BONK’s price surges: Signs of a strong rally ahead?

- BONK’s bullish momentum is backed by strong RSI and expanding Bollinger Bands.

- Rising volume, short liquidations, and Open Interest point to continued gains.

Bonk [BONK] continues to impress with an 8.73% rise, reaching $0.00002571 at press time, marking a significant gain in its upward trend.

This rally follows increased trading activity, leaving investors to question whether BONK is set for even greater gains.

With strong technical indicators and growing market participation, the token seems poised for a sustained breakout.

Price action analysis

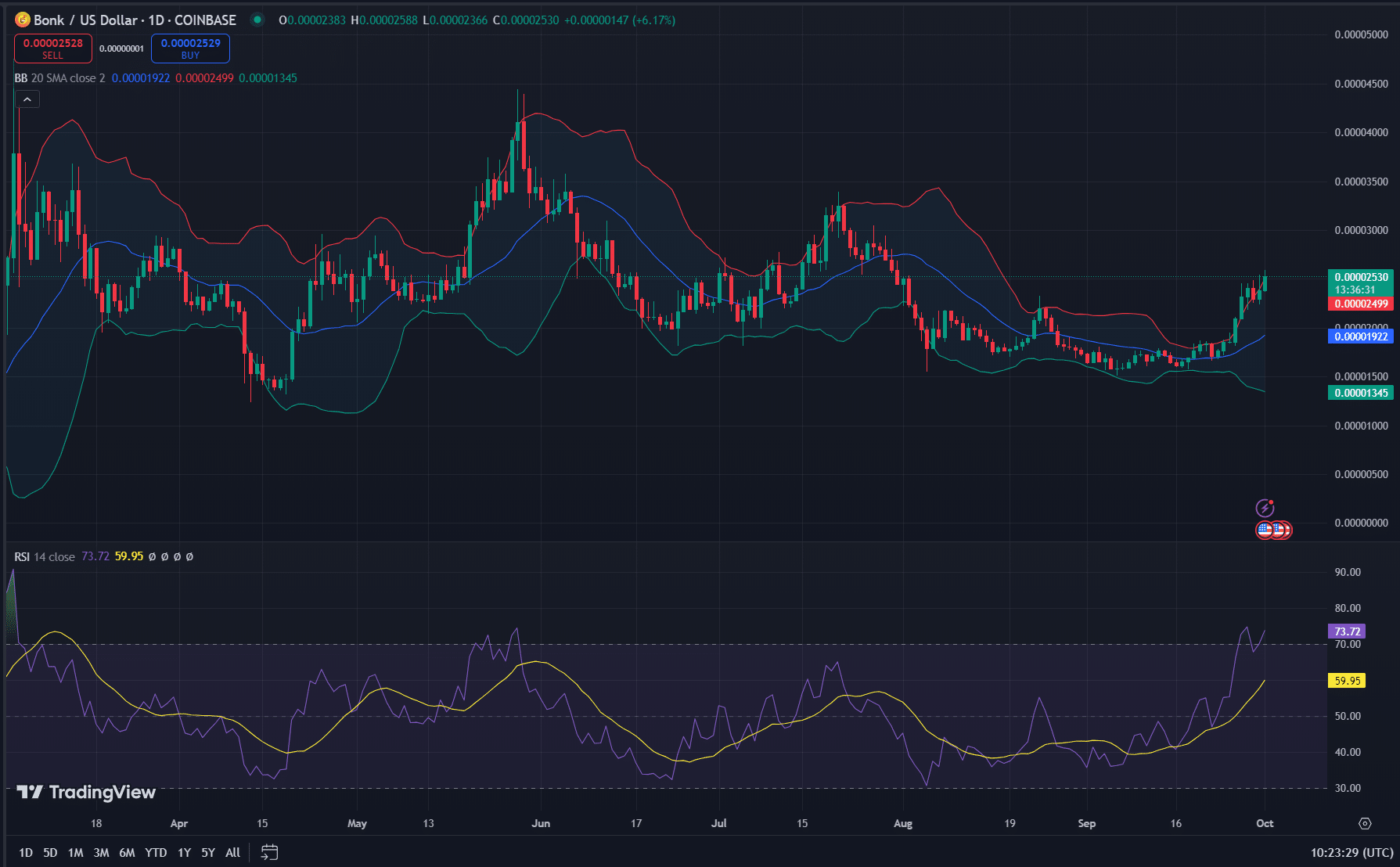

Looking closely at BONK’s price chart, two key indicators demand attention—the Relative Strength Index (RSI) and Bollinger Bands (BB). The RSI has surged to 73.72, signaling that BONK has entered overbought territory.

While this could suggest a potential short-term pullback, the widening of the Bollinger Bands implies increasing volatility, which often leads to significant price action.

Therefore, if the token holds above the middle Bollinger Band, BONK could be primed for another strong move upward.

Volume surge: Sign of growing interest?

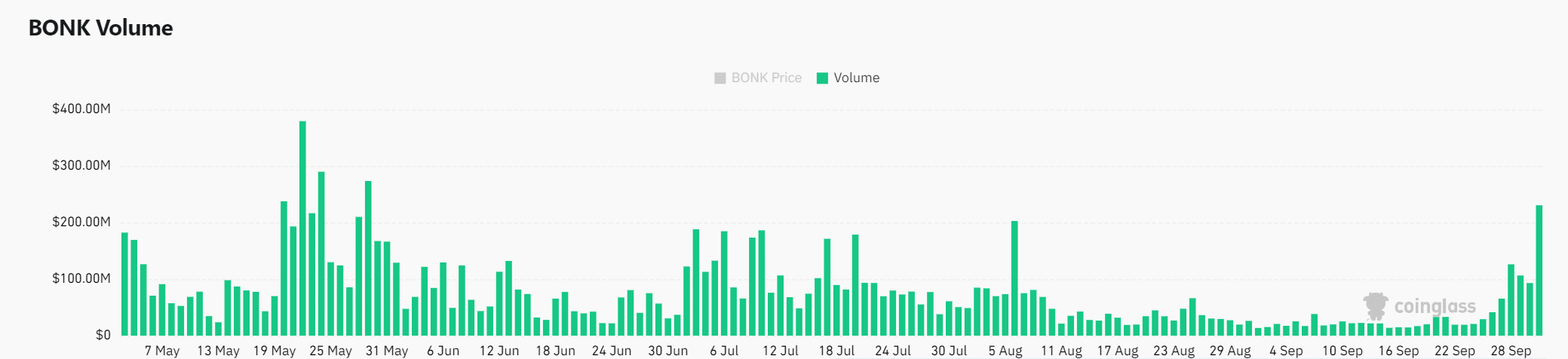

BONK has witnessed a remarkable 48.18% increase in trading volume, climbing to $221.91 million. This uptick signals growing interest from both retail and institutional investors.

Furthermore, higher volume generally correlates with stronger price momentum, further supporting the view that BONK’s bullish trend may continue.

Additionally, increased volume reflects stronger buyer conviction, signaling potential for continued gains.

Bonk liquidation: A squeeze on shorts

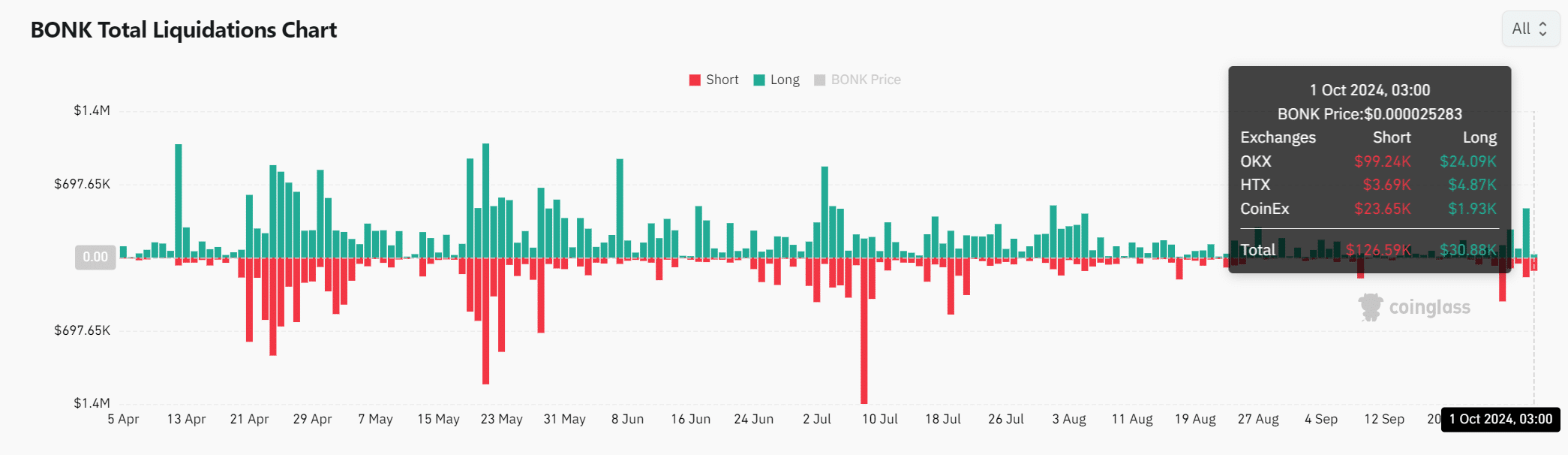

Short sellers are under pressure, with $126.59K in short liquidations recently recorded. The liquidation chart highlights a dominance of long positions, with only $30.88K in long liquidations during the same period.

This imbalance has created additional buy pressure as short sellers scramble to cover their positions.

Consequently, this ongoing short squeeze could propel BONK past critical resistance levels, further fueling its bullish momentum.

Open Interest: What’s the market saying?

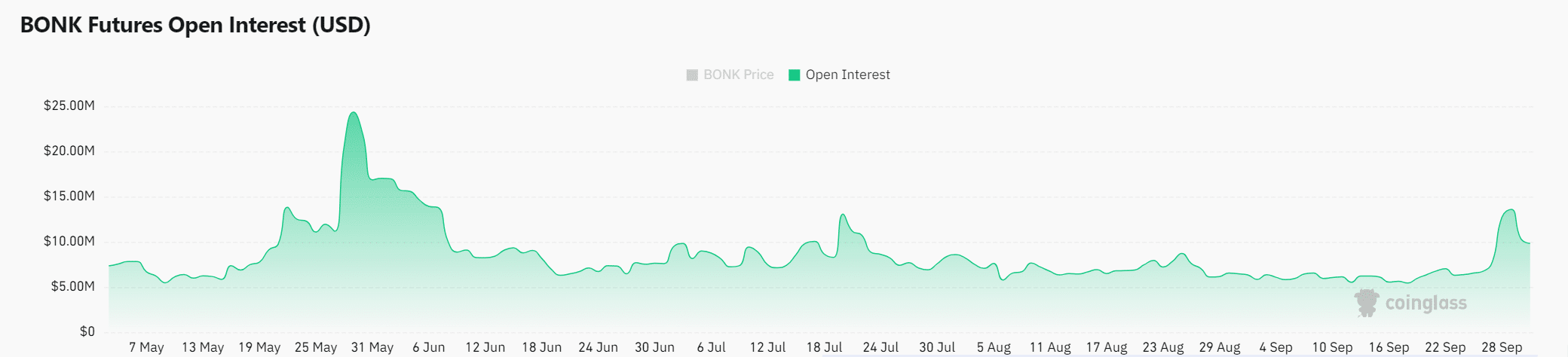

Open Interest has risen by 15.33%, reaching $11.51 million. This increase points to heightened market engagement, with more participants taking new positions.

Rising Open Interest often complements price action, indicating that this rally could be more than a short-term spike.

Considering the technical indicators, volume surge, and rising open interest, BONK appears well-positioned for continued growth.

The combination of strong price action, fueled by liquidations and increased market engagement, suggests that the rally has more room to run.

Read Bonk’s [BONK] Price Prediction 2024–2025

While the overbought RSI raises caution for minor corrections, the overall momentum strongly favors continued gains.

Therefore, BONK is likely to maintain its upward trajectory in the coming days, barring any drastic market shifts.