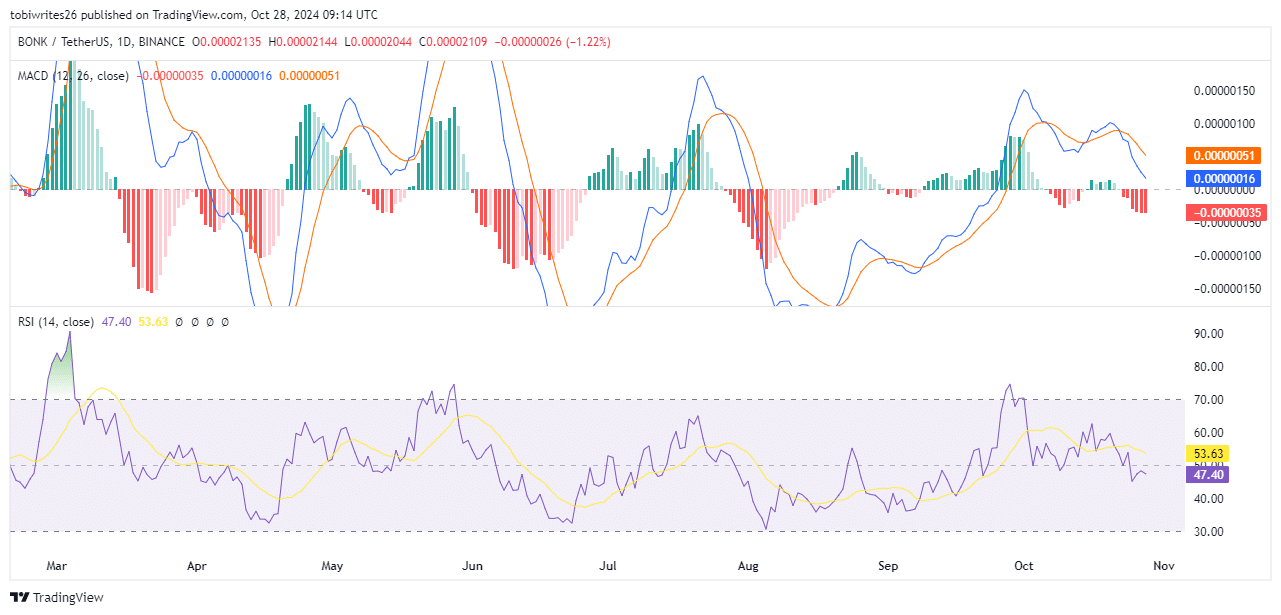

Technical indicators currently counter any bullish outlook for BONK. Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) suggest ongoing bearish momentum.

The MACD, which assesses market momentum, indicates a likely downturn as both the MACD line and signal line move deeper into negative territory. The rise in bearish momentum bars further reflects this negative market sentiment.

Similarly, the RSI, which measures the speed and change of price movements, is trending downward. This decline suggests increased selling pressure, with BONK’s price likely to continue its downward trend.

With both indicators showing further losses, BONK may be set for a sustained decline.

Bullish sentiment persists despite mixed signals

Data from Coinglass reveals that open interest, which reflects market sentiment based on outstanding derivative contracts, currently favors long positions for BONK.

Read Bonk’s [BONK] Price Prediction 2024–2025

As of the latest data, BONK’s open interest has risen by 12.75% to $7.31 million, indicating that long contracts outnumber short contracts—a factor that could positively impact the market.

However, given the mixed signals across technical indicators, further confirmations are needed to clarify BONK’s next directional move.