BONK, WIF: This week’s price prediction says…

- Both meme coins have a bearish structure on the 4-hour chart.

- The liquidation heatmap and HTF structure showed BONK had a good chance of recovery.

Two popular meme coins Bonk [BONK] and dogwifhat [WIF] exhibited strong bearish sentiment in the short term. The coming week could see more selling pressure heaped on these tokens.

Buyers lacked the strength to reverse the short-term downtrend. The sentiment across the market was neutral or bearish as Bitcoin [BTC] dithered above the $64k level at press time.

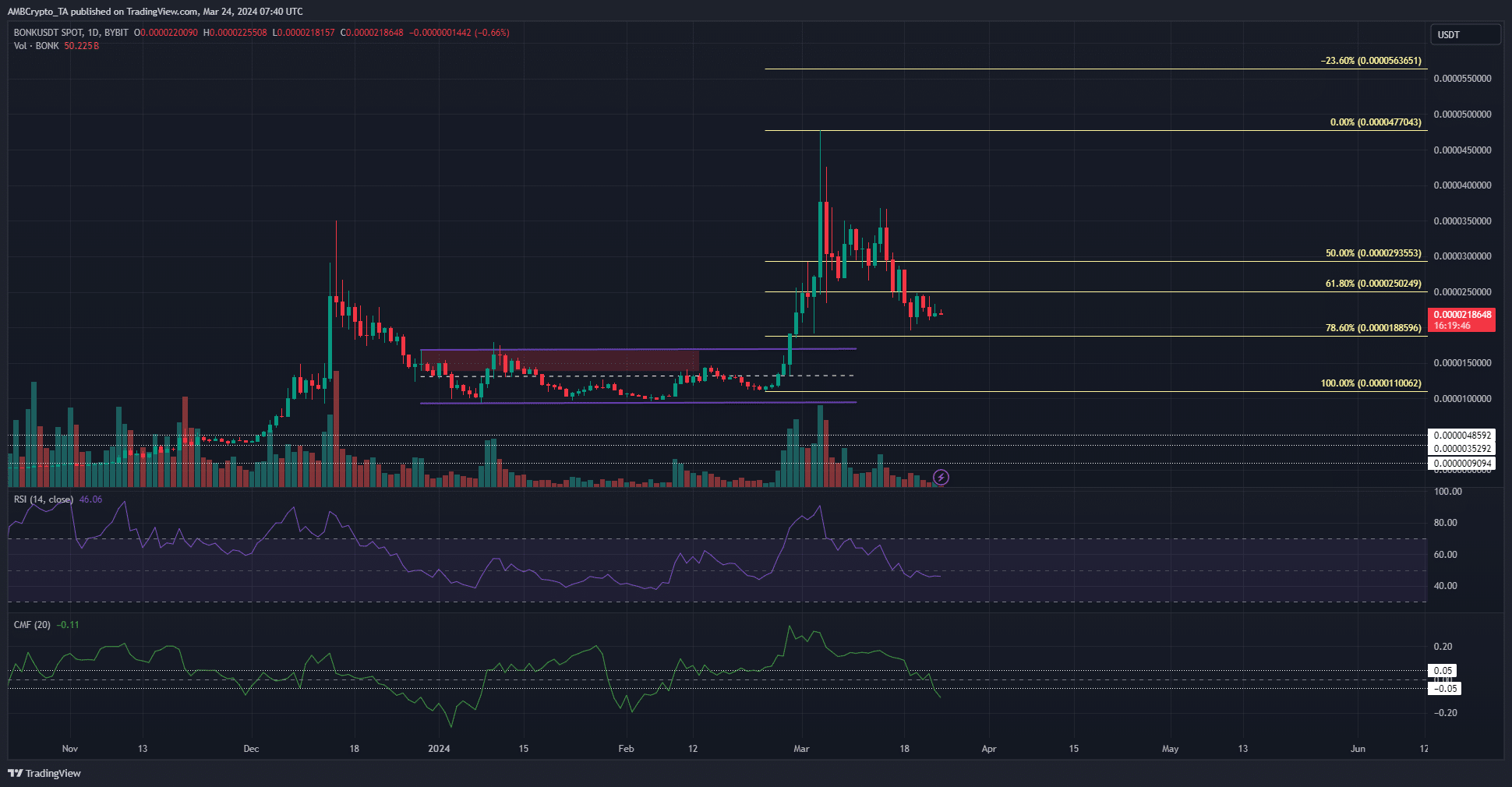

BONK capital outflow was troubling for investors

The one-day chart reflected a bullish structure, but prices were hovering above the 78.6% Fibonacci retracement level.

Moreover, the RSI slipped below the neutral 50 mark a week, handing the reins to the bears.

A drop below the 78.6% level at $0.00001885 would indicate that BONK is headed to the swing low at $0.000011. A bearish market structure would become more likely in this scenario.

Aside from the RSI, the Chaikin Money Flow (CMF) indicator also underlined bearishness. It fell below -0.05, a level traders use to filter weak signals. It signaled notable capital flow out of the BONK market.

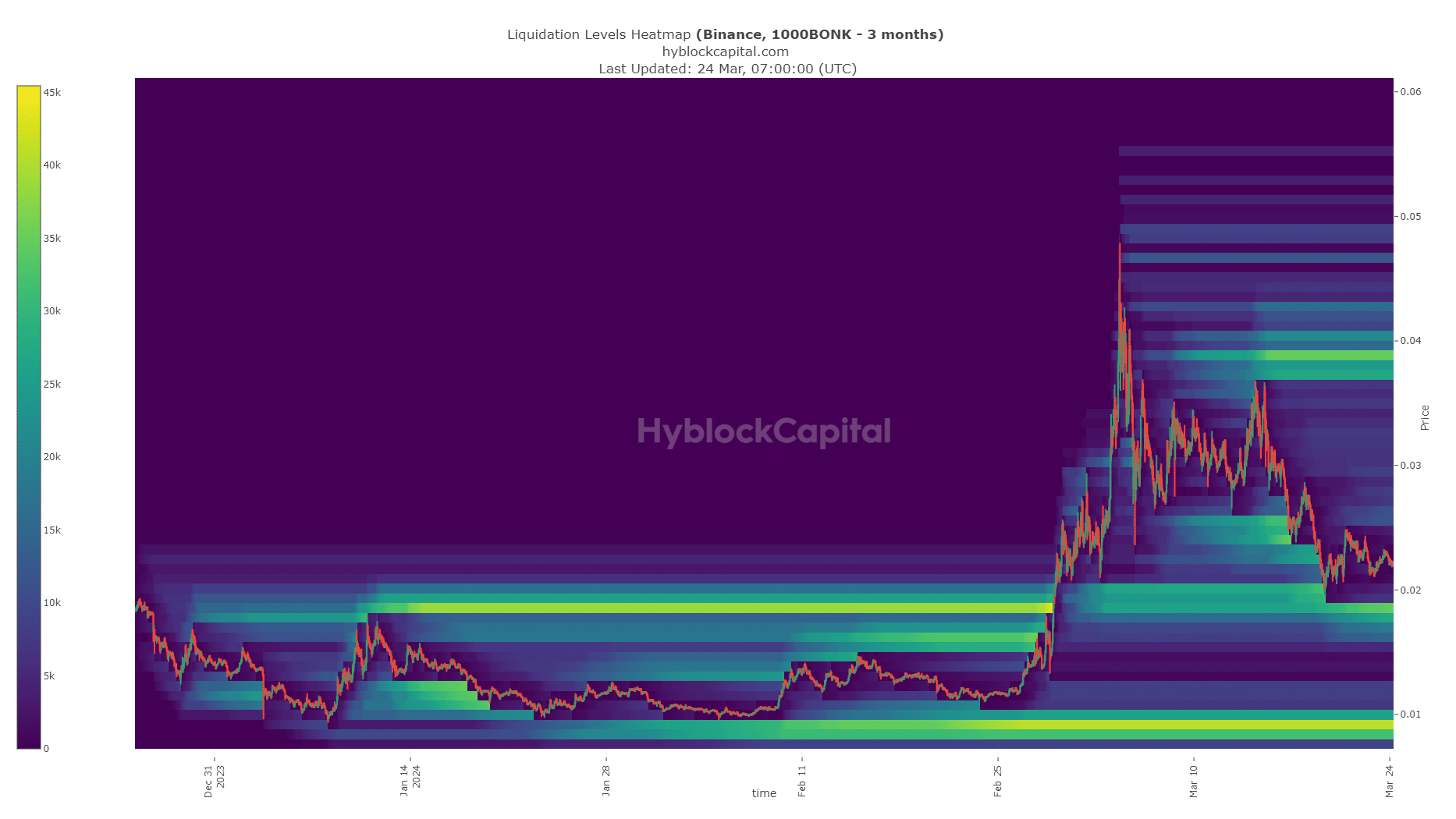

Source: Hyblock

The liquidation heatmap showed a bright band at the $0.0000177-$0.0000185 area. It was a pocket of liquidity that could attract BONK prices lower before a rally could be initiated.

To the north, the $0.0000372-$0.0000388 area was another significant pocket. In between, the liquidation levels were relatively sparse, meaning prices could traverse between these regions quickly.

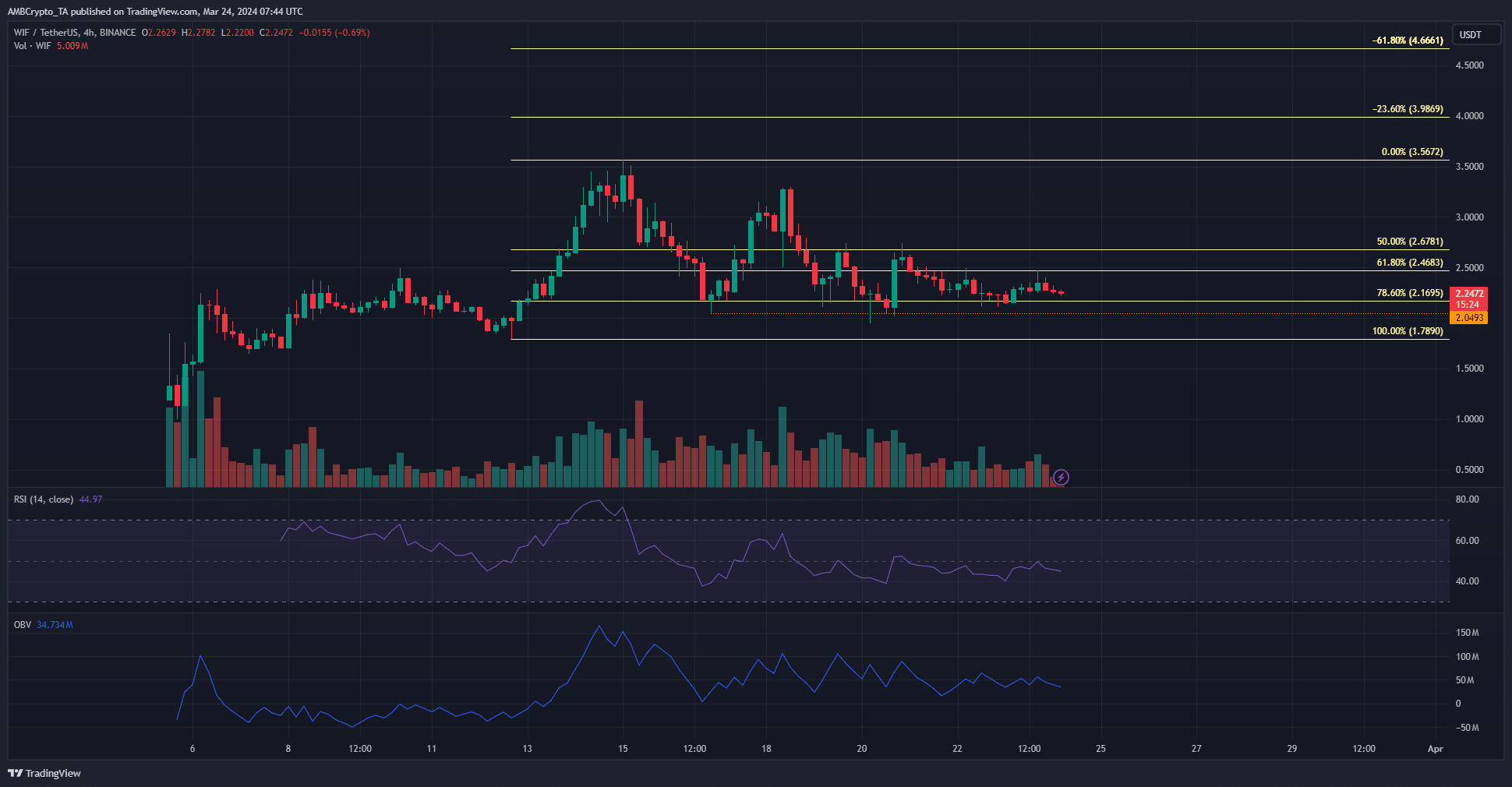

WIF Bulls unable to win the crowd over

The 4-hour chart has a bearish market structure. The swing low at $2.04 set on the 16th of March was breached on the 20th.

The momentum has also been firmly bearish since the 18th of March, as the RSI remained below neutral 50.

WIF needs to climb back above $3.3 to flip the 4-hour timeframe structure bullishly. The evidence of the past ten days showed that bulls lacked the strength to force this recovery.

The OBV has moved sideways over the past week, and the trading volume was relatively low.

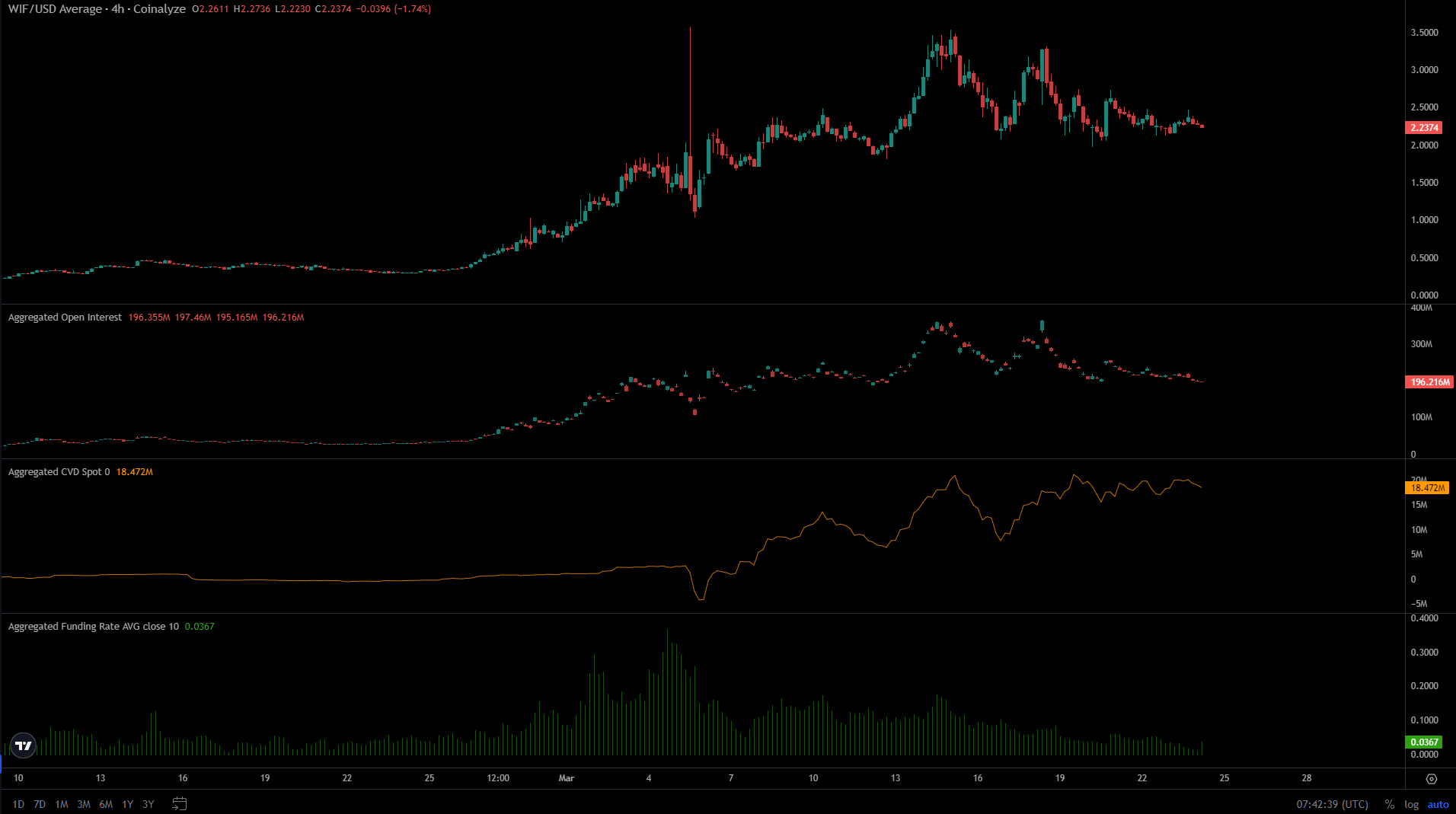

Source: Coinalyze

The Open Interest chart fell lower over the past week alongside prices. This reflected bearish sentiment and speculators choosing to remain sidelined. Short selling has not ramped up yet.

Is your portfolio green? Check out the WIF Profit Calculator

Surprisingly, the spot CVD has been flat in the past four days. This was an encouraging sign for WIF bulls in the short term.

It meant that the selling volume in the spot markets was low, and if sentiment could shift bullishly somehow, the bulls could push prices higher.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.